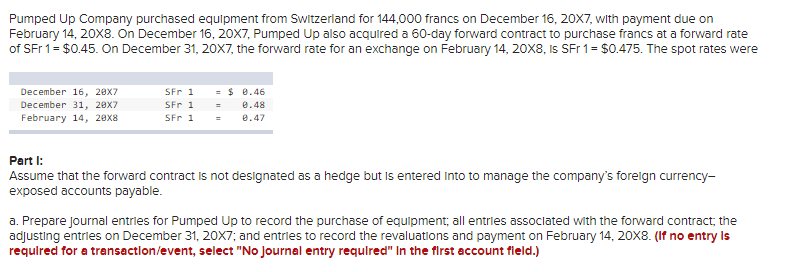

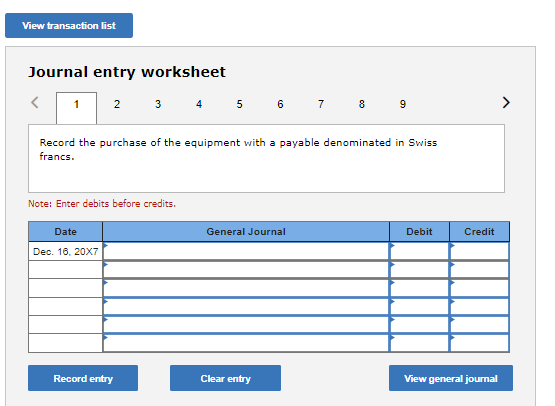

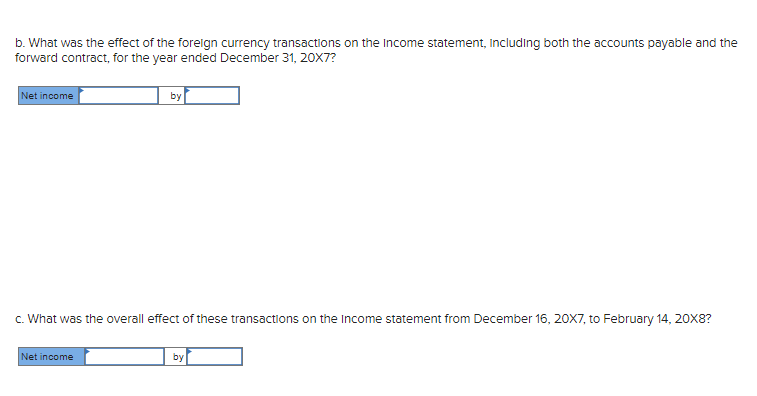

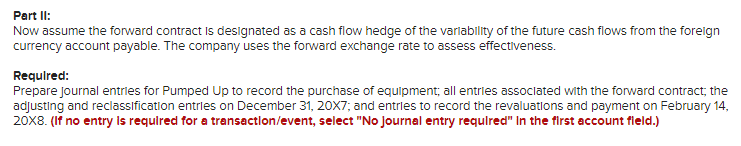

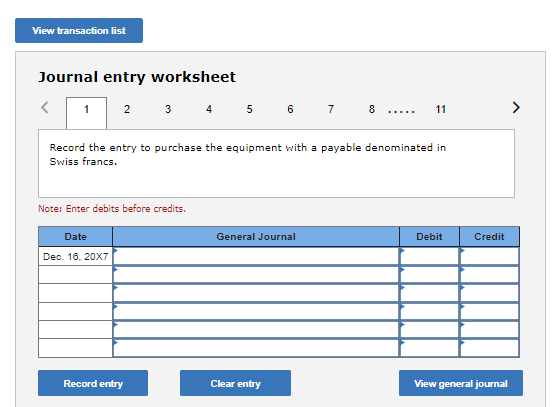

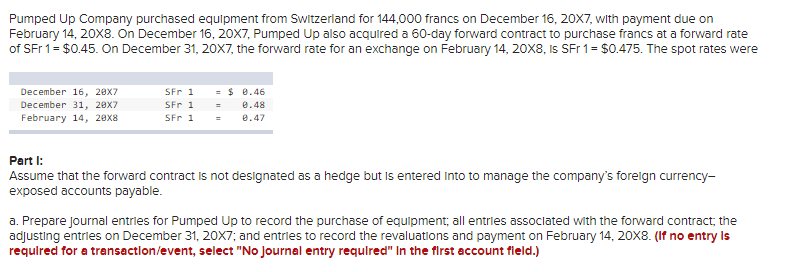

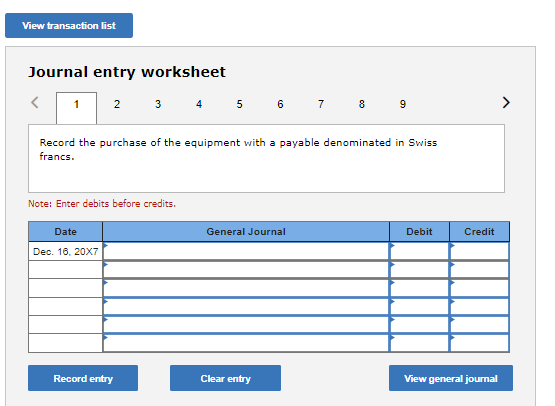

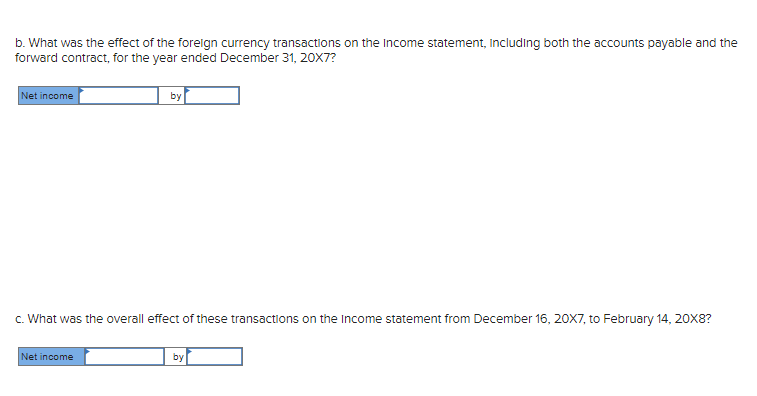

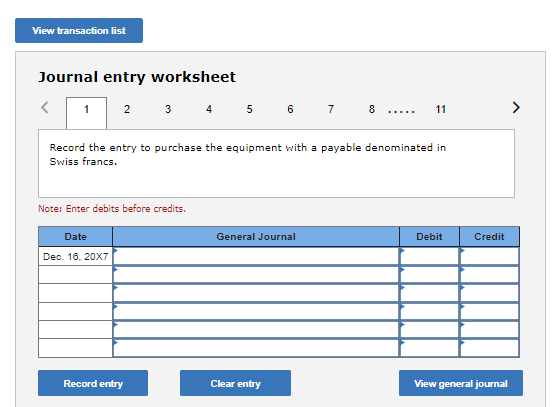

Pumped Up Company purchased equlpment from Switzerland for 144,000 francs on December 16,207, with payment due on February 14, 20X8. On December 16,207, Pumped Up also acquired a 60 -day forward contract to purchase francs at a forward rate of SFr 1=$0.45. On December 31,207, the forward rate for an exchange on February 14,208, is SFr1=$0.475. The spot rates were Part I: Assume that the forward contract is not designated as a hedge but is entered Into to manage the company's foreign currencyexposed accounts payable. a. Prepare journal entrles for Pumped Up to record the purchase of equipment; all entrles assoclated with the forward contract; the adjusting entrles on December 31, 20X7; and entrles to record the revaluations and payment on February 14, 20X8. (If no entry is requlred for a transaction/event, select "No journal entry requlred" In the flrst account field.) Journal entry worksheet 456789 Record the purchase of the equipment with a payable denominated in Swiss francs. Note: Enter debits before credits. b. What was the effect of the foreign currency transactlons on the Income statement, Including both the accounts payable and the forward contract, for the year ended December 31,207 ? c. What was the overall effect of these transactions on the Income statement from December 16,207, to February 14 , 208 ? Part II: Now assume the forward contract is designated as a cash flow hedge of the varlability of the future cash flows from the forelgn currency account payable. The company uses the forward exchange rate to assess effectlveness. Requlred: Prepare Journal entrles for Pumped Up to record the purchase of equipment; all entrles assoclated with the forward contract; the adjusting and reclasslfication entrles on December 31,207; and entrles to record the revaluations and payment on February 14 , 20X8. (If no entry is requlred for a transactlon/event, select "No journal entry requlred" In the first account field.) Journal entry worksheet 567811 Record the entry to purchase the equipment with a payable denominated in Swiss francs. Note: Enter debits before credits. Pumped Up Company purchased equlpment from Switzerland for 144,000 francs on December 16,207, with payment due on February 14, 20X8. On December 16,207, Pumped Up also acquired a 60 -day forward contract to purchase francs at a forward rate of SFr 1=$0.45. On December 31,207, the forward rate for an exchange on February 14,208, is SFr1=$0.475. The spot rates were Part I: Assume that the forward contract is not designated as a hedge but is entered Into to manage the company's foreign currencyexposed accounts payable. a. Prepare journal entrles for Pumped Up to record the purchase of equipment; all entrles assoclated with the forward contract; the adjusting entrles on December 31, 20X7; and entrles to record the revaluations and payment on February 14, 20X8. (If no entry is requlred for a transaction/event, select "No journal entry requlred" In the flrst account field.) Journal entry worksheet 456789 Record the purchase of the equipment with a payable denominated in Swiss francs. Note: Enter debits before credits. b. What was the effect of the foreign currency transactlons on the Income statement, Including both the accounts payable and the forward contract, for the year ended December 31,207 ? c. What was the overall effect of these transactions on the Income statement from December 16,207, to February 14 , 208 ? Part II: Now assume the forward contract is designated as a cash flow hedge of the varlability of the future cash flows from the forelgn currency account payable. The company uses the forward exchange rate to assess effectlveness. Requlred: Prepare Journal entrles for Pumped Up to record the purchase of equipment; all entrles assoclated with the forward contract; the adjusting and reclasslfication entrles on December 31,207; and entrles to record the revaluations and payment on February 14 , 20X8. (If no entry is requlred for a transactlon/event, select "No journal entry requlred" In the first account field.) Journal entry worksheet 567811 Record the entry to purchase the equipment with a payable denominated in Swiss francs. Note: Enter debits before credits