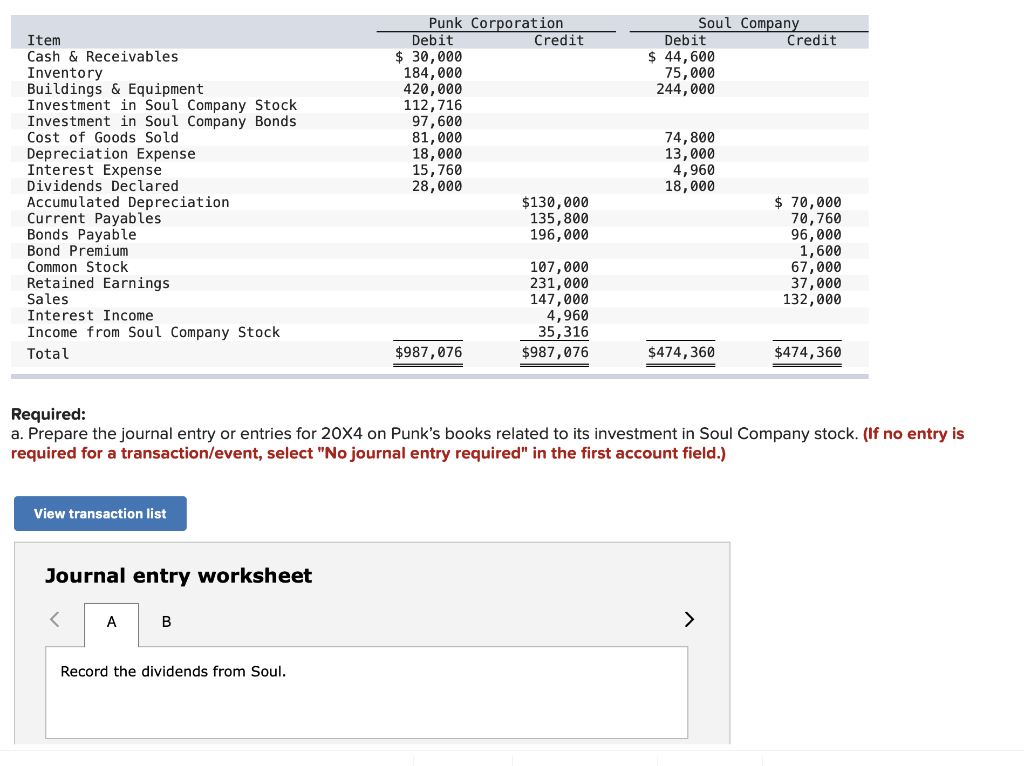

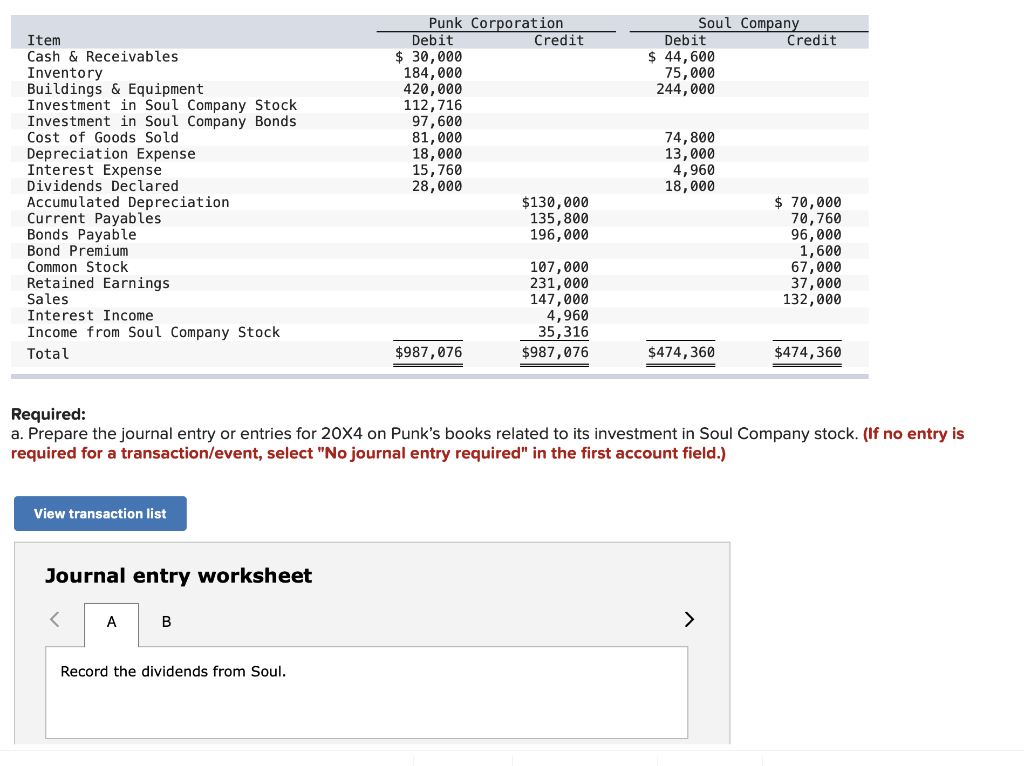

Punk Corporation purchased 90 percent of Soul Companys voting common shares on January 1, 20X2, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 10 percent of the book value of Soul Company. Punk also purchased $96,000 of 6 percent, five-year bonds directly from Soul on January 1, 20X2, for $100,000. The bonds pay interest annually on December 31. The trial balances of the companies as of December 31, 20X4, are as follows:

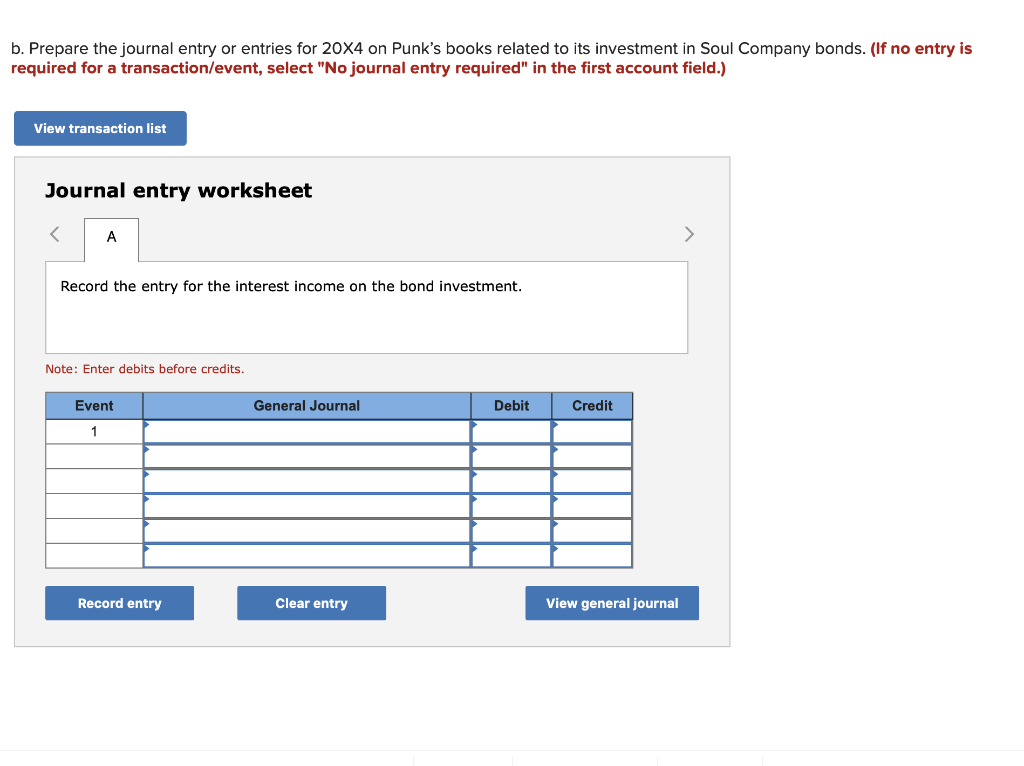

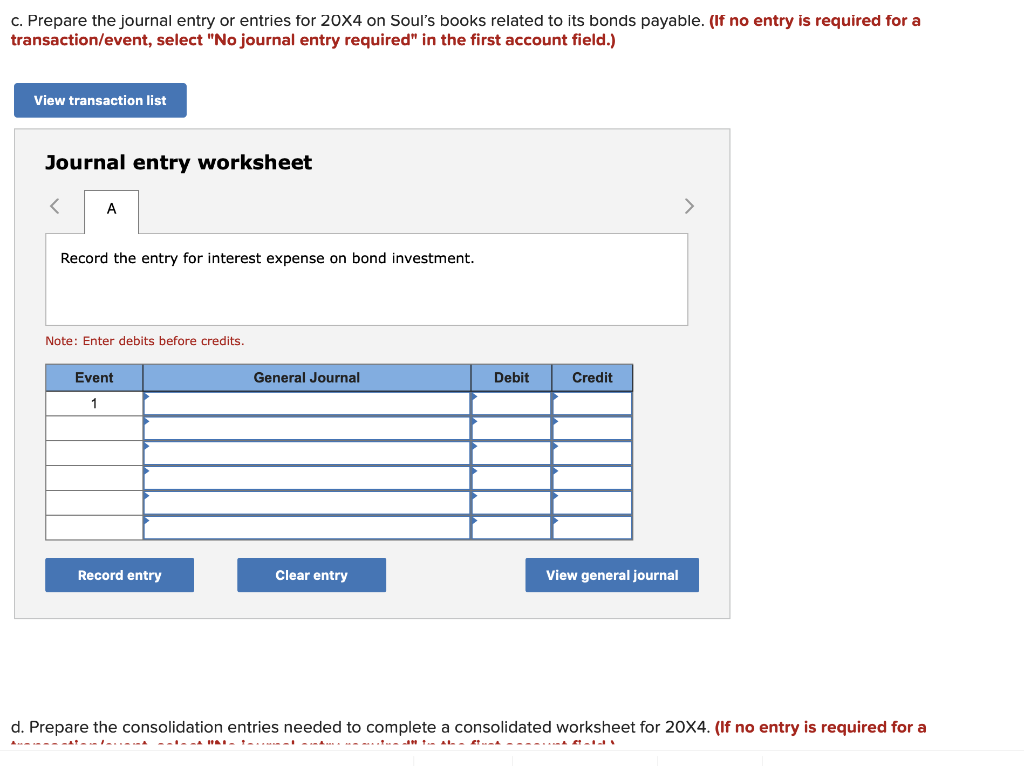

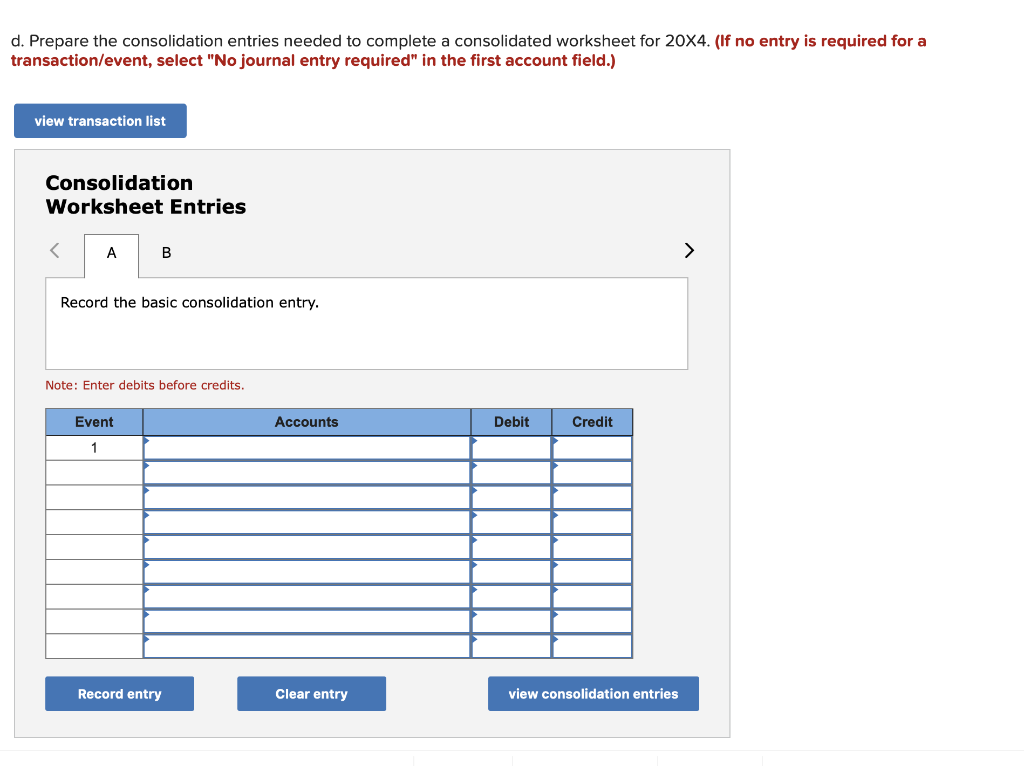

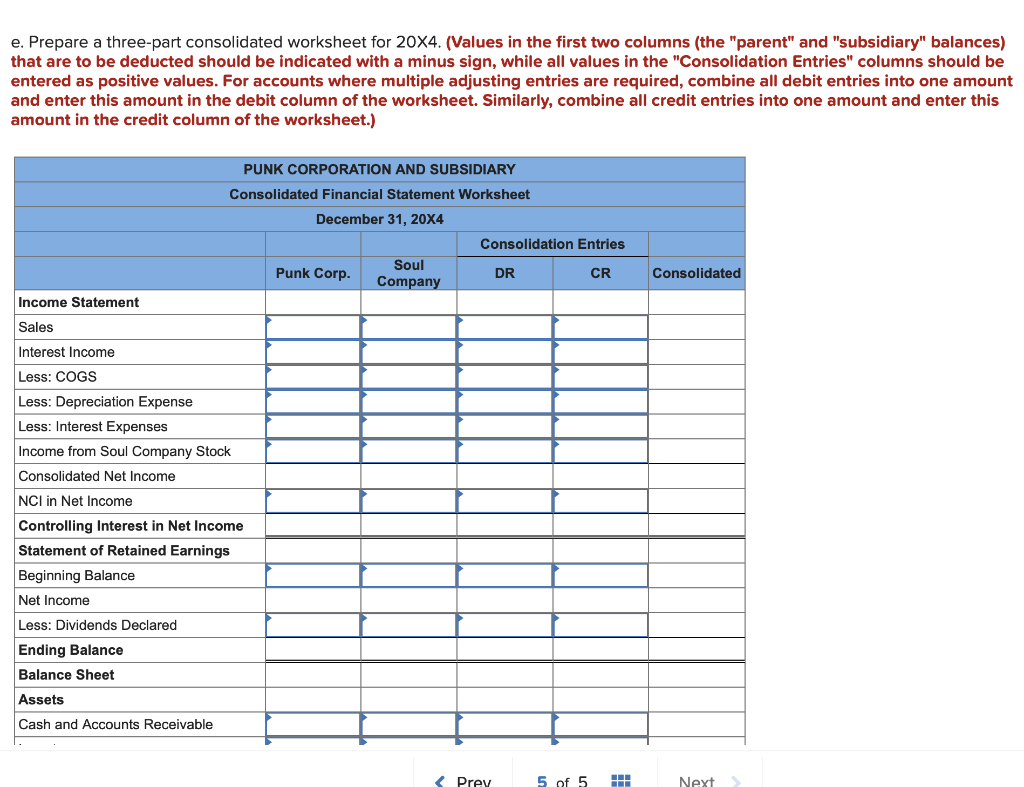

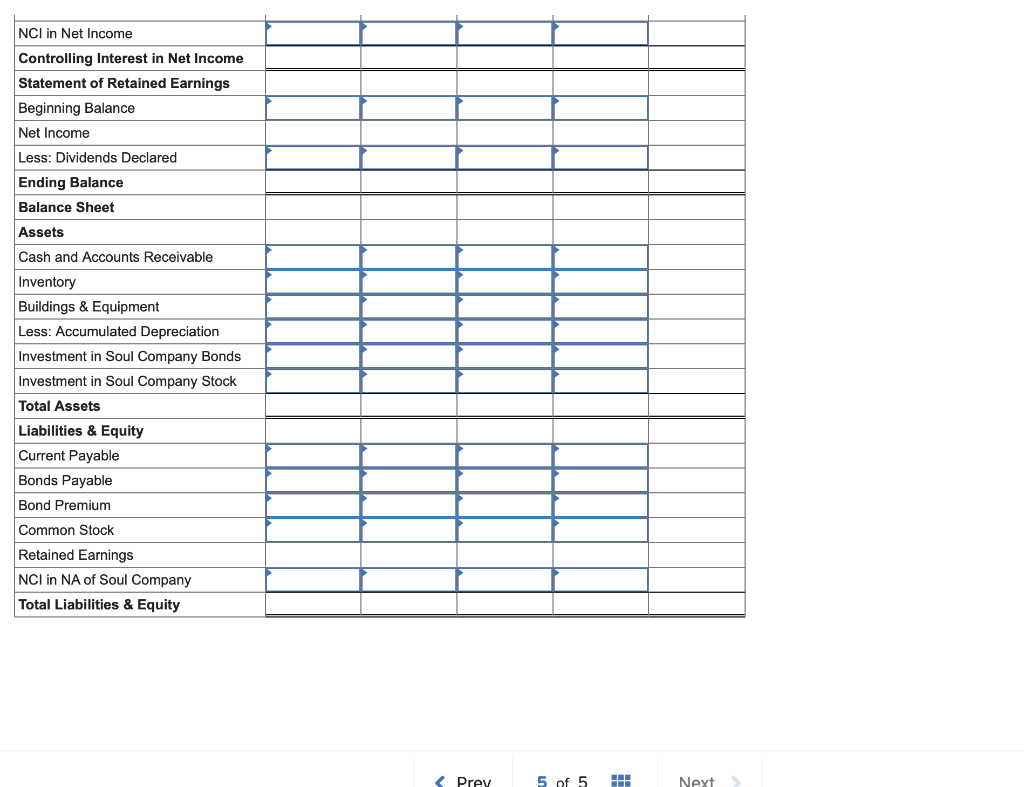

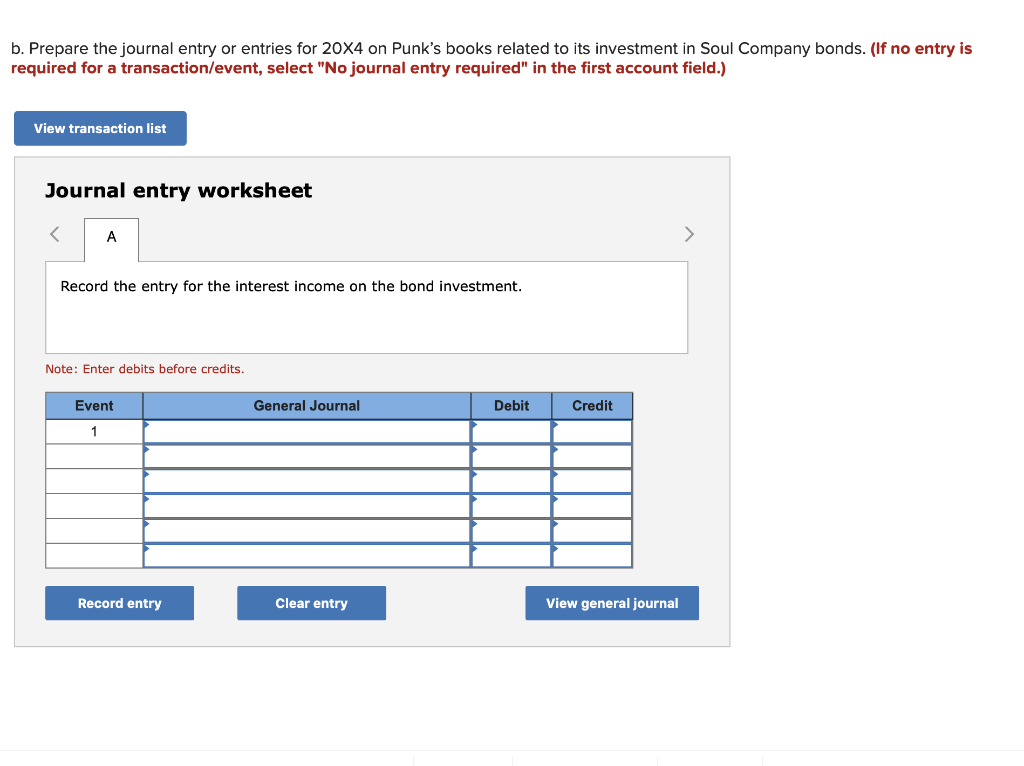

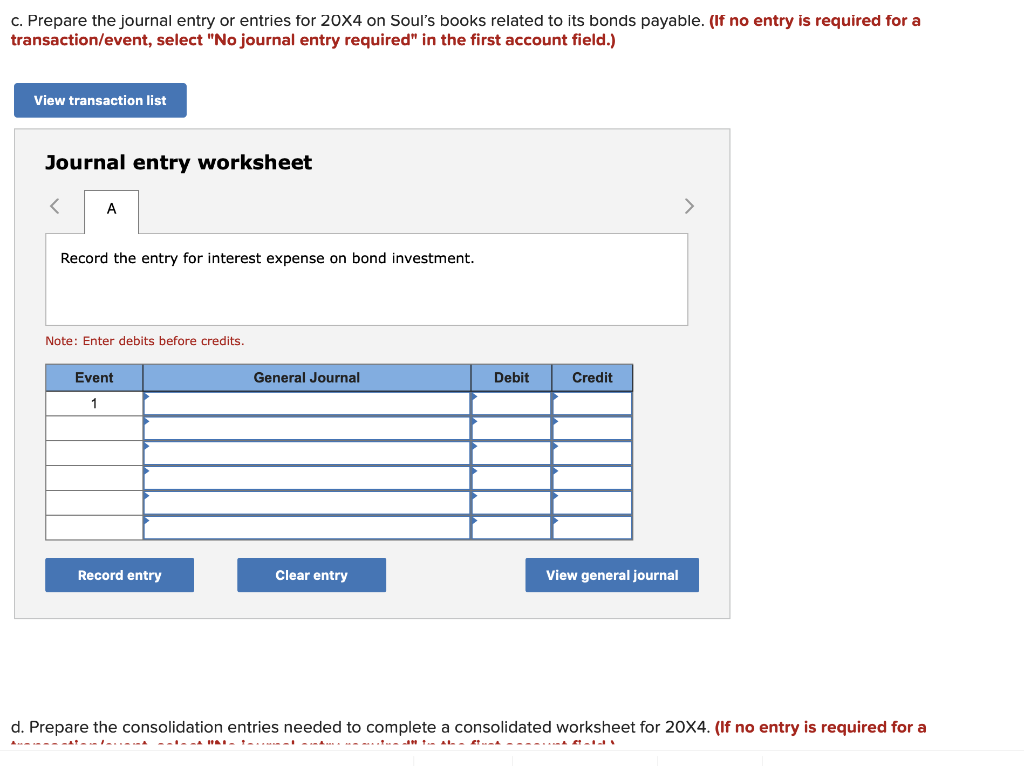

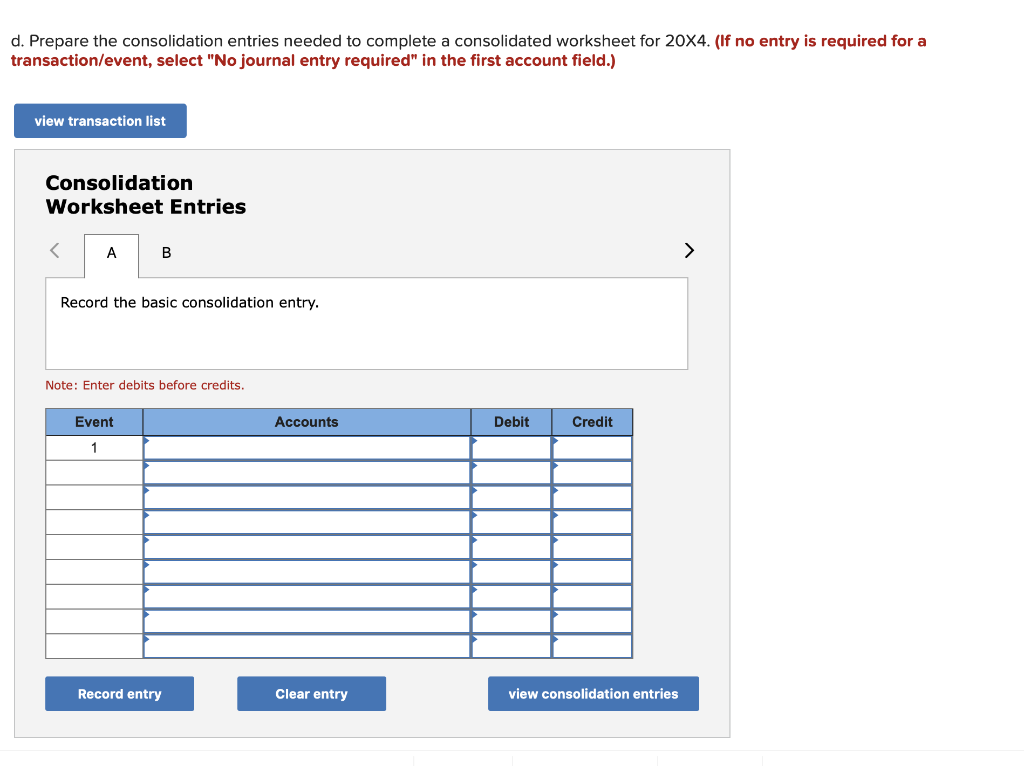

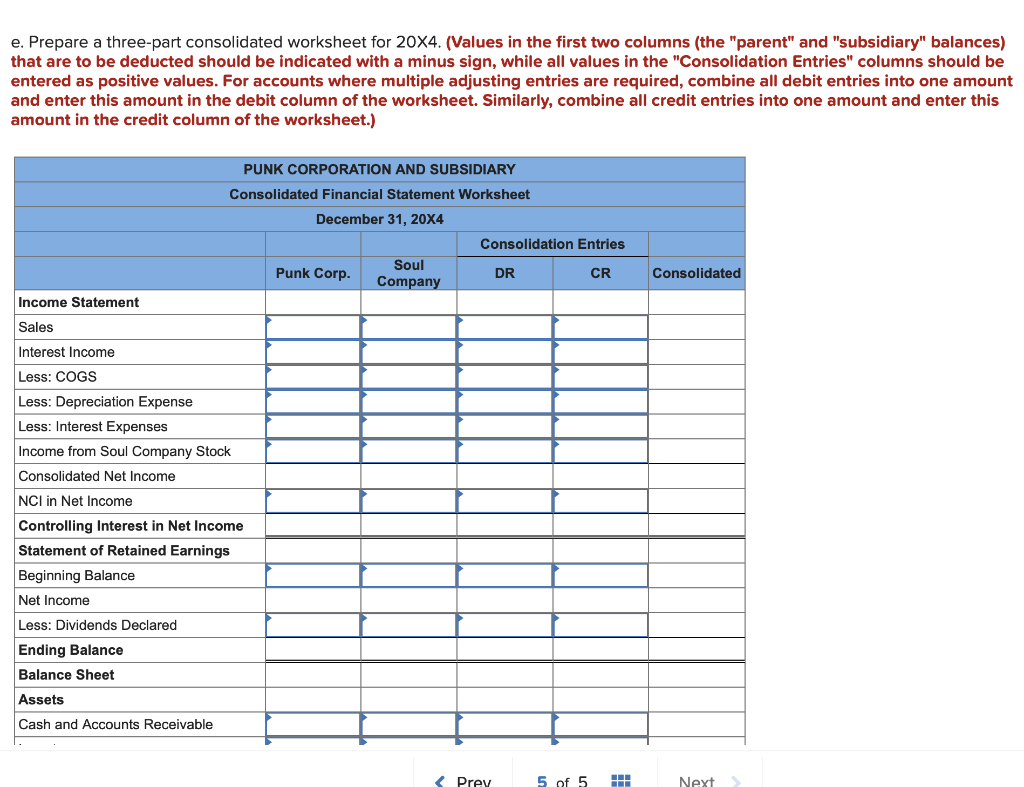

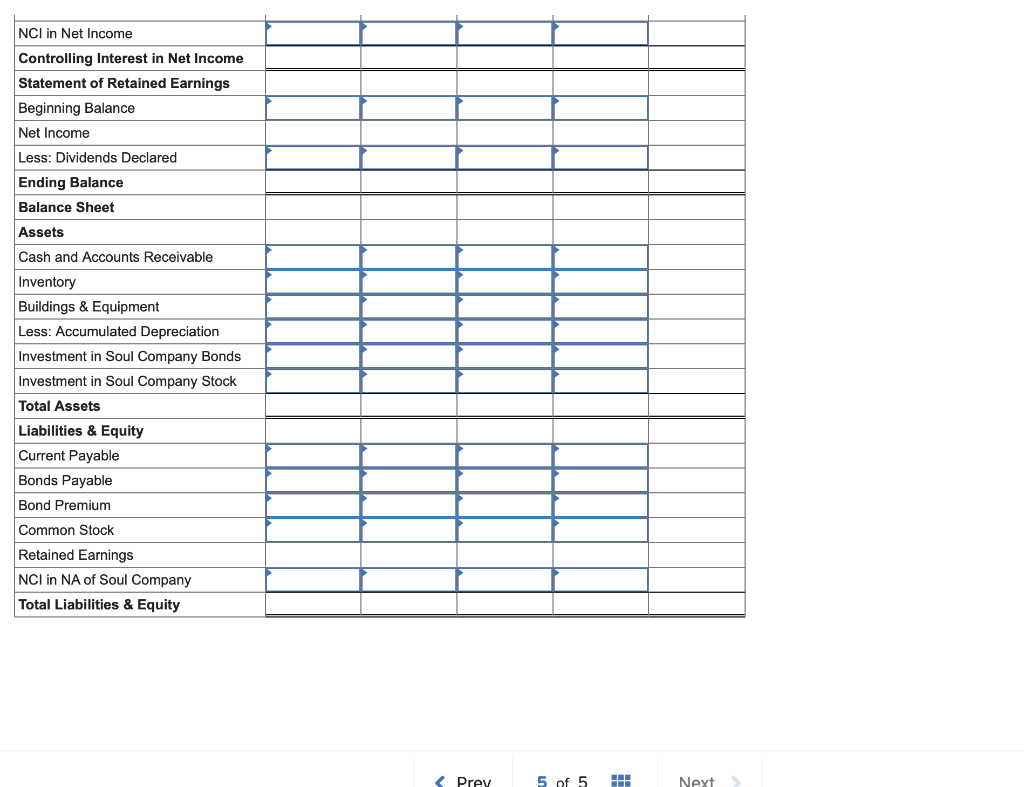

Punk Corporation Debit Credit $ 30,000 184,000 420,000 112, 716 97,600 81,000 18,000 Soul Company Debit Credit $ 44,600 75,000 244,000 Expense 15, 760 74,800 13,000 4,960 18,000 28,000 Item Cash & Receivables Inventory Buildings & Equipment Investment in Soul Company Stock Investment in Soul Company Bonds Cost of Goods Sold Teciation Expense Dividends Declared Accumulated Depreciation Current Payables Bonds Payable Bond Premium Common Stock Retained Earnings Sales Interest Income Income from Soul Company Stock Total $130,000 135,800 196,000 $ 70,000 70,760 96,000 1,600 67,000 37,000 132,000 107,000 231,000 147,000 4,960 35, 316 $987,076 $987,076 $474,360 $474,360 Required: a. Prepare the journal entry or entries for 20X4 on Punk's books related to its investment in Soul Company stock. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the dividends from Soul. b. Prepare the journal entry or entries for 20X4 on Punk's books related to its investment in Soul Company bonds. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the entry for the interest income on the bond investment. Note: Enter debits before credits. Event General Journal Debit Credit 1 Record entry Clear entry View general journal c. Prepare the journal entry or entries for 20X4 on Soul's books related to its bonds payable. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the entry for interest expense on bond investment. Note: Enter debits before credits. Event General Journal Debit Credit 1 Record entry Clear entry View general journal d. Prepare the consolidation entries needed to complete a consolidated worksheet for 20X4. (If no entry is required for a 1. LA HAITIA.............AL d. Prepare the consolidation entries needed to complete a consolidated worksheet for 20X4. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) view transaction list Consolidation Worksheet Entries Record the basic consolidation entry. Note: Enter debits before credits. Event Accounts Debit Credit 1 Record entry Clear entry view consolidation entries e. Prepare a three-part consolidated worksheet for 20X4. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.) PUNK CORPORATION AND SUBSIDIARY Consolidated Financial Statement Worksheet December 31, 20X4 Consolidation Entries Soul Punk Corp. DR CR Company Consolidated Income Statement Sales Interest Income Less: COGS Less: Depreciation Expense Less: Interest Expenses Income from Soul Company Stock Consolidated Net Income NCI in Net Income Controlling Interest in Net Income Statement of Retained Earnings Beginning Balance Net Income Less: Dividends Declared Ending Balance Balance Sheet Assets Cash and Accounts Receivable Prev 5 of 5 Next NCI in Net Income Controlling Interest in Net Income Statement of Retained Earnings Beginning Balance Net Income Less: Dividends Declared Ending Balance Balance Sheet Assets Cash and Accounts Receivable Inventory Buildings & Equipment Less: Accumulated Depreciation Investment in Soul Company Bonds Investment in Soul Company Stock Total Assets Liabilities & Equity Current Payable Bonds Payable Bond Premium Common Stock Retained Earnings NCI in NA of Soul Company Total Liabilities & Equity Prev 5 of 5 Next Punk Corporation Debit Credit $ 30,000 184,000 420,000 112, 716 97,600 81,000 18,000 Soul Company Debit Credit $ 44,600 75,000 244,000 Expense 15, 760 74,800 13,000 4,960 18,000 28,000 Item Cash & Receivables Inventory Buildings & Equipment Investment in Soul Company Stock Investment in Soul Company Bonds Cost of Goods Sold Teciation Expense Dividends Declared Accumulated Depreciation Current Payables Bonds Payable Bond Premium Common Stock Retained Earnings Sales Interest Income Income from Soul Company Stock Total $130,000 135,800 196,000 $ 70,000 70,760 96,000 1,600 67,000 37,000 132,000 107,000 231,000 147,000 4,960 35, 316 $987,076 $987,076 $474,360 $474,360 Required: a. Prepare the journal entry or entries for 20X4 on Punk's books related to its investment in Soul Company stock. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the dividends from Soul. b. Prepare the journal entry or entries for 20X4 on Punk's books related to its investment in Soul Company bonds. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the entry for the interest income on the bond investment. Note: Enter debits before credits. Event General Journal Debit Credit 1 Record entry Clear entry View general journal c. Prepare the journal entry or entries for 20X4 on Soul's books related to its bonds payable. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the entry for interest expense on bond investment. Note: Enter debits before credits. Event General Journal Debit Credit 1 Record entry Clear entry View general journal d. Prepare the consolidation entries needed to complete a consolidated worksheet for 20X4. (If no entry is required for a 1. LA HAITIA.............AL d. Prepare the consolidation entries needed to complete a consolidated worksheet for 20X4. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) view transaction list Consolidation Worksheet Entries Record the basic consolidation entry. Note: Enter debits before credits. Event Accounts Debit Credit 1 Record entry Clear entry view consolidation entries e. Prepare a three-part consolidated worksheet for 20X4. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.) PUNK CORPORATION AND SUBSIDIARY Consolidated Financial Statement Worksheet December 31, 20X4 Consolidation Entries Soul Punk Corp. DR CR Company Consolidated Income Statement Sales Interest Income Less: COGS Less: Depreciation Expense Less: Interest Expenses Income from Soul Company Stock Consolidated Net Income NCI in Net Income Controlling Interest in Net Income Statement of Retained Earnings Beginning Balance Net Income Less: Dividends Declared Ending Balance Balance Sheet Assets Cash and Accounts Receivable Prev 5 of 5 Next NCI in Net Income Controlling Interest in Net Income Statement of Retained Earnings Beginning Balance Net Income Less: Dividends Declared Ending Balance Balance Sheet Assets Cash and Accounts Receivable Inventory Buildings & Equipment Less: Accumulated Depreciation Investment in Soul Company Bonds Investment in Soul Company Stock Total Assets Liabilities & Equity Current Payable Bonds Payable Bond Premium Common Stock Retained Earnings NCI in NA of Soul Company Total Liabilities & Equity Prev 5 of 5 Next