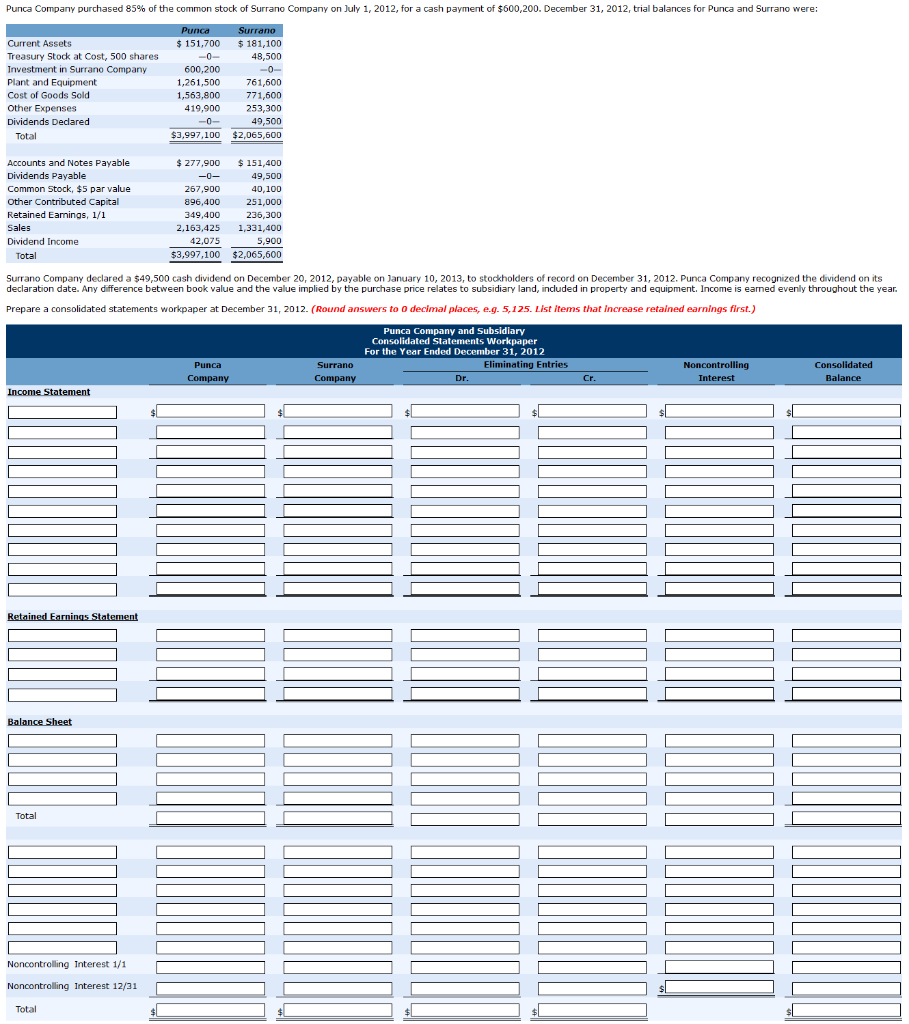

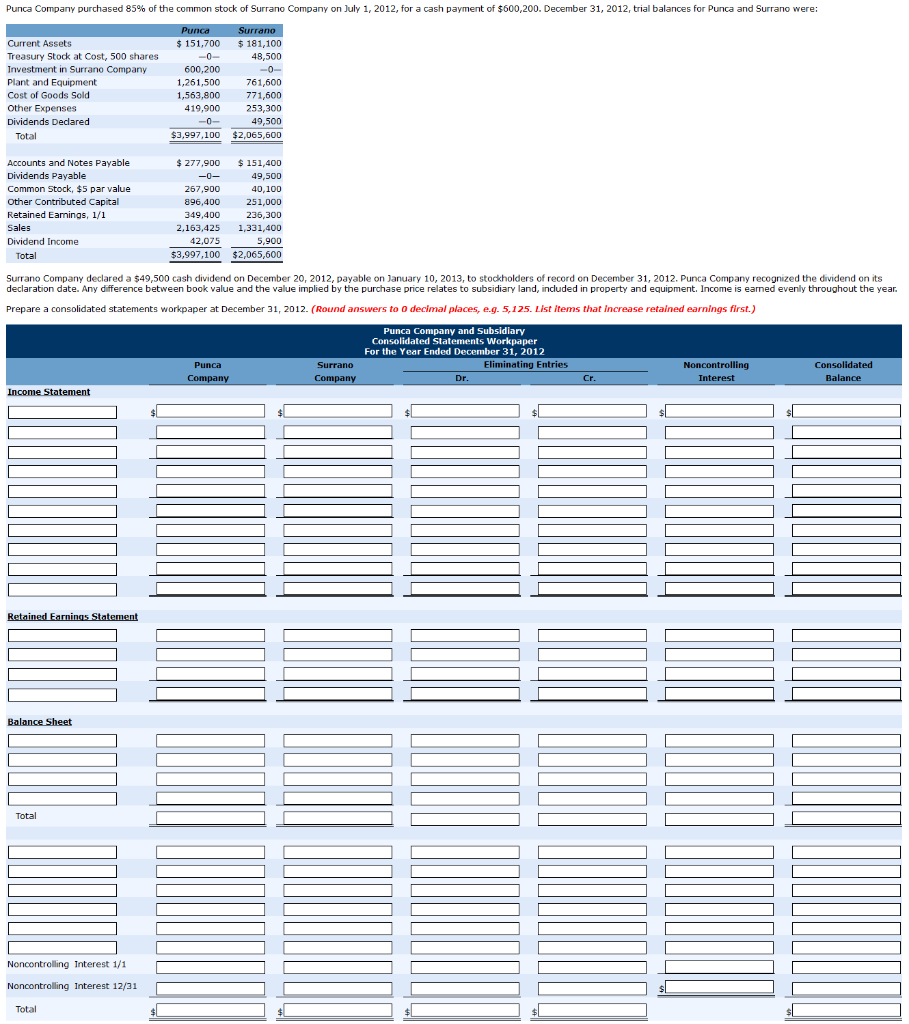

Punca Company purchased 85% of the common stock of Surrano Company on July 1, 2012, for a cash payment of $600,200. December 31, 2012, trial balances for Punca and Surrano were: Current Assets Treasury Stock at Cost, 500 shares Investment in Surrano Company Plant and Equipment Cost of Goods Sold Other Expenses Dividends Declared Total Punca $ 151,700 -0- 600,200 1,261,500 1,563,800 419,900 -0- $3,997,100 Surrano $ 181,100 48,500 -O 761,600 771,600 253,300 49,500 $2,065,500 Accounts and Notes Payable Dividends Payable Common Stock, $5 par value Other Contributed Capital Retained Earnings, 1/1 Sales Dividend Income Total $ 277,900 0- 267,900 896,400 349,400 2,163,425 42,075 $3,997,100 $ 151,400 49,500 40,100 251,000 236,300 1,331,400 5,900 $2,065,600 Surrano Company declared a $49,500 cash dividend on December 20, 2012, payable on January 10, 2013, to stockholders of record on December 31, 2012. Punca Company recognized the dividend on its declaration date. Any difference between book value and the value implied by the purchase price relates to subsidiary land, included in property and equipment. Income is earned evenly throughout the year. Prepare a consolidated statements workpaper at December 31, 2012. (Round answers to o decimal places, e.g. 5,125. List Items that increase retained earnings first.) Punca Company and Subsidiary Consolidated Statements Workpaper For the Year Ended December 31, 2012 Eliminating Entries Punca Company Surrano Company Noncontrolling Interest Consolidated Balance Dr. Income Statement 4440440044 Retained Earnings Statement Balance Sheet Total |u044 OOOO044 Noncontrolling Interest 1/1 Noncontrolling Interest 12/31 Total Punca Company purchased 85% of the common stock of Surrano Company on July 1, 2012, for a cash payment of $600,200. December 31, 2012, trial balances for Punca and Surrano were: Current Assets Treasury Stock at Cost, 500 shares Investment in Surrano Company Plant and Equipment Cost of Goods Sold Other Expenses Dividends Declared Total Punca $ 151,700 -0- 600,200 1,261,500 1,563,800 419,900 -0- $3,997,100 Surrano $ 181,100 48,500 -O 761,600 771,600 253,300 49,500 $2,065,500 Accounts and Notes Payable Dividends Payable Common Stock, $5 par value Other Contributed Capital Retained Earnings, 1/1 Sales Dividend Income Total $ 277,900 0- 267,900 896,400 349,400 2,163,425 42,075 $3,997,100 $ 151,400 49,500 40,100 251,000 236,300 1,331,400 5,900 $2,065,600 Surrano Company declared a $49,500 cash dividend on December 20, 2012, payable on January 10, 2013, to stockholders of record on December 31, 2012. Punca Company recognized the dividend on its declaration date. Any difference between book value and the value implied by the purchase price relates to subsidiary land, included in property and equipment. Income is earned evenly throughout the year. Prepare a consolidated statements workpaper at December 31, 2012. (Round answers to o decimal places, e.g. 5,125. List Items that increase retained earnings first.) Punca Company and Subsidiary Consolidated Statements Workpaper For the Year Ended December 31, 2012 Eliminating Entries Punca Company Surrano Company Noncontrolling Interest Consolidated Balance Dr. Income Statement 4440440044 Retained Earnings Statement Balance Sheet Total |u044 OOOO044 Noncontrolling Interest 1/1 Noncontrolling Interest 12/31 Total