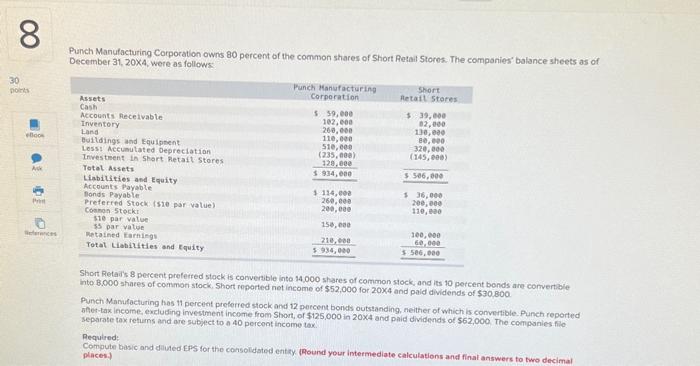

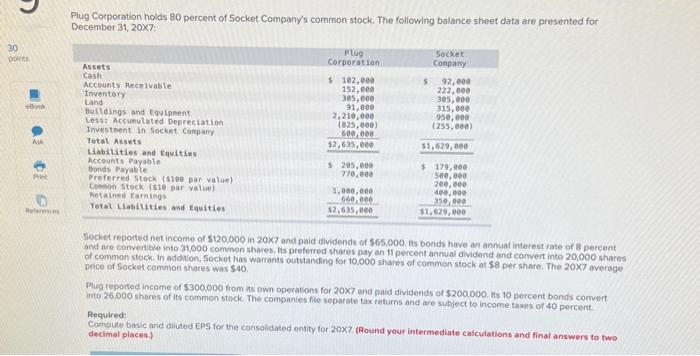

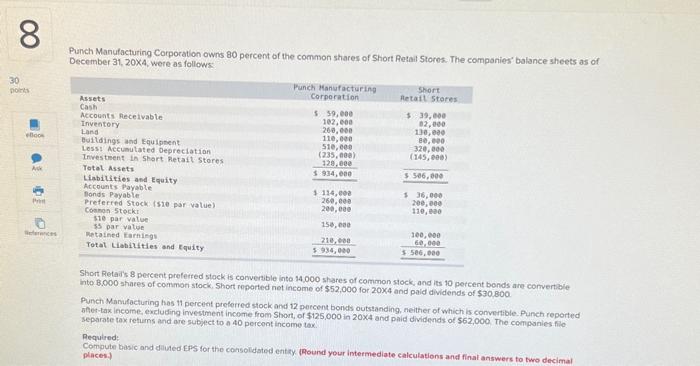

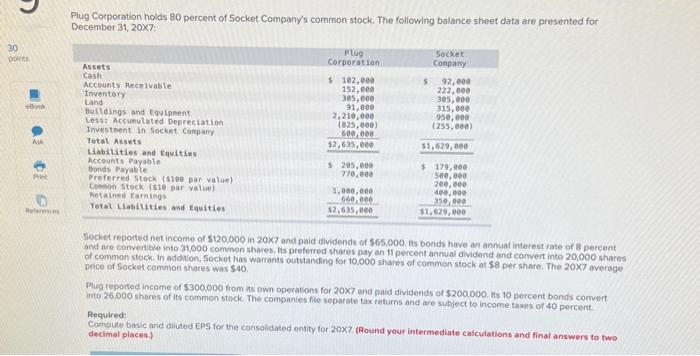

Punch Manufacturing Corporation owns 80 percent of the common shares of Short Retait Stores. The companies' balance sheets as of December 31,204, were as follows: Short Retas 8 percent preferted stock is conversble into 14,000 shares of common stock, and its 10 petcent bonds are corvertible into B,000 shares of common stock, Short reported net income of $52,000 for 204 and paid dividends of $30,800 Punch Mamufacturing has 11 percent preferred stock and 12 porcent bonds outstanding, neither of which is convertible. Punch reported afes-tax income, excluding imvestment income from 5 hort, of $125,000 in 204 and paid dividends of 562,000 . The componies file separate tax returns and are subject to 4.40 percont income tox. Pequired: Compute basic and dilued EPS for the consoldated entex. (Pound your intermediate calculations and final answers to tmo decimal places. Plug Corporation holds 80 percent of Socket Company's common stock. The following balance sheet data are presented for December 31, 20X7: Socket repoted net income of \$120,000 in 207 and paid dividends of \$65,000. its bonds hove an annual interest rate of 8 percent. and are comverible inta 31,000 corvmon thares, is preferred shares pay an 11 percent annual dividend and comvert into 20,000 shares of common stock. In addition, Socket has warrants outstanding for 10,000 shares of common stock at 58 per share. The 207 overage price of Socket common shares was $40. Piug reported income of $300000 from its own operations for 207 and pald dividends of $200,000, its 10 percent bonds convert into 26,000 shares of its common stock. The companies file separate tax returns and are subject to income taxes of 40 percent. Required: Compute bosic and dilited EPS for the consolidated entity for 207. (Round your intermediate calculations and final answers to two decimal places? Punch Manufacturing Corporation owns 80 percent of the common shares of Short Retait Stores. The companies' balance sheets as of December 31,204, were as follows: Short Retas 8 percent preferted stock is conversble into 14,000 shares of common stock, and its 10 petcent bonds are corvertible into B,000 shares of common stock, Short reported net income of $52,000 for 204 and paid dividends of $30,800 Punch Mamufacturing has 11 percent preferred stock and 12 porcent bonds outstanding, neither of which is convertible. Punch reported afes-tax income, excluding imvestment income from 5 hort, of $125,000 in 204 and paid dividends of 562,000 . The componies file separate tax returns and are subject to 4.40 percont income tox. Pequired: Compute basic and dilued EPS for the consoldated entex. (Pound your intermediate calculations and final answers to tmo decimal places. Plug Corporation holds 80 percent of Socket Company's common stock. The following balance sheet data are presented for December 31, 20X7: Socket repoted net income of \$120,000 in 207 and paid dividends of \$65,000. its bonds hove an annual interest rate of 8 percent. and are comverible inta 31,000 corvmon thares, is preferred shares pay an 11 percent annual dividend and comvert into 20,000 shares of common stock. In addition, Socket has warrants outstanding for 10,000 shares of common stock at 58 per share. The 207 overage price of Socket common shares was $40. Piug reported income of $300000 from its own operations for 207 and pald dividends of $200,000, its 10 percent bonds convert into 26,000 shares of its common stock. The companies file separate tax returns and are subject to income taxes of 40 percent. Required: Compute bosic and dilited EPS for the consolidated entity for 207. (Round your intermediate calculations and final answers to two decimal places