Answered step by step

Verified Expert Solution

Question

1 Approved Answer

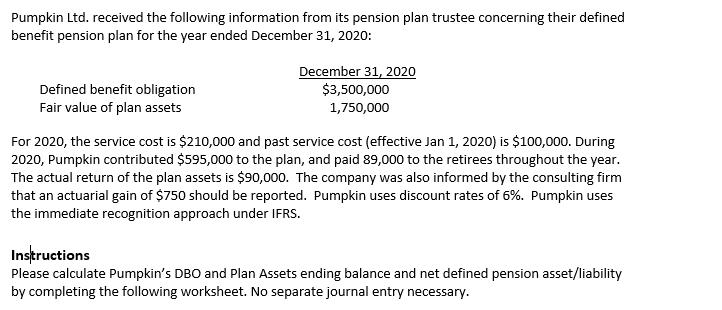

Pumpkin Ltd. received the following information from its pension plan trustee concerning their defined benefit pension plan for the year ended December 31, 2020:

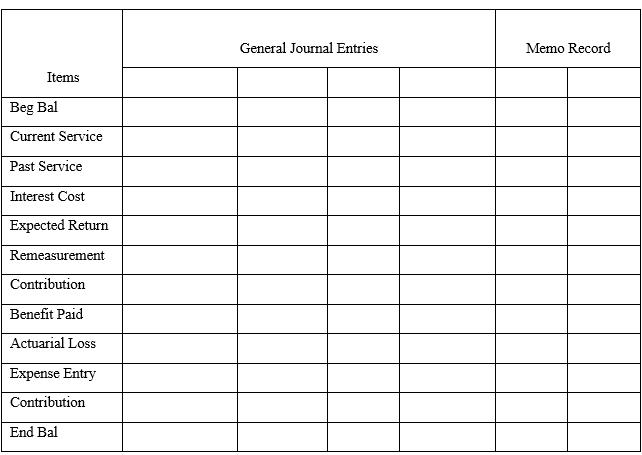

Pumpkin Ltd. received the following information from its pension plan trustee concerning their defined benefit pension plan for the year ended December 31, 2020: Defined benefit obligation December 31, 2020 $3,500,000 1,750,000 Fair value of plan assets For 2020, the service cost is $210,000 and past service cost (effective Jan 1, 2020) is $100,000. During 2020, Pumpkin contributed $595,000 to the plan, and paid 89,000 to the retirees throughout the year. The actual return of the plan assets is $90,000. The company was also informed by the consulting firm that an actuarial gain of $750 should be reported. Pumpkin uses discount rates of 6%. Pumpkin uses the immediate recognition approach under IFRS. Instructions Please calculate Pumpkin's DBO and Plan Assets ending balance and net defined pension asset/liability by completing the following worksheet. No separate journal entry necessary. Items Beg Bal Current Service Past Service Interest Cost Expected Return Remeasurement Contribution Benefit Paid Actuarial Loss Expense Entry Contribution End Bal General Journal Entries Memo Record

Step by Step Solution

★★★★★

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Pumpkin Ltd Pension Plan Defined Benefit Obligatio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started