Answered step by step

Verified Expert Solution

Question

1 Approved Answer

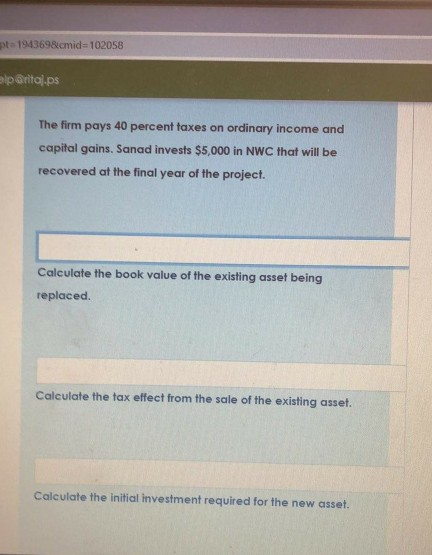

pta 1943698cmid=102058 elp@rital.ps The firm pays 40 percent taxes on ordinary income and capital gains. Sanad invests $5,000 in NWC that will be recovered at

pta 1943698cmid=102058 elp@rital.ps The firm pays 40 percent taxes on ordinary income and capital gains. Sanad invests $5,000 in NWC that will be recovered at the final year of the project. Calculate the book value of the existing asset being replaced Calculate the tax effect from the sale of the existing asset. Calculate the initial investment required for the new asset. pta 1943698cmid=102058 elp@rital.ps The firm pays 40 percent taxes on ordinary income and capital gains. Sanad invests $5,000 in NWC that will be recovered at the final year of the project. Calculate the book value of the existing asset being replaced Calculate the tax effect from the sale of the existing asset. Calculate the initial investment required for the new asset

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started