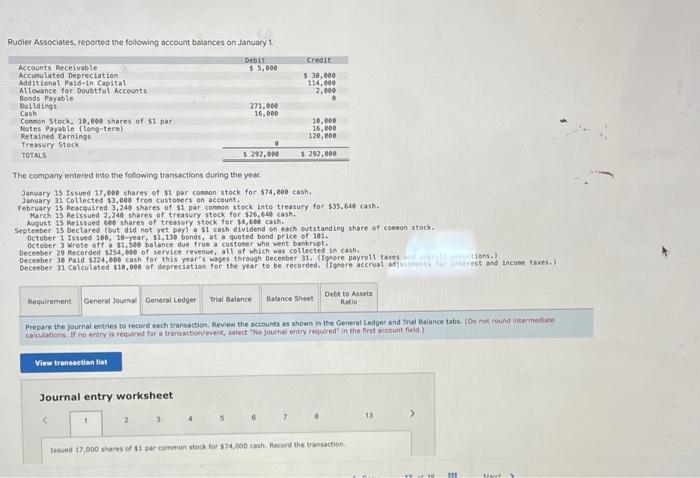

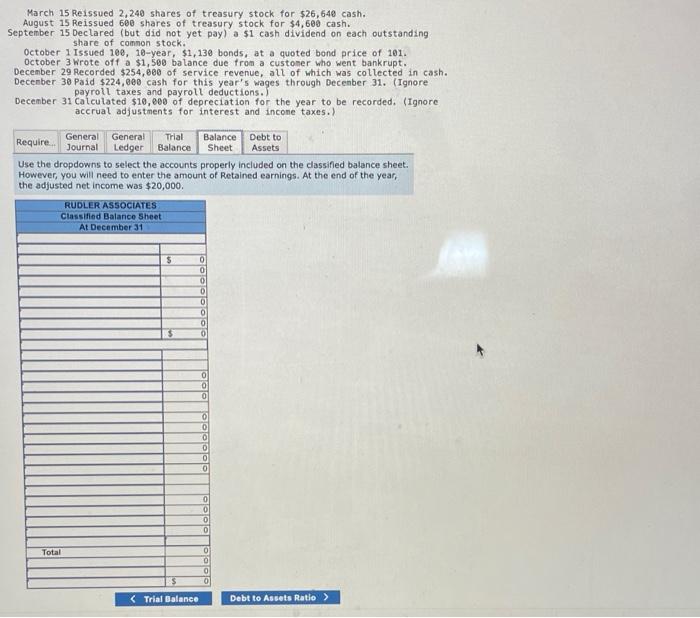

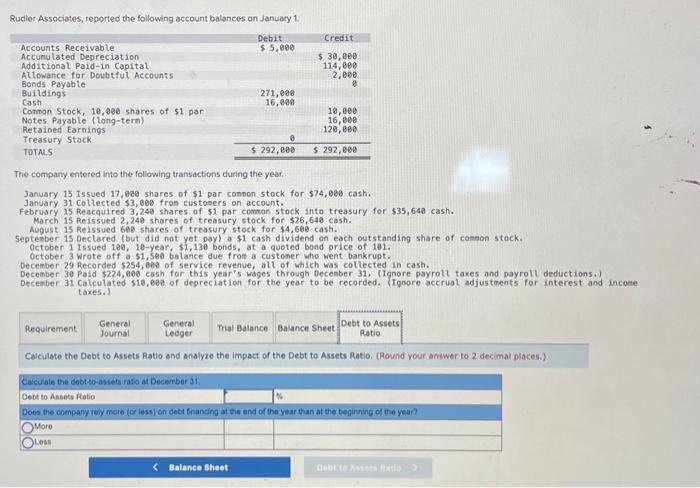

Puder Associates, reported the folowing account balances on January 1. The company entered into the following transactions during the year. January 15 Issued 17,620 shares of $1 par common stock for 574 , eee cash. January 31 Collected $3, e0e fren custosers on account february 15 Peaceaired 3,240 shares of 51 par connen steck into treasury for 35,640 cash. March is Reissued 2,24 shares of treasury steck for 126,600 cash. dugust is peissued eae shares of treaswry stock for 14 , tee cash. septenber is Deetared (but did not yet phyl a 51 cash dividend sh each eutatanding share of conaon stock. oetober 1 Issued 10e, 10-year, 11,130 bonds, at a quoted bond price of 101. octeber 3 Mrete off a 11, bet batance due fros a custoeer whe went bankrspt. Decenber 29 Pecorded 1254,600 of service revenue, atl of which was collected in cash. Presare the jeurnal entries to recoed fech trarsection. Review the accounts as shown in the Generat Ledger and thial Byanoe tabs. foo not round intermediate March 15 Reissued 2,240 shares of treasury stock for $26,648 cash. August 15 Reissued 600 shares of treasury stock for $4,600 cash. September 15 Declared (but did not yet pay) a 51 cash dividend on each outstanding share of common stock. October 1 Issued 10e, 10-year, \$1,130 bonds, at a quoted bond price of 101. october 3 Wrote off a $1,500 balance due from a custoner who went bankrupt. December 29 Recorded $254,800 of service revenue, all of which was collected in cash. Decenber 30 Paid $224,000 cash for this year's wages through Decenber 31 . (Ignore payroll taxes and payroll deductions. December 31 Calculated $10,000 of depreciation for the year to be recorded. (Ignore accrual adjustments for interest and incone taxes.) Use the dropdowns to select the accounts properly included on the classifled balance sheet. However, you will need to enter the amount of Retained earnings. At the end of the year, the adjusted net income was $20,000. Rudier Associates, reported the foliowing account balances on January 1 . The company entered into the following transactions during the year. January 15 Issued 17 , ee shares of $1 par connon stock for $74,0e0 cash. January 31 collected $3,000 fron custobers on account. February 15 Reacquired 3,240 shares of $1 par common stock into treasury for $35,64a cash. March 15 Reissued 2,240 shares of treasury stock for $26,640 cash. August 15 Reissued 60 stares of treasury stock for $4,600 cash. September is Declared (but did not yet pay) a $1 cash dividend on each outstanding share of common stock. 0ctober 1 Issued 100, 1e-year, $1,130 bonds, at a quoted bond price of 101 . octobet 3 Wrote off a $1,506 balance due fron a custoner who went bankrupt. December 29 Recorded 5254 , e09 of service revenve, all of which was coltected in cash. Decenter 30 Paid $224,000 cash for this year's wages through becenber 31 . (Ignore payrolt taxes and payroll deductions, Decenber 31 Calculated 510 , ees of depreciation for the year to be recorded. (Ignore acerual adjustments for interest and incone taxes.) Puder Associates, reported the folowing account balances on January 1. The company entered into the following transactions during the year. January 15 Issued 17,620 shares of $1 par common stock for 574 , eee cash. January 31 Collected $3, e0e fren custosers on account february 15 Peaceaired 3,240 shares of 51 par connen steck into treasury for 35,640 cash. March is Reissued 2,24 shares of treasury steck for 126,600 cash. dugust is peissued eae shares of treaswry stock for 14 , tee cash. septenber is Deetared (but did not yet phyl a 51 cash dividend sh each eutatanding share of conaon stock. oetober 1 Issued 10e, 10-year, 11,130 bonds, at a quoted bond price of 101. octeber 3 Mrete off a 11, bet batance due fros a custoeer whe went bankrspt. Decenber 29 Pecorded 1254,600 of service revenue, atl of which was collected in cash. Presare the jeurnal entries to recoed fech trarsection. Review the accounts as shown in the Generat Ledger and thial Byanoe tabs. foo not round intermediate March 15 Reissued 2,240 shares of treasury stock for $26,648 cash. August 15 Reissued 600 shares of treasury stock for $4,600 cash. September 15 Declared (but did not yet pay) a 51 cash dividend on each outstanding share of common stock. October 1 Issued 10e, 10-year, \$1,130 bonds, at a quoted bond price of 101. october 3 Wrote off a $1,500 balance due from a custoner who went bankrupt. December 29 Recorded $254,800 of service revenue, all of which was collected in cash. Decenber 30 Paid $224,000 cash for this year's wages through Decenber 31 . (Ignore payroll taxes and payroll deductions. December 31 Calculated $10,000 of depreciation for the year to be recorded. (Ignore accrual adjustments for interest and incone taxes.) Use the dropdowns to select the accounts properly included on the classifled balance sheet. However, you will need to enter the amount of Retained earnings. At the end of the year, the adjusted net income was $20,000. Rudier Associates, reported the foliowing account balances on January 1 . The company entered into the following transactions during the year. January 15 Issued 17 , ee shares of $1 par connon stock for $74,0e0 cash. January 31 collected $3,000 fron custobers on account. February 15 Reacquired 3,240 shares of $1 par common stock into treasury for $35,64a cash. March 15 Reissued 2,240 shares of treasury stock for $26,640 cash. August 15 Reissued 60 stares of treasury stock for $4,600 cash. September is Declared (but did not yet pay) a $1 cash dividend on each outstanding share of common stock. 0ctober 1 Issued 100, 1e-year, $1,130 bonds, at a quoted bond price of 101 . octobet 3 Wrote off a $1,506 balance due fron a custoner who went bankrupt. December 29 Recorded 5254 , e09 of service revenve, all of which was coltected in cash. Decenter 30 Paid $224,000 cash for this year's wages through becenber 31 . (Ignore payrolt taxes and payroll deductions, Decenber 31 Calculated 510 , ees of depreciation for the year to be recorded. (Ignore acerual adjustments for interest and incone taxes.)