Cohen Co. is a farming equipment dealer who reports using IFRS. It plans to lease a piece of farming equipment to Warren Inc. and

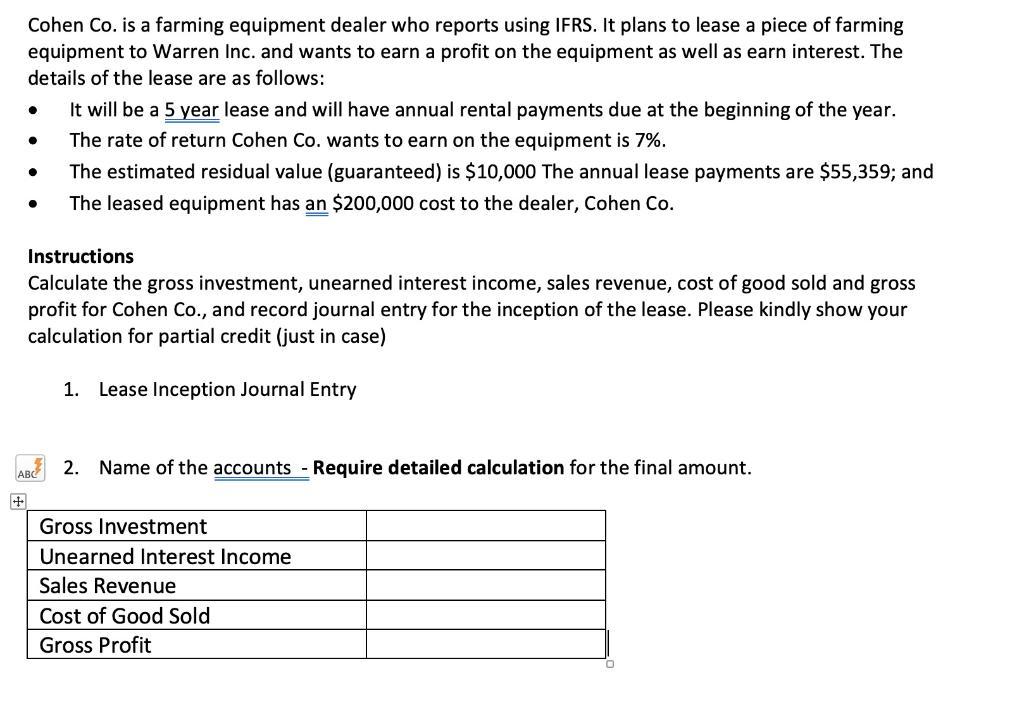

Cohen Co. is a farming equipment dealer who reports using IFRS. It plans to lease a piece of farming equipment to Warren Inc. and wants to earn a profit on the equipment as well as earn interest. The details of the lease are as follows: It will be a 5 year lease and will have annual rental payments due at the beginning of the year. The rate of return Cohen Co. wants to earn on the equipment is 7%. The estimated residual value (guaranteed) is $10,000 The annual lease payments are $55,359; and The leased equipment has an $200,000 cost to the dealer, Cohen Co. Instructions Calculate the gross investment, unearned interest income, sales revenue, cost of good sold and gross profit for Cohen Co., and record journal entry for the inception of the lease. Please kindly show your calculation for partial credit (just in case) 1. Lease Inception Journal Entry 2. Name of the accounts Require detailed calculation for the final amount. ABC Gross Investment Unearned Interest Income Sales Revenue Cost of Good Sold Gross Profit

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Calculate the followings for Apple Tree Co A Gross investment B unearned interest income C sales r...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started