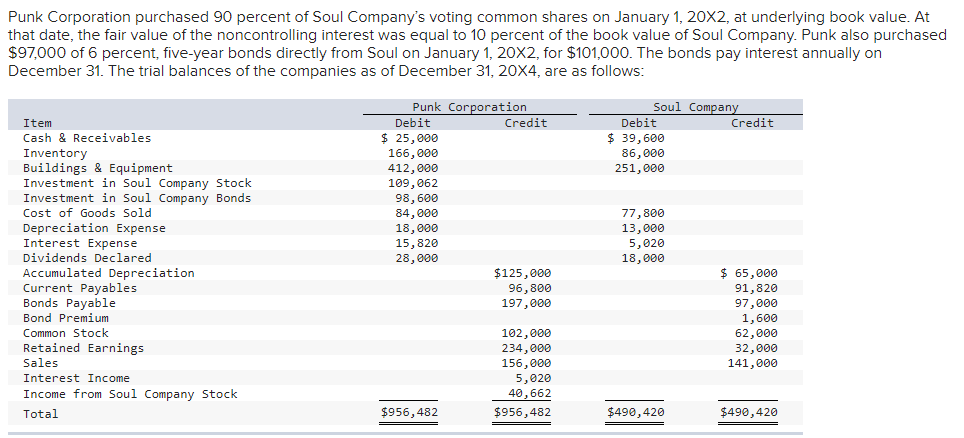

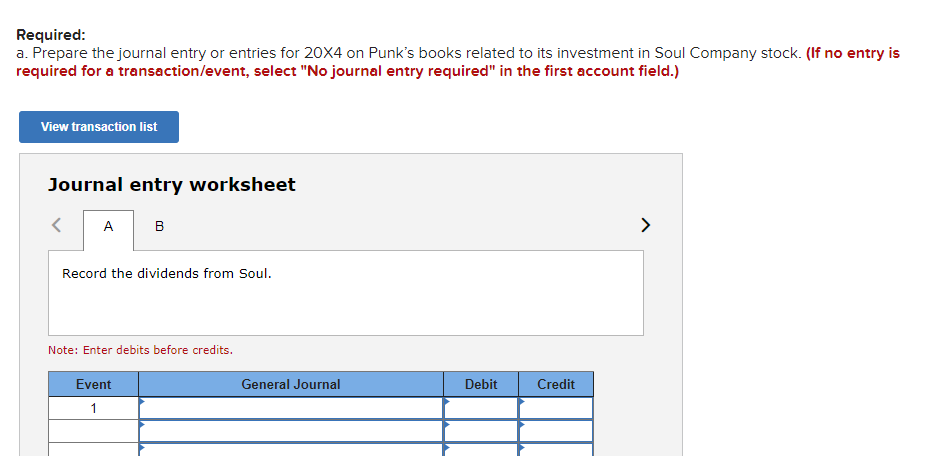

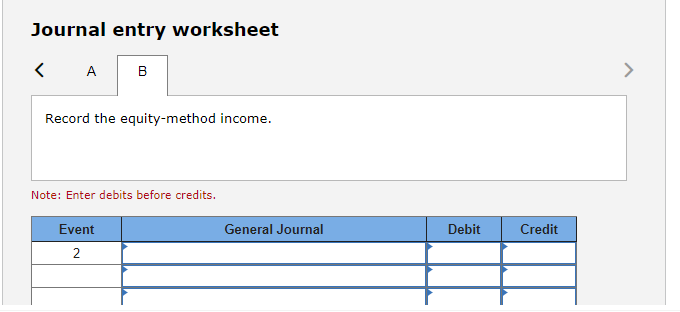

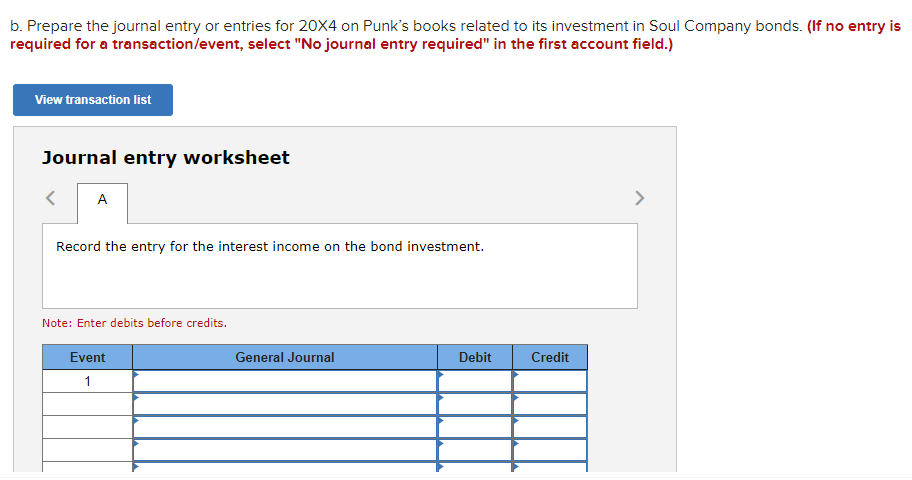

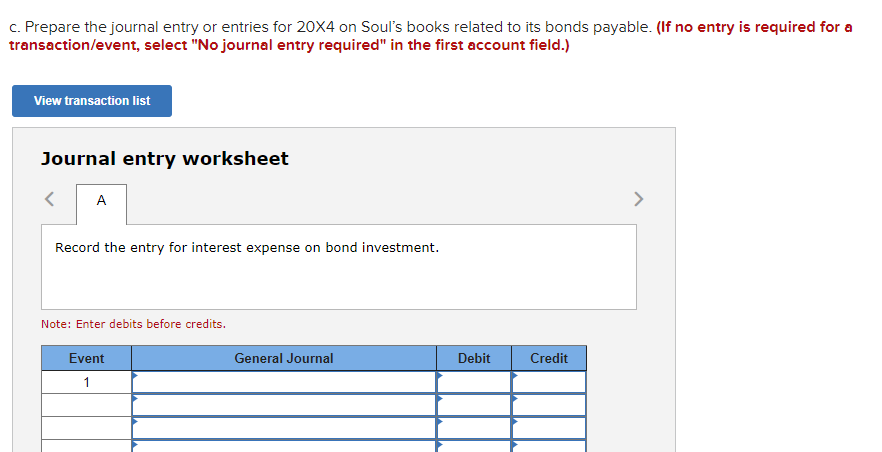

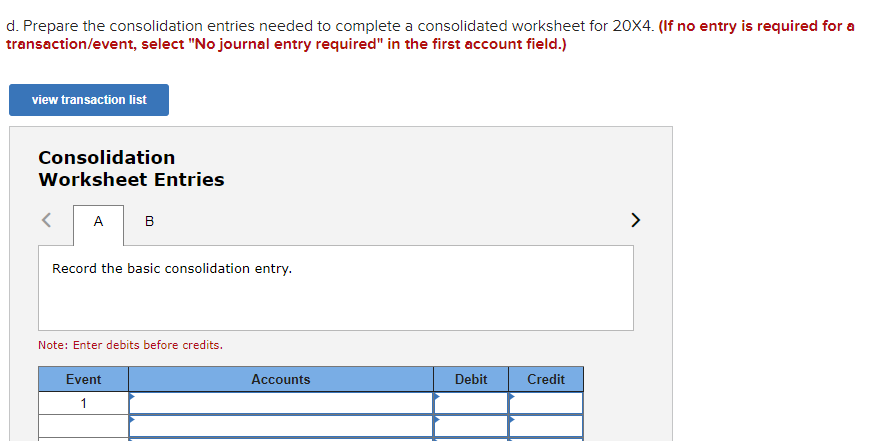

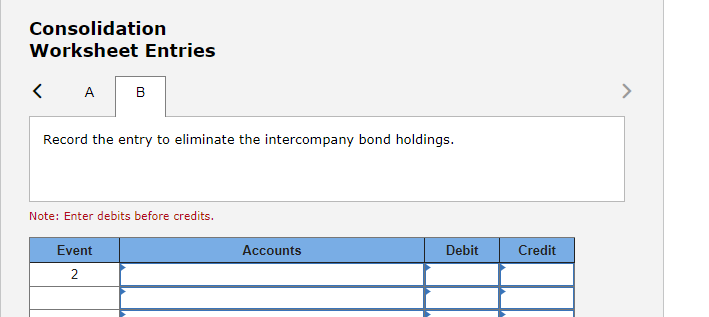

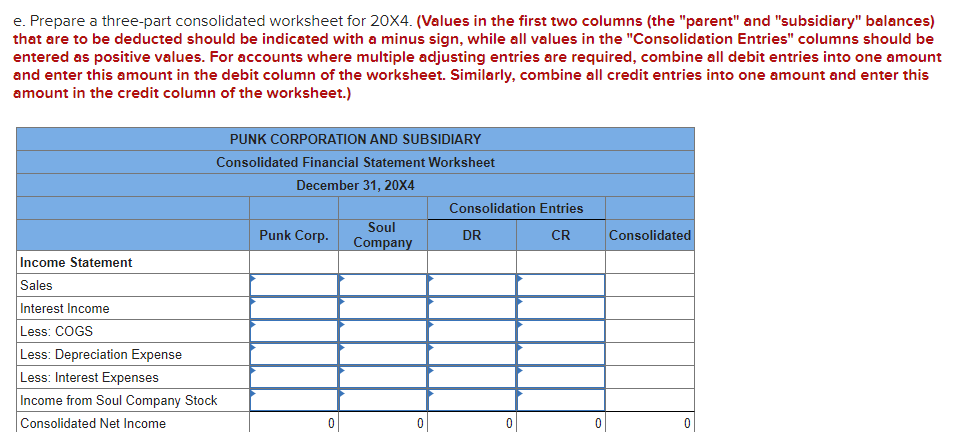

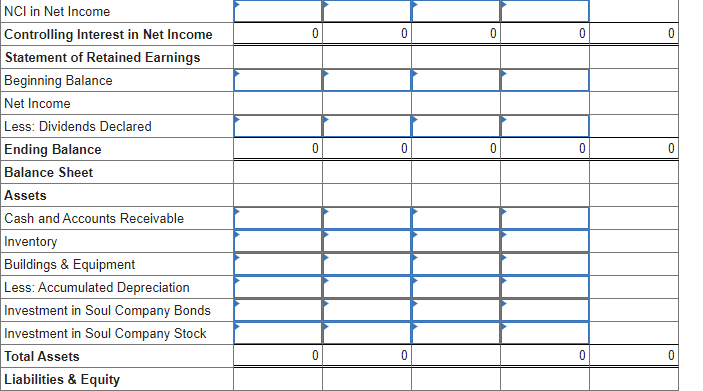

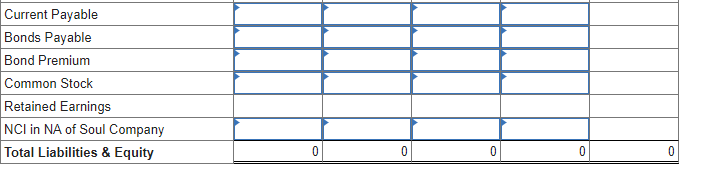

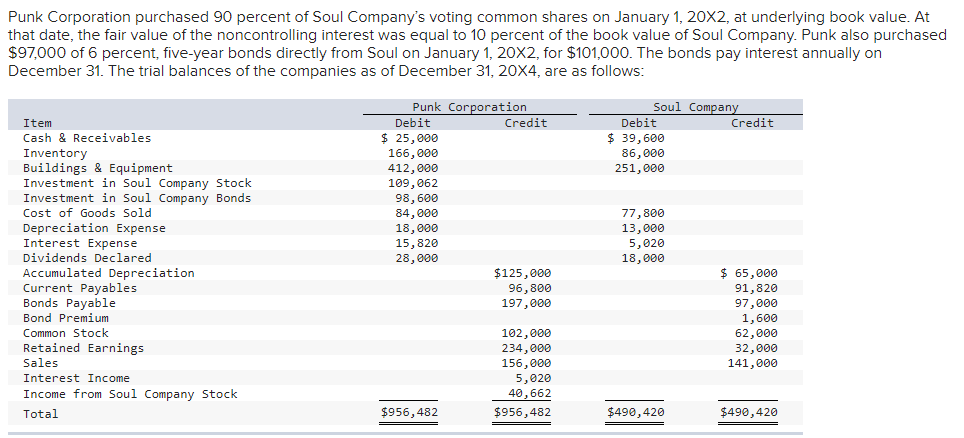

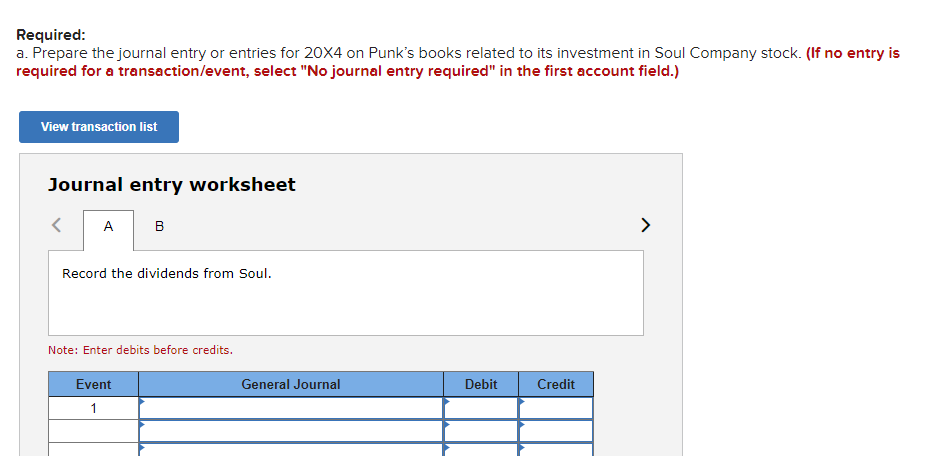

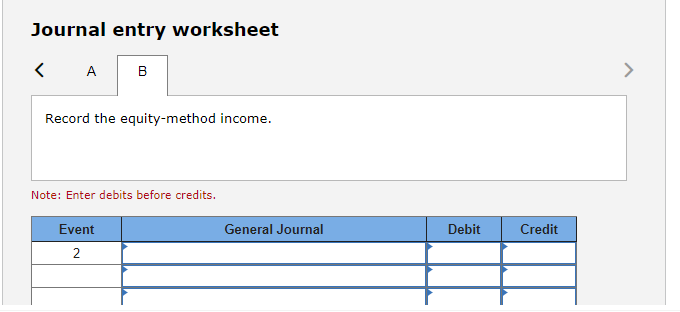

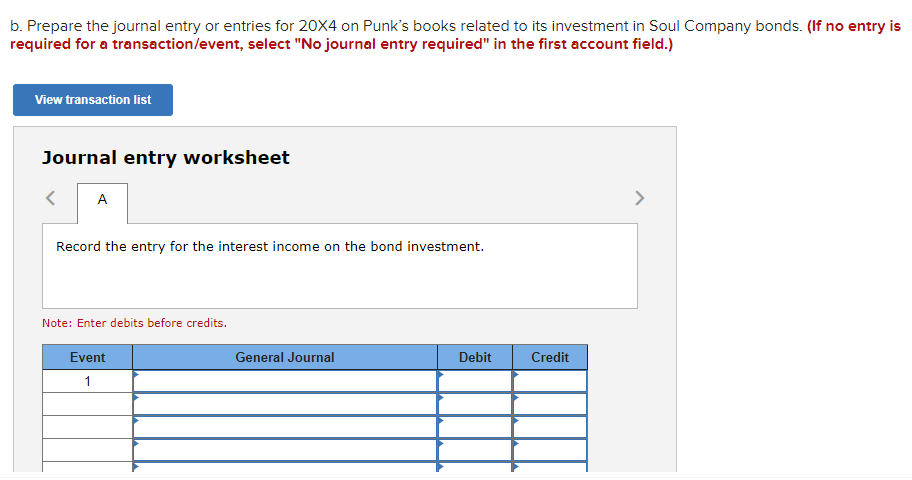

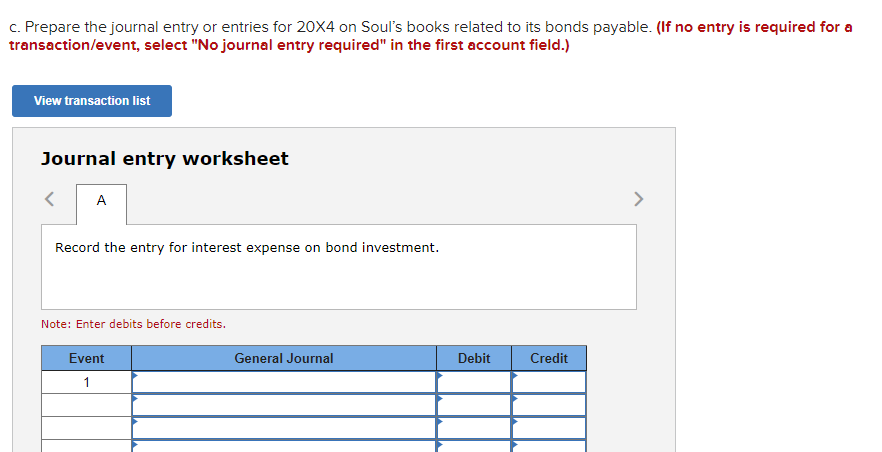

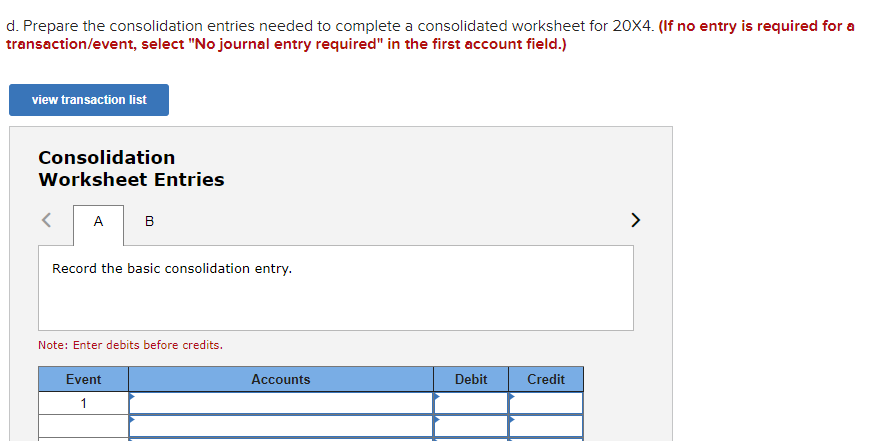

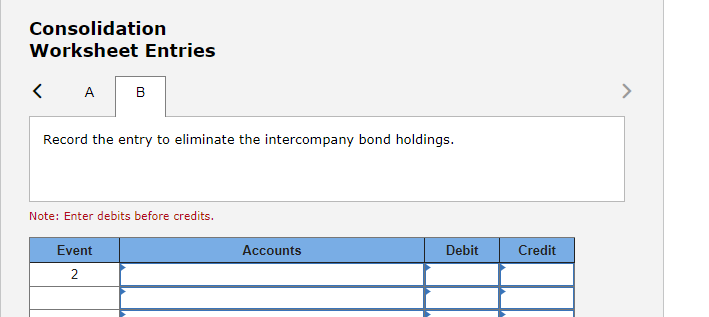

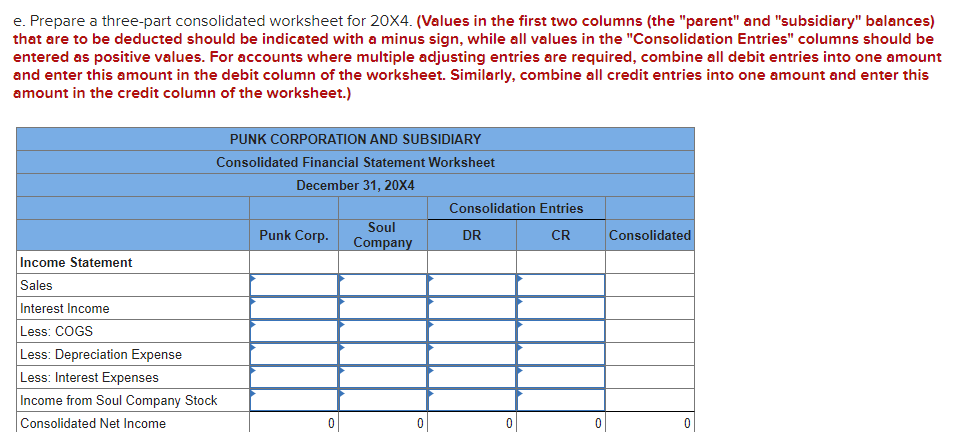

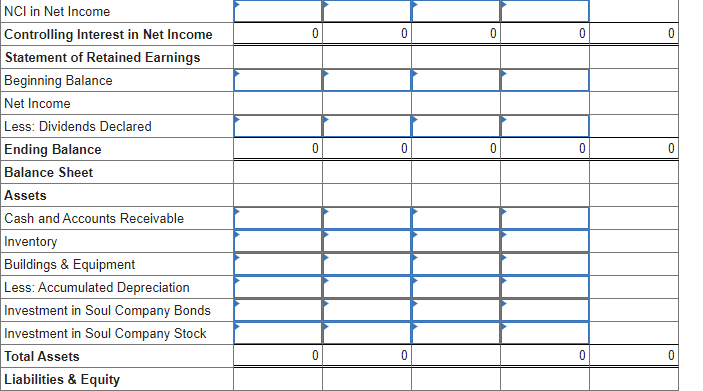

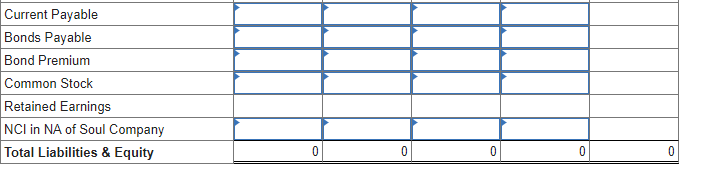

Punk Corporation purchased 90 percent of Soul Company's voting common shares on January 1 , 202, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 10 percent of the book value of Soul Company. Punk also purchased $97,000 of 6 percent, five-year bonds directly from Soul on January 1,202, for $101,000. The bonds pay interest annually on December 31 . The trial balances of the companies as of December 31,204, are as follows: Required: a. Prepare the journal entry or entries for 204 on Punk's books related to its investment in Soul Company stock. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. b. Prepare the journal entry or entries for 204 on Punk's books related to its investment in Soul Company bonds. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the entry for the interest income on the bond investment. Note: Enter debits before credits. c. Prepare the journal entry or entries for 204 on Soul's books related to its bonds payable. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the entry for interest expense on bond investment. Note: Enter debits before credits. d. Prepare the consolidation entries needed to complete a consolidated worksheet for 204. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Consolidation Worksheet Entries IVULE: IILE UEUILS eIUI CI EUILS. Consolidation Worksheet Entries Record the entry to eliminate the intercompany bond holdings. Note: Enter debits before credits. e. Prepare a three-part consolidated worksheet for 204. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.) NCl in Net Income Controlling Interest in Net Income \begin{tabular}{|r|r|r|r|r|} \hline & & & & \\ \hline 0 & 0 & 0 & 0 & 0 \\ \hline \hline \end{tabular} Statement of Retained Earnings Beginning Balance Net Income Less: Dividends Declared Ending Balance Balance Sheet Assets Cash and Accounts Receivable Inventory Buildings \& Equipment Less: Accumulated Depreciation Investment in Soul Company Bonds Investment in Soul Company Stock Total Assets \begin{tabular}{|r|r|r|r|r|} \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} Liabilities \& Equity