Answered step by step

Verified Expert Solution

Question

1 Approved Answer

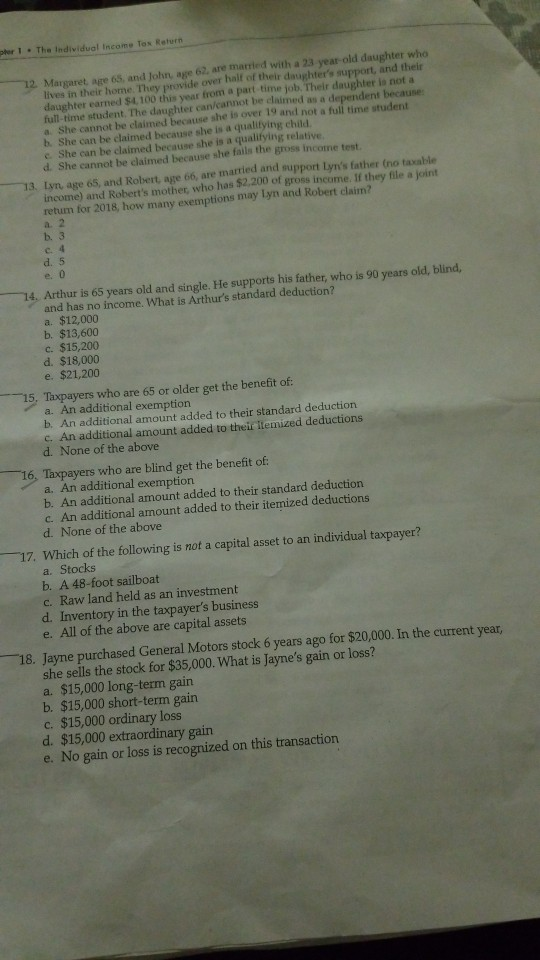

pter 1 The Individual Income Tox Return 12 Margaret, age 65, and John, age 62, are matried with a 23 year-old daughter who lives in

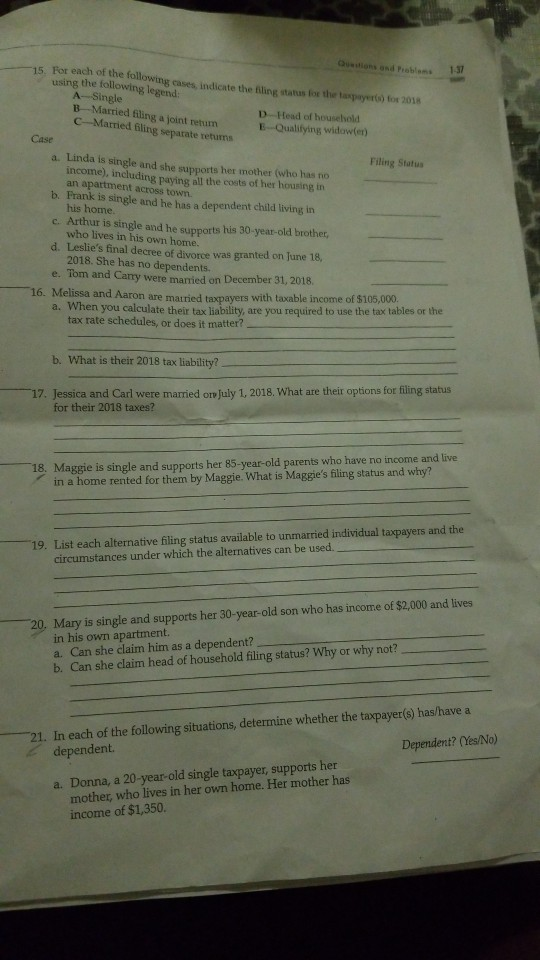

pter 1 The Individual Income Tox Return 12 Margaret, age 65, and John, age 62, are matried with a 23 year-old daughter who lives in their home. They provide over half of their daughter's support, and their daughter earned $4,100 this year from a part time job. Their daughter ia not a full-time student. The daughter can/cannot be claimed a. She cannot be claimed because she is over 19 and not a full time student b. She can be claimed because she is a qualifying child c. She can be claimed because she is a qualifying relative d. She cannot be claimed because she fails the gross income test. as a dependent because 13. Ly age 65, and Robert, age 66, are married and support Lyn's father (no taxable income) and Robert's mother, who has $2,200 of gross income. If they file a joint retum for 2018, how many exemptions may lyn and Robert claim? a. 2 b. 3 C. d. 5 e. 14, Arthur is 65 years old and single. He supports his father, who is 90 years old, blind, and has no income. What is Arthur's standard deduction? a. $12,000 b. $13,600 c. $15,200 d. $18,000 e. $21,200 15, Taxpayers who are 65 or older get the benefit of a. An additional exemption b. An additional amount added to their standard deduction c. An additional amount added to thei 'temized deductions d. None of the above 16, Taxpayers who are blind get the benefit of a. An additional exemption b. An additional amount added to their standard deduction c. An additional amount added to their itemized deductions d. None of the above 17, Which of the following is not a capital asset to an individual taxpayer? a. Stocks b. A 48-foot sailboat c. Raw land held as an investment d. Inventory in the taxpayer's business e. All of the above are capital assets 18. Jayne purchased General Motors stock 6 years ago for $20,000. In the current year she sells the stock for $35,000. What is Jayne's gain or loss? a. $15,000 long-term gain b. $15,000 short-term gain c. $15,000 ordinary los d. $15,000 extraordinary gain e. No gain or loss is recognized on this transaction Quadtions and P -15. For each of the following cases, indicate the fling status for the laspeyero) for 2018 robles 13 using the following legend: A-Single B-Married filing a joint retum D-Head of household E-Qualifying widow(er) C-Married filing sepatate r Case retums a. Linda is single and she supports her mother (who has no b. Frank is sing and he has a dependent chaila living in c. Arthur is single and he supports his 30-year-old brother, d. Leslie's final decree of divorce was granted on June 18, e. Tom and Cary were maried on December 31, 2018. a. When you calculate their tax liability, are you required to use the tax tabiles or ih Filing Status income), including paying all the costs of her housing in an apartment across town. his home. who lives in his own home. 2018. She has no dependents. Aaron are matried taxpayers with taxable income of $105,000. tax rate schedules, or does it matter? b. What is their 2018 tax liability? 17. Jessica and Carl were married oreJuly 1, 2018. What are their options for filing status for their 2018 taxes? Maggie is single and supports her 85-year-old parents who have no income and live in a home rented for them by Maggie. What is Maggie's fling status and why? 18. 19. List each alternative filing status available to unmarried individual taxpayers and the circumstances under which the alternatives can be used 20. Mary is single and supports her 30- year-old son who has incore of $2.000 and lives in his own apartment. a. Can she claim him as a dependent? b. Can she claim head of household filing status? Why or why not? 21. In each of the following situations, deternine whether the taspayer() has/have a Dependent? (Ys/No) dependent. mother, who lives in her own home. Her mother has income of $1,350. a. Donna, a 20-year-old single taxpayer, supports her

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started