Question

The following is data at one of the Main Branch Offices (KCU) of Bank DEF for 2019 and 2020: Question: a. What is KCU Bank

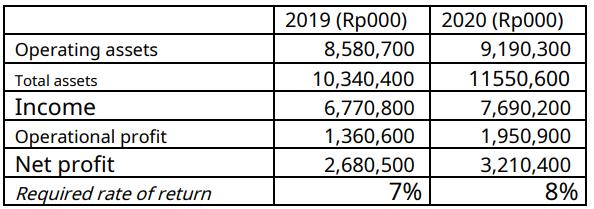

The following is data at one of the Main Branch Offices (KCU) of Bank DEF for 2019 and 2020:

Question:

a. What is KCU Bank DEF's Return On Investment (ROI) in 2020? Use DuPont Analysis (margin and turnover)!

b. How much is the Residual Income (RI) of KCU Bank DEF in 2020? (3%)

c. In your opinion, which one is more appropriate to use to assess division performance? ROI or RI? Explain!

Operating assets Total assets Income Operational profit Net profit Required rate of return 2019 (Rp000) 8,580,700 10,340,400 6,770,800 1,360,600 2,680,500 7% 2020 (Rp000) 9,190,300 11550,600 7,690,200 1,950,900 3,210,400 8%

Step by Step Solution

3.30 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the Return on Investment ROI of KCU Bank DEF in 2020 using DuPont Analysis we need to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham, Joel F. Houston

15th edition

1337671002, 978-1337395250

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App