Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Purchase price was in question 5 was $765.81 You click around and realize that your favorite web-site actually provides a snapshot of the limit order

Purchase price was in question 5 was $765.81

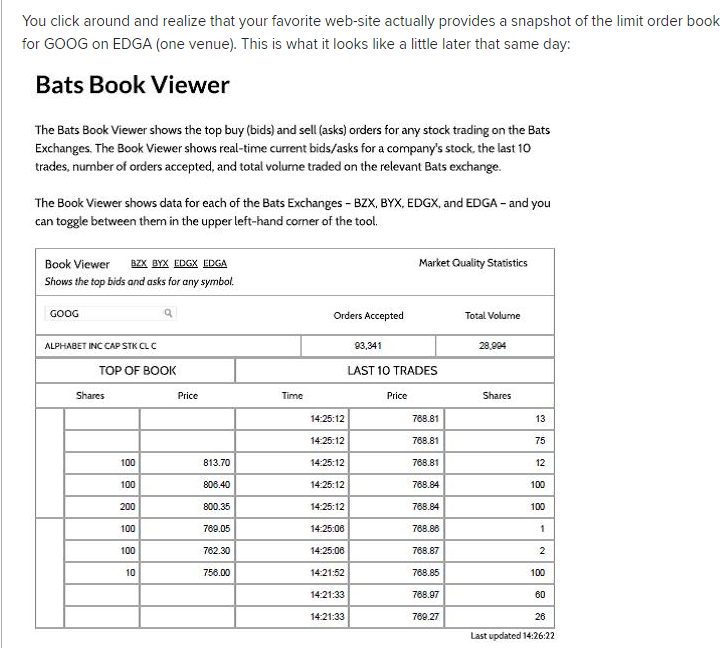

You click around and realize that your favorite web-site actually provides a snapshot of the limit order book for GOOG on EDGA (one venue). This is what it looks like a little later that same day: Bats Book Viewer The Bats Book Viewer shows the top buy (bids) and sell (asks) orders for any stock trading on the Bats Exchanges. The Book Viewer shows real-time current bids/asks for a company's stock, the last 10 trades, number of orders accepted, and total volume traded on the relevant Bats exchange. The Book Viewer shows data for each of the Bats Exchanges - BZX, BYX, EDGX, and EDGA - and you can toggle between thern in the upper left-hand corner of the tool. [Please refer back to Exhibit in Question 9] Suppose you are convinced this is a temporary blip so you decide to sell the 100 shares you bought in Question 5 above. How much would you get for your 100 share market sell order? Please answer by providing the amount for all 100 shares and omit the $ signStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started