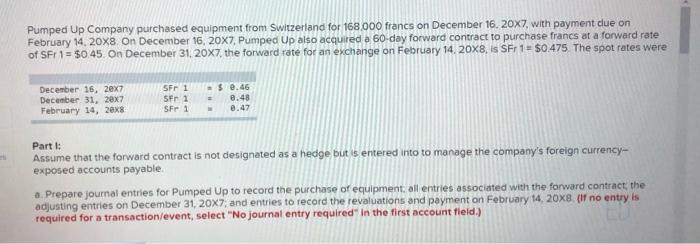

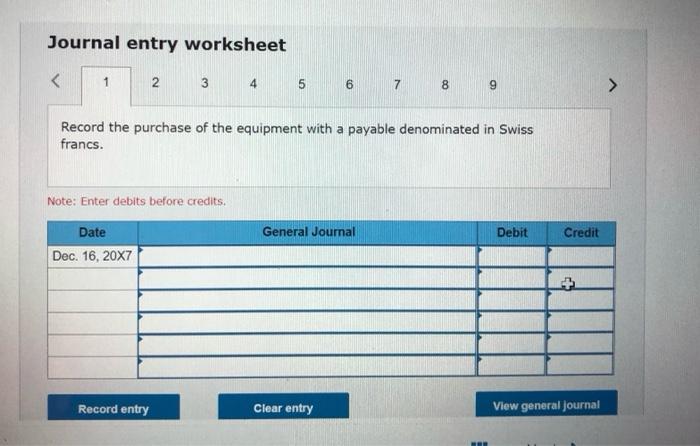

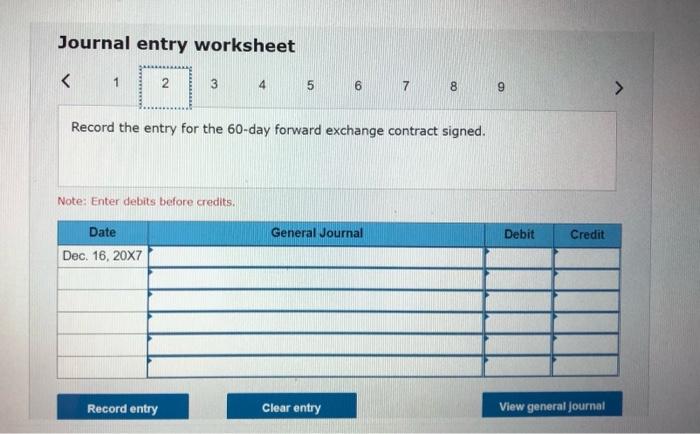

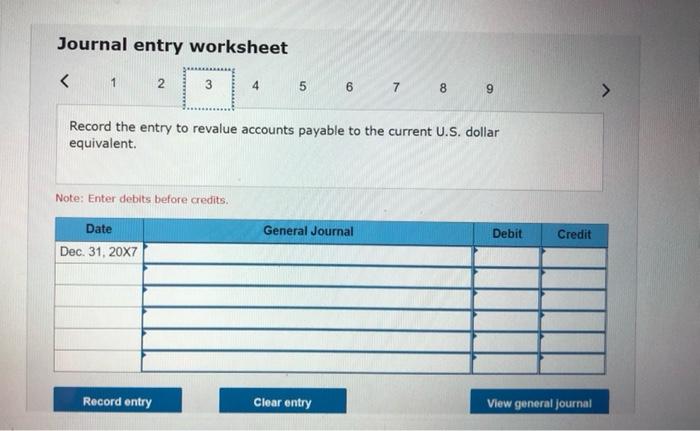

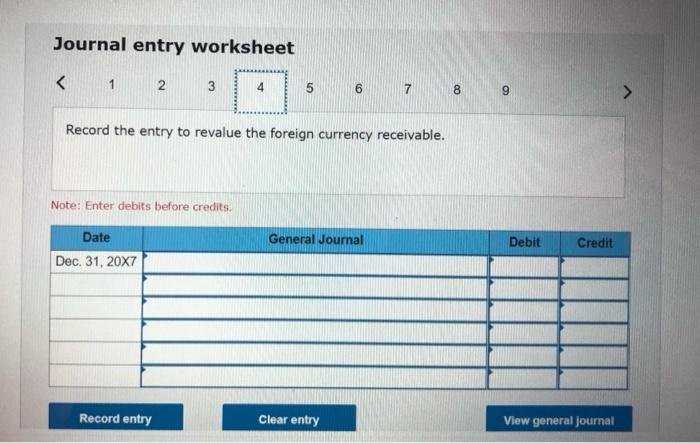

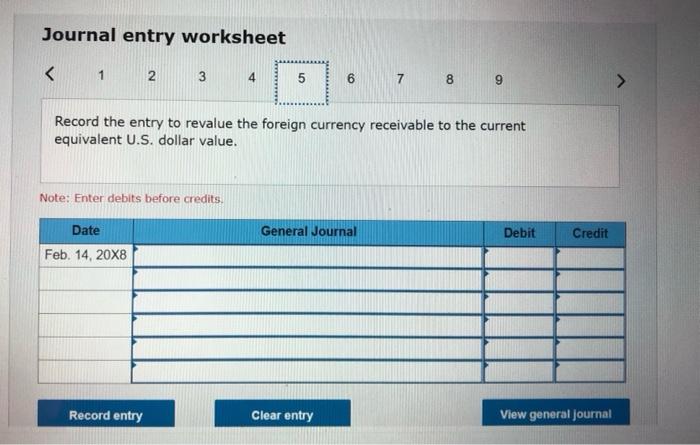

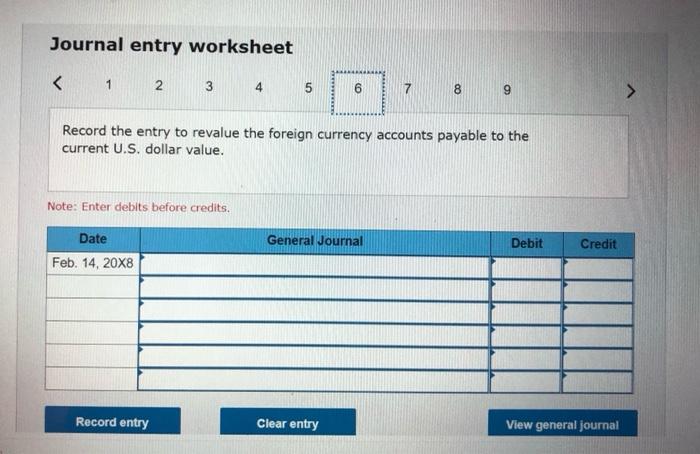

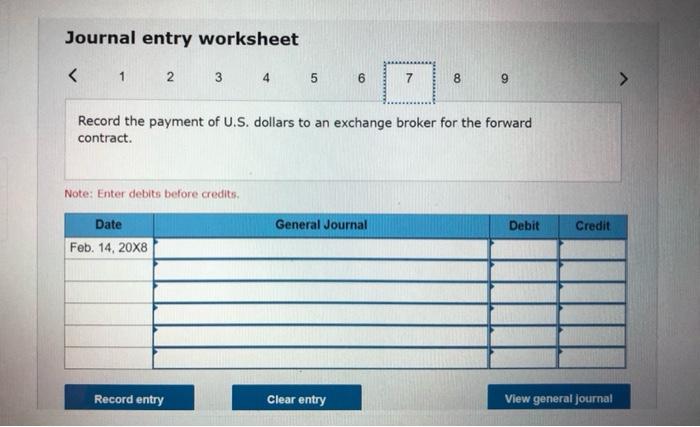

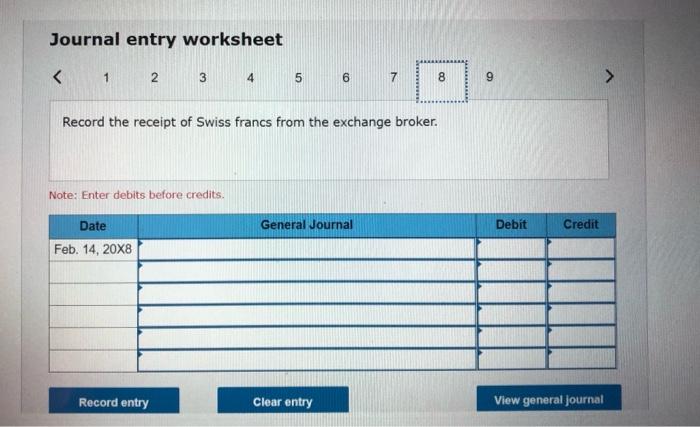

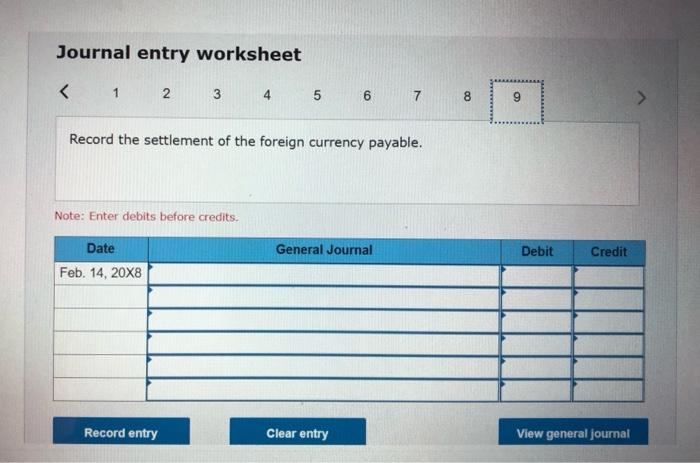

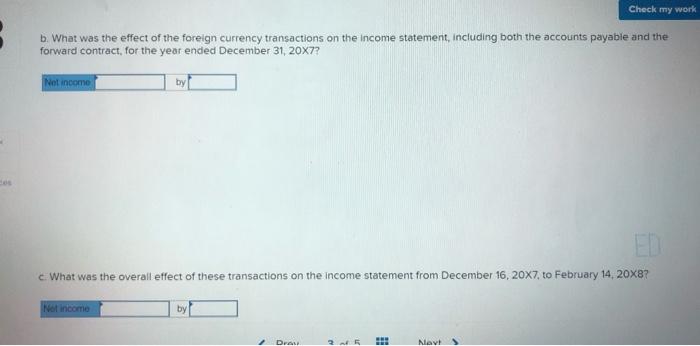

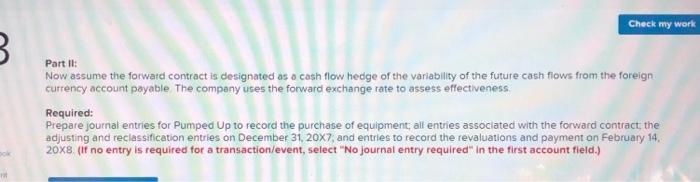

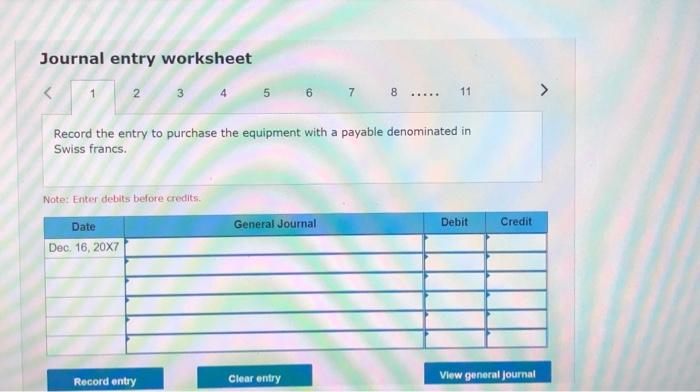

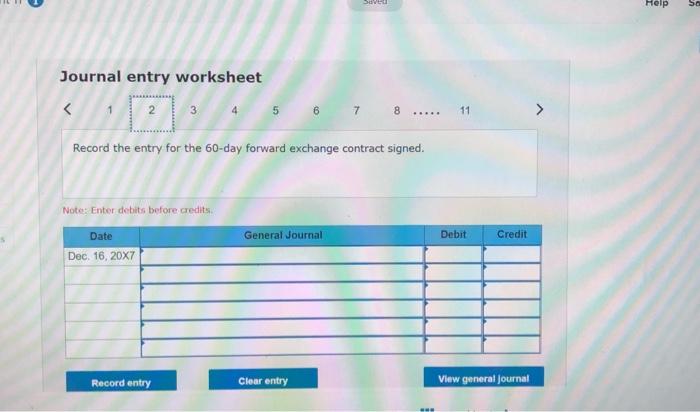

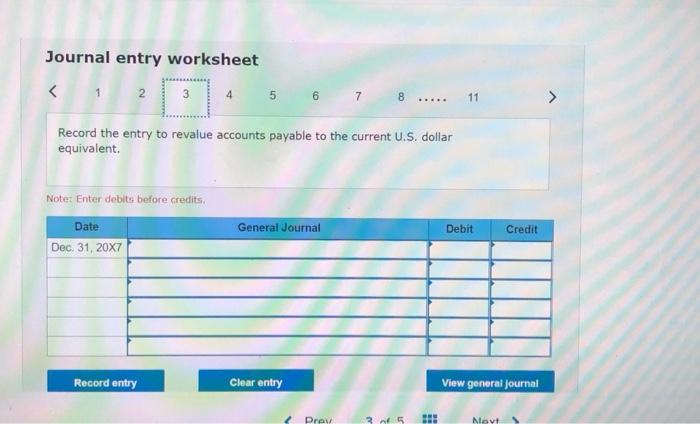

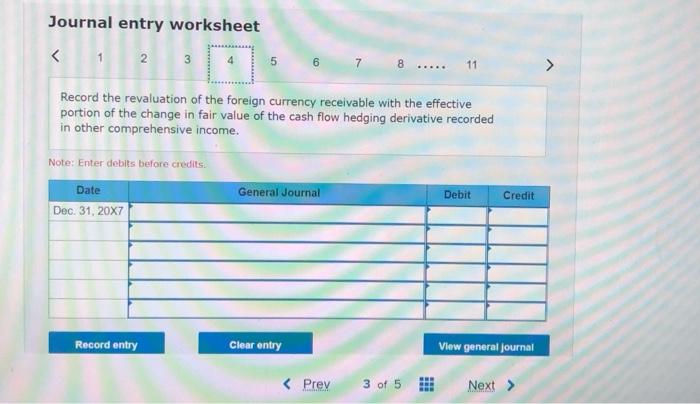

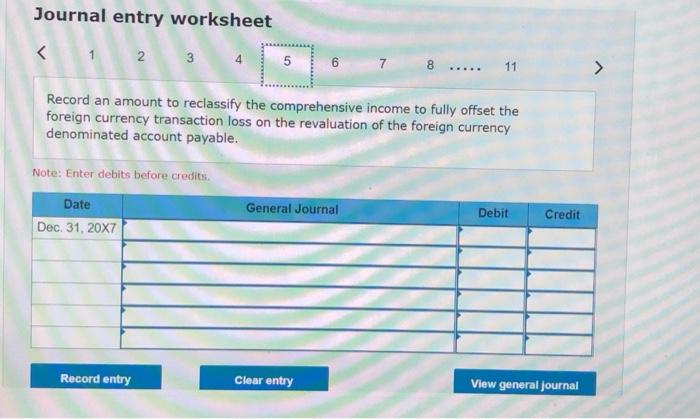

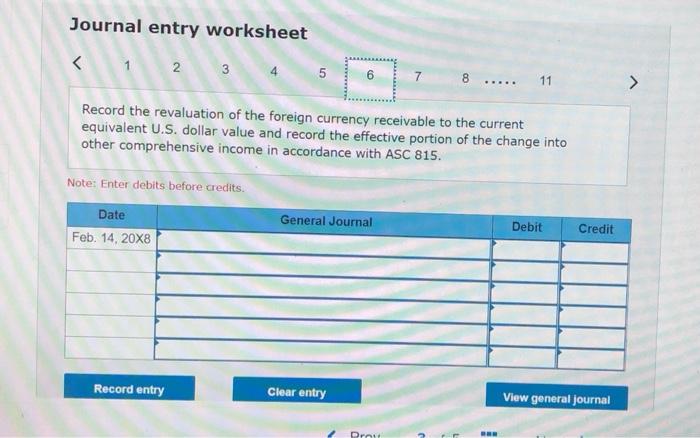

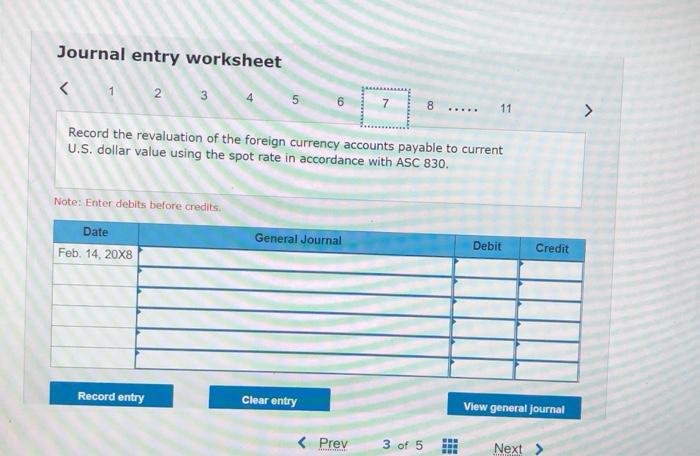

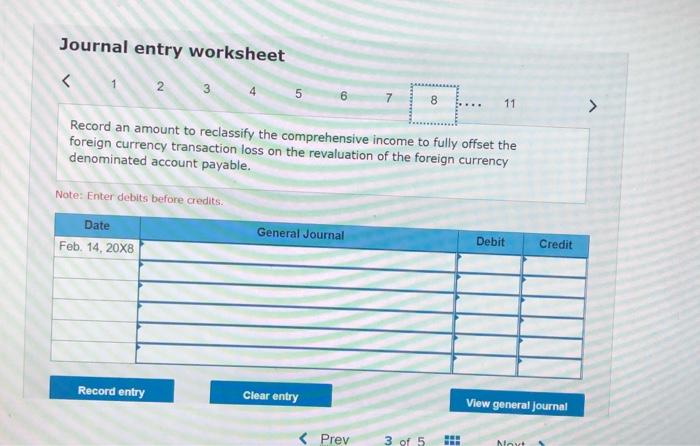

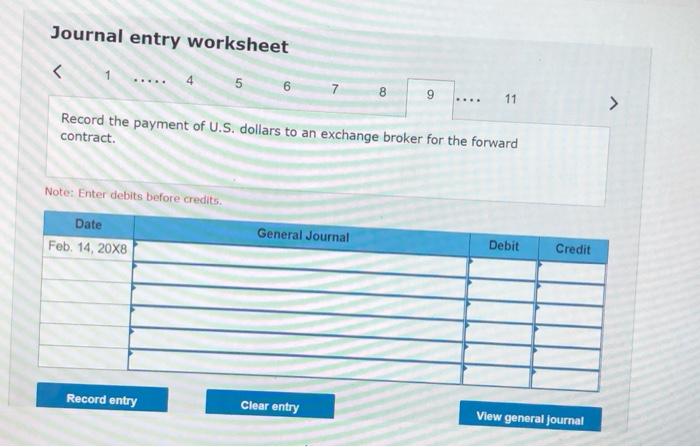

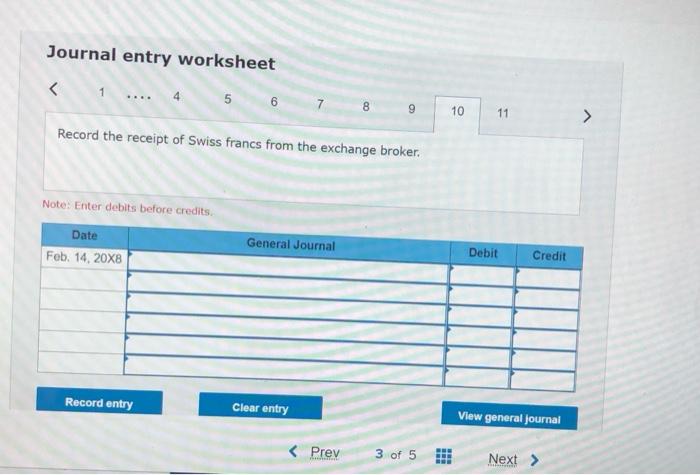

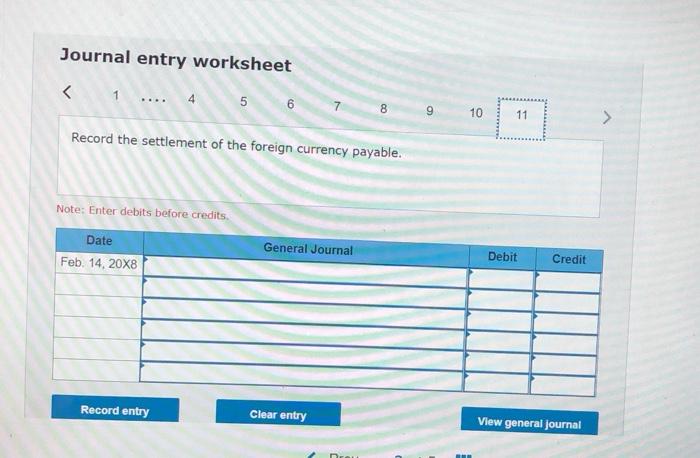

Pumped Up Company purchased equipment from Switzerland for 168.000 francs on December 16, 20X7, with payment clue on February 14, 20x8 on December 16, 20X7, Pumped Up also acquired a 60 day forward contract to purchase francs at a forward rate of SFI1 = $0.45. On December 31, 20X7, the forward rate for an exchange on February 14, 20x8, is SFr 1 $0.475. The spot rates were December 16, 20x7 December 31, 20x7 February 14, 20x8 SFr 1 SFr 1 SFr 1 $2.46 0.48 0.47 Part 1: Assume that the forward contract is not designated as a hedge but is entered into to manage the company's foreign currency- exposed accounts payable a. Prepare journal entries for Pumped Up to record the purchase of equipment, all entries associated with the forward contract the adjusting entries on December 31, 20X7, and entries to record the revaluations and payment on February 14, 20x8 (if no entry is required for a transaction/event, select "No journal entry required in the first account field.) Journal entry worksheet Record the purchase of the equipment with a payable denominated in Swiss francs. Note: Enter debits before credits eneral Journal Debit Credit Date Dec. 16, 20X7 Record entry Clear entry View general Journal Journal entry worksheet N 3 4 5 6 7 8 9 Record the entry for the 60-day forward exchange contract signed. Note: Enter debits before credits. General Journal Debit Credit Date Dec. 16, 20X7 Record entry Clear entry View general Journal Journal entry worksheet Record the payment of U.S. dollars to an exchange broker for the forward contract. Note: Enter debits before credits. Date Feb. 14, 20x8 General Journal Debit Credit Record entry Clear entry View general journal Journal entry worksheet Journal entry worksheet Record the revaluation of the foreign currency receivable to the current equivalent U.S. dollar value and record the effective portion of the change into other comprehensive income in accordance with ASC 815. Note: Enter debits before credits. Date Feb. 14, 20X8 General Journal Debit Credit Record entry Clear entry View general journal Drent Journal entry worksheet 1 2 2 3 5 7 00 ..... 11 ALLER > Record the revaluation of the foreign currency accounts payable to current U.S. dollar value using the spot rate in accordance with ASC 830. Note: Enter debits before credits Date General Journal Debit Credit Feb. 14, 20X8 Record entry Clear entry View general journal Prev 3 of 5 HR Next Journal entry worksheet 1 2 3 4 5 5 8 11 Record an amount to reclassify the comprehensive income to fully offset the foreign currency transaction loss on the revaluation of the foreign currency denominated account payable. Note: Enter debits before credits. Date General Journal Feb. 14, 20X8 Debit Credit Record entry Clear entry View general Journal Record the payment of U.S. dollars to an exchange broker for the forward contract. Note: Enter debits before credits. Date Feb. 14, 20X8 General Journal Debit Credit Record entry Clear entry View general journal Journal entry worksheet 1 .... 4 5 6 7 CD 9 10 11 > Record the receipt of Swiss francs from the exchange broker. Note: Enter debits before credits Date General Journal Feb. 14, 20X8 Debit Credit Record entry Clear entry View general Journal Prev 3 of 5 Next > Journal entry worksheet Record the settlement of the foreign currency payable. Note: Enter debits before credits. Date Feb 14, 20X8 General Journal Debit Credit Record entry Clear entry View general journal