Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PT Lemari is a crypto brokerage company located in Indonesia. Currently, PT Lemari has two customers, customer A and B. To facilitate the crypto

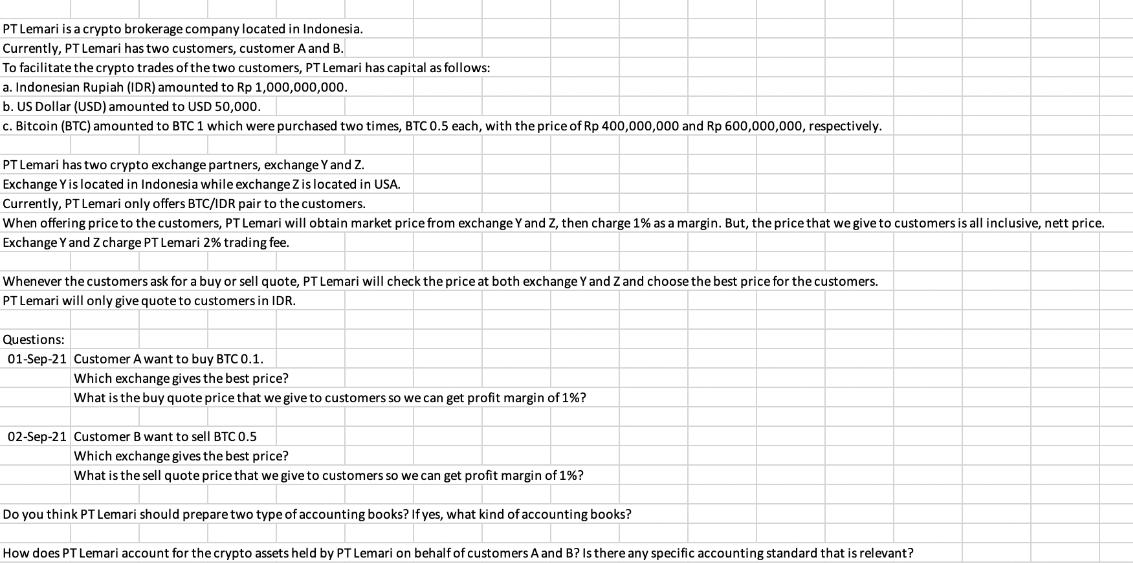

PT Lemari is a crypto brokerage company located in Indonesia. Currently, PT Lemari has two customers, customer A and B. To facilitate the crypto trades of the two customers, PT Lemari has capital as follows: a. Indonesian Rupiah (IDR) amounted to Rp 1,000,000,000. b. US Dollar (USD) amounted to USD 50,000. c. Bitcoin (BTC) amounted to BTC 1 which were purchased two times, BTC 0.5 each, with the price of Rp 400,000,000 and Rp 600,000,000, respectively. PT Lemari has two crypto exchange partners, exchange Y and Z. Exchange Y is located in Indonesia while exchange Z is located in USA. Currently, PT Lemari only offers BTC/IDR pair to the customers. When offering price to the customers, PT Lemari will obtain market price from exchange Y and Z, then charge 1% as a margin. But, the price that we give to customers is all inclusive, nett price. Exchange Y and Z charge PT Lemari 2% trading fee. Whenever the customers ask for a buy or sell quote, PT Lemari will check the price at both exchange Y and Z and choose the best price for the customers. PT Lemari will only give quote to customers in IDR. Questions: 01-Sep-21 Customer A want to buy BTC 0.1. Which exchange gives the best price? What is the buy quote price that we give to customers so we can get profit margin of 1%? 02-Sep-21 Customer B want to sell BTC 0.5 Which exchange gives the best price? What is the sell quote price that we give to customers so we can get profit margin of 1%? Do you think PT Lemari should prepare two type of accounting books? If yes, what kind of accounting books? How does PT Lemari account for the crypto assets held by PT Lemari on behalf of customers A and B? Is there any specific accounting standard that is relevant?

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Customer A want to buy BTC 01 Which exchange gives the best price To determine which exchange gives the best price for BTC 01 PT Lemari needs to check the prices at both exchange Y and Z Lets assume t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started