Answered step by step

Verified Expert Solution

Question

1 Approved Answer

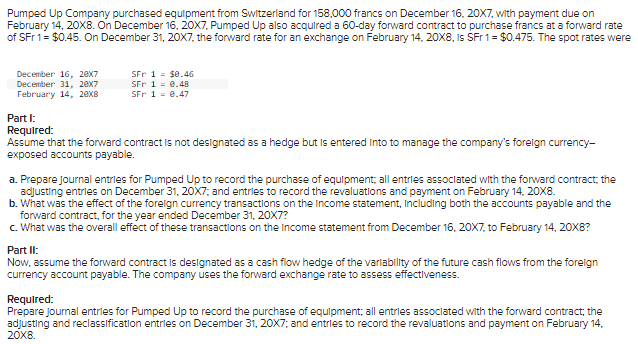

Pumped Up Company purchased equipment from Switzerland for 158,000 francs on December 16, 20X7, with payment due on February 14, 20X8. On December 16,

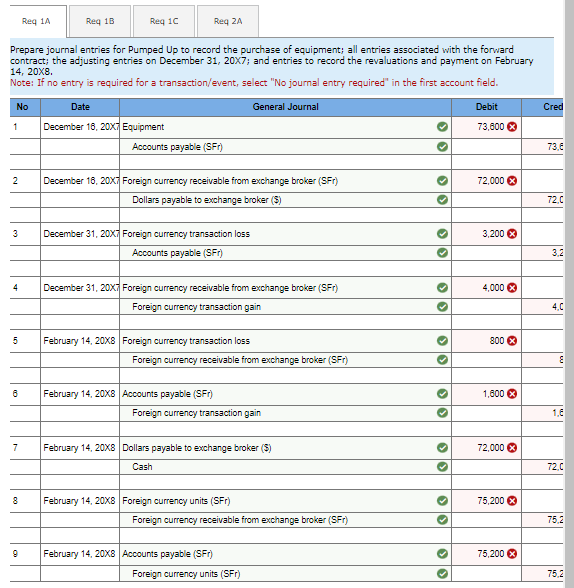

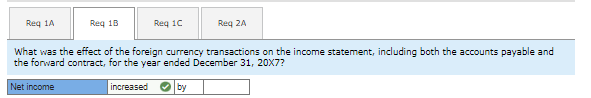

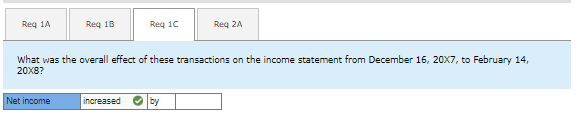

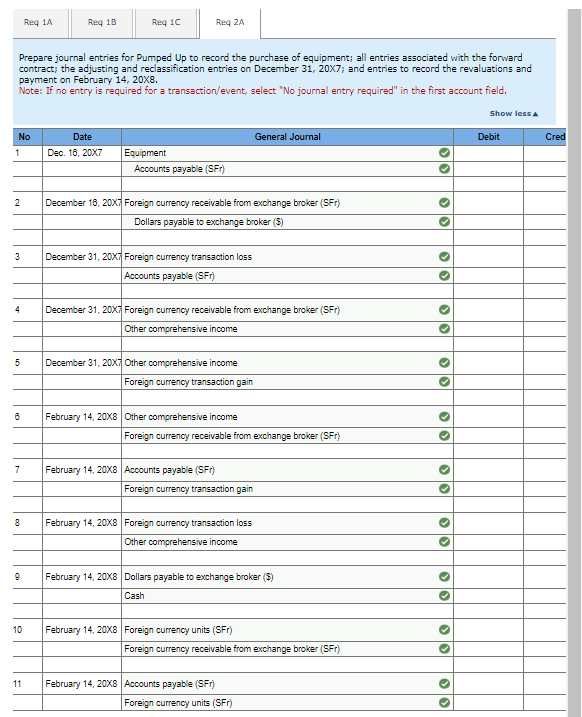

Pumped Up Company purchased equipment from Switzerland for 158,000 francs on December 16, 20X7, with payment due on February 14, 20X8. On December 16, 20X7, Pumped Up also acquired a 60-day forward contract to purchase francs at a forward rate of SFr 1 = $0.45. On December 31, 20X7, the forward rate for an exchange on February 14, 20X8, Is SFr 1 = $0.475. The spot rates were December 16, 20x7 December 31, 20x7 February 14, 20x8 Part I: Required: SFr 1 = $0.46 SFr 1 = 0.48 SFr 1 = 0.47 Assume that the forward contract is not designated as a hedge but is entered into to manage the company's foreign currency- exposed accounts payable. a. Prepare journal entries for Pumped Up to record the purchase of equipment; all entries associated with the forward contract; the adjusting entries on December 31, 20X7; and entries to record the revaluations and payment on February 14, 20X8. b. What was the effect of the foreign currency transactions on the income statement, including both the accounts payable and the forward contract, for the year ended December 31, 20X7? c. What was the overall effect of these transactions on the income statement from December 16, 20X7, to February 14, 20X8? Part II: Now, assume the forward contract is designated as a cash flow hedge of the variability of the future cash flows from the foreign currency account payable. The company uses the forward exchange rate to assess effectiveness. Required: Prepare journal entries for Pumped Up to record the purchase of equipment; all entries associated with the forward contract; the adjusting and reclassification entries on December 31, 20X7; and entries to record the revaluations and payment on February 14. 20X8. Req 1A Req 18 Req 1C Req 2A Prepare journal entries for Pumped Up to record the purchase of equipment; all entries associated with the forward contract; the adjusting entries on December 31, 20X7; and entries to record the revaluations and payment on February 14, 20X8. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. No Date 1 December 16, 20X7 Equipment Accounts payable (SFr) General Journal 2 December 18, 20XT Foreign currency receivable from exchange broker (SFr) Dollars payable to exchange broker ($) 3 December 31, 20X7 Foreign currency transaction loss 4 Accounts payable (SFr) December 31, 20XT Foreign currency receivable from exchange broker (SFr) Foreign currency transaction gain 5 February 14, 20X8 Foreign currency transaction loss 8 7 Foreign currency receivable from exchange broker (SFr) February 14, 20X8 Accounts payable (SFr) Foreign currency transaction gain February 14, 20X8 Dollars payable to exchange broker ($) Cash 8 February 14, 20X8 Foreign currency units (SFr) Foreign currency receivable from exchange broker (SFr) 9 February 14, 20X8 Accounts payable (SFr) Foreign currency units (SFr) S S > > > > > > Debit Cred 73,600 x 73,6 72,000 72,0 3,200 3,2 4,000 4,0 800 > 1,600 x 1,6 72,000 72,0 75,200 75,2 75,200 75,2 Req 1A Req 1B Req 1C Req 2A What was the effect of the foreign currency transactions on the income statement, including both the accounts payable and the forward contract, for the year ended December 31, 20X7? Net income increased by Req 1A Req 1B Req 1C Req 2A What was the overall effect of these transactions on the income statement from December 16, 20X7, to February 14, 20X8? Net income increased by Req 1A Req 18 Req 1C Req 2A Prepare journal entries for Pumped Up to record the purchase of equipment; all entries associated with the forward contract; the adjusting and reclassification entries on December 31, 20X7; and entries to record the revaluations and payment on February 14, 20X8. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. No Date General Journal 1 Dec. 16, 20X7 Equipment Accounts payable (SFr) 2 3 4 5 December 18, 20X7 Foreign currency receivable from exchange broker (SFr) Dollars payable to exchange broker ($) December 31, 20X7 Foreign currency transaction loss Accounts payable (SFr) December 31, 20XT Foreign currency receivable from exchange broker (SFr) Other comprehensive income December 31, 20X7 Other comprehensive income Foreign currency transaction gain 6 February 14, 20X8 Other comprehensive income Foreign currency receivable from exchange broker (SFr) 7 8 9 10 11 February 14, 20X8 Accounts payable (SFr) Foreign currency transaction gain February 14, 20X8 Foreign currency transaction loss Other comprehensive income February 14, 20X8 Dollars payable to exchange broker ($) Cash February 14, 20X8 Foreign currency units (SFr) Foreign currency receivable from exchange broker (SFr) February 14, 20X8 Accounts payable (SFr) Foreign currency units (SFr) > > > > Show less A Debit Cred

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started