Answered step by step

Verified Expert Solution

Question

1 Approved Answer

publice finance and budgeting midterm False 6. The nuts and bolts of public finance and budgeting for each level of are clearly defined in the

publice finance and budgeting midterm

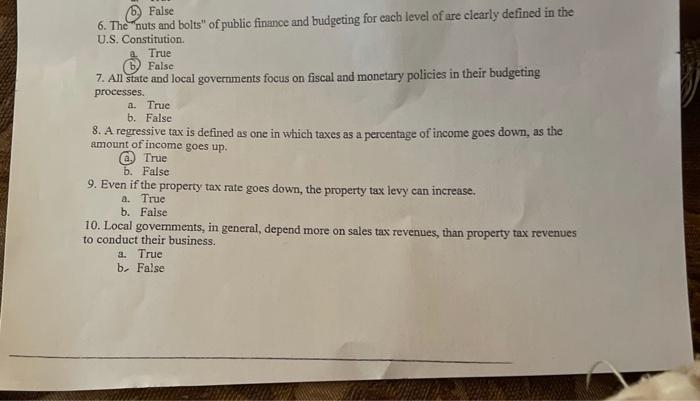

False 6. The "nuts and bolts" of public finance and budgeting for each level of are clearly defined in the U.S. Constitution True False 7. All state and local governments focus on fiscal and monetary policies in their budgeting processes a. True b. False 8. A regressive tax is defined as one in which taxes as a percentage of income goes down, as the amount of income goes up. @ True b. False 9. Even if the property tax rate goes down, the property tax levy can increase. a. True b. False 10. Local governments, in general, depend more on sales tax revenues, than property tax revenues to conduct their business. a. True b. False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started