Question: public finance Question One: Explain the two fundamental principles often used in evaluating tax policy. Can these principles typically be satisfied simultaneously? (10 Marks) Question

public finance

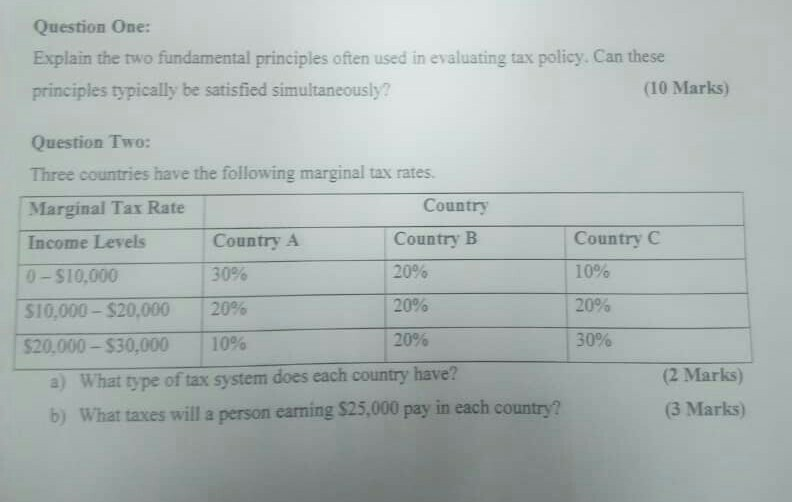

Question One: Explain the two fundamental principles often used in evaluating tax policy. Can these principles typically be satisfied simultaneously? (10 Marks) Question Two: Three countries have the following marginal tax rates. Marginal Tax Rate Income Levels 0-$10,000 Country Country 20% 20% 20% Country C 10% 20% 30% Country A 10,000-520.000 :$20.000-$30,000 30% | 20% | 1096 a) What type of tax system does each country have? b) What taxes willa person carning $25,000 pay in each country? (2 Marks) 3 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts