pt.1

pt.2

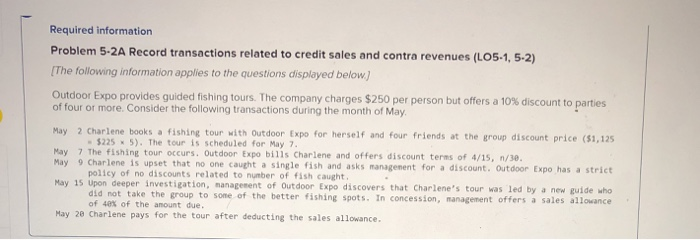

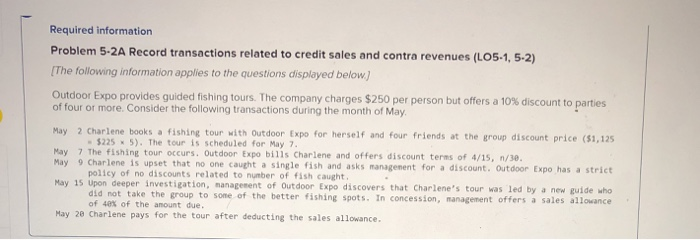

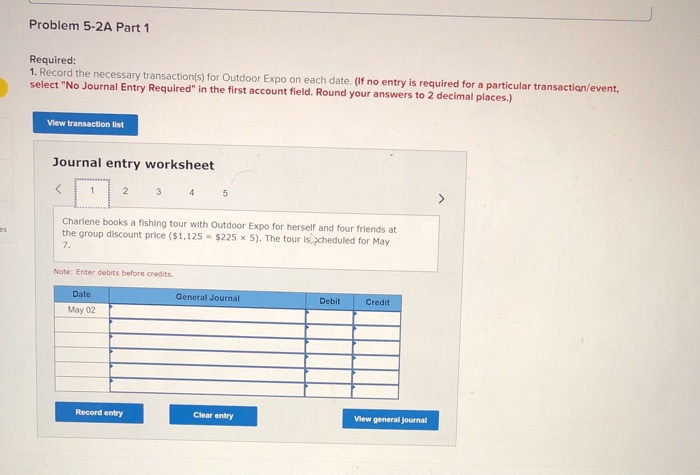

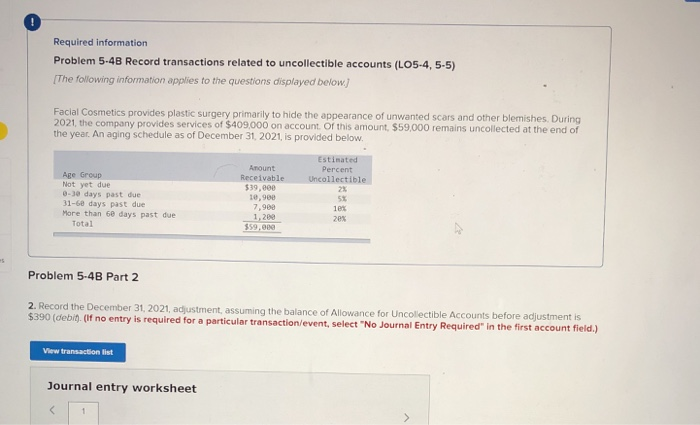

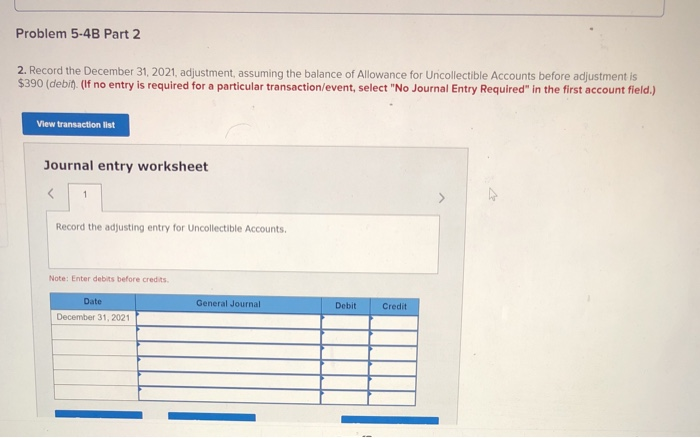

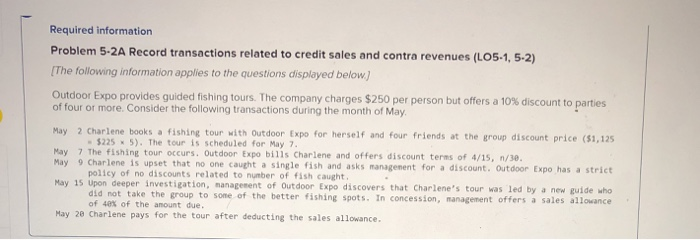

Required information Problem 5-2A Record transactions related to credit sales and contra revenues (LO5-1, 5-2) [The following information applies to the questions displayed below) Outdoor Expo provides guided fishing tours. The company charges $250 per person but offers a 10% discount to parties of four or more. Consider the following transactions during the month of May. May 2 Charlene books a fishing tour with Outdoor Expo for herself and four friends at the group discount price (81,125 - $2255). The tour is scheduled for May 7. May 7 The fishing tour occurs. Outdoor Expo bills Charlene and offers discount terms of 4/15, n/30. May 9 Charlene is upset that no one caught a single fish and asks management for a discount. Outdoor Expo has a strict policy of no discounts related to number of fish caught May 15 Upon deeper investigation, management of Outdoor Expo discovers that Charlene's tour was led by a new guide who did not take the group to some of the better fishing spots. In concession, management offers a sales allowance of 40% of the amount due. May 20 Charlene pays for the tour after deducting the sales allowance. Problem 5-2A Part 1 Required: 1. Record the necessary transaction(s) for Outdoor Expo on each date. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Round your answers to 2 decimal places.) View transaction list Journal entry worksheet 1 2 3 4 5 Charlene books a fishing tour with Outdoor Expo for herself and four friends at the group discount price ($1,125 - $225 x 5). The tour is cheduled for May 7. Note: Enter debits before credits General Journal Date May 02 Debit Credit Record entry Clear entry View general Journal Required information Problem 5-4B Record transactions related to uncollectible accounts (LO5-4, 5-5) [The following information applies to the questions displayed below) Facial Cosmetics provides plastic surgery primarily to hide the appearance of unwanted scars and other blemishes. During 2021, the company provides services of $409,000 on account of this amount, $59,000 remains uncollected at the end of the year. An aging schedule as of December 31, 2021, is provided below. Age Group Not yet due 0-30 days past due 31-60 days past due More than 60 days past due Total Amount Receivable $39.000 10,900 7.900 1,280 $59.000 Estimated Percent Uncollectible 2x 5% 1ex 5 Problem 5-4B Part 2 2. Record the December 31, 2021, adjustment, assuming the balance of Allowance for Uncollectible Accounts before adjustment is $390 (debih(If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Problem 5-4B Part 2 2. Record the December 31, 2021, adjustment, assuming the balance of Allowance for Uncollectible Accounts before adjustment is $390 (debih. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 Record the adjusting entry for Uncollectible Accounts. Note: Enter debits before credits Date General Journal Debit Credit December 31, 2021