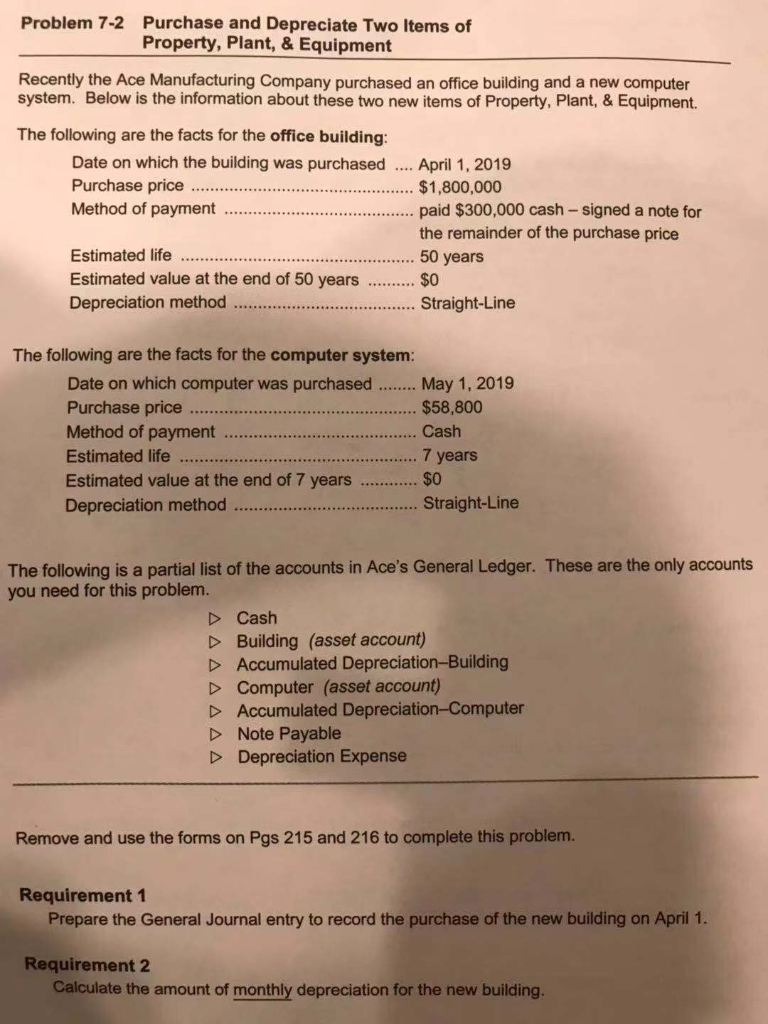

Purchase and Depreciate Two Items of Property, Plant, & Equipment Problem 7-2 Recently the Ace Manufacturing Company purchased an office building and a new computer system. Below is the information about these two new items of Property, Plant, & Equipment The following are the facts for the office building: Date on which the building was purchased... April 1, 2019 Purchase price Method of payment...paid $300,000 cash- signed a note for $1,800,000 the remainder of the purchase price Estimated life.. 50 years Estimated value at the end of 50 years .$.O0 Depreciation method.. .traight-Line The following are the facts for the computer system: May 1, 2019 $58,800 Date on which computer was purchased..M Purchase price Method of payment Estimated life. Estimated value at the end of 7 years...... $0 Depreciation method.. Straight-Line 7 years The following is a partial list of the accounts in Ace's General Ledger. These are the only accounts you need for this problem. Cash D Building (asset account) D Accumulated Depreciation-Building Computer (asset account) D Accumulated Depreciation-Computer D Note Payable Depreciation Expense Remove and use the forms on Pgs 215 and 216 to complete this problem. Requirement 1 Prepare the General Journal entry to record the purchase of the new building on April 1 Requirement 2 Calculate the amount of monthly depreciation for the new building. Problem 7-2 (continued) Requirement 3 Prepare the April 30 General Journal adjusting entry to record depreciation of the office building for the month of April. Requirement 4 Prepare the General Journal entry to record the purchase of the new computer system on May 1 Requirement 5 Calculate the amount of monthly depreciation for the new computer system. Requirement 6 Prepare the May 31 General Journal adjusting entry to record depreciation of the computer system for the month of May. Requirement 7 Prepare the May 31 General Journal adjusting entry to record depreciation of the office building for the month of May. Requirement 8 Ace prepares financial statements monthly. Assuming that these are Ace's only two items of Property, Plant, & Equipment, what would be the amount of Depreciation Expense on Ace's May Income Statement