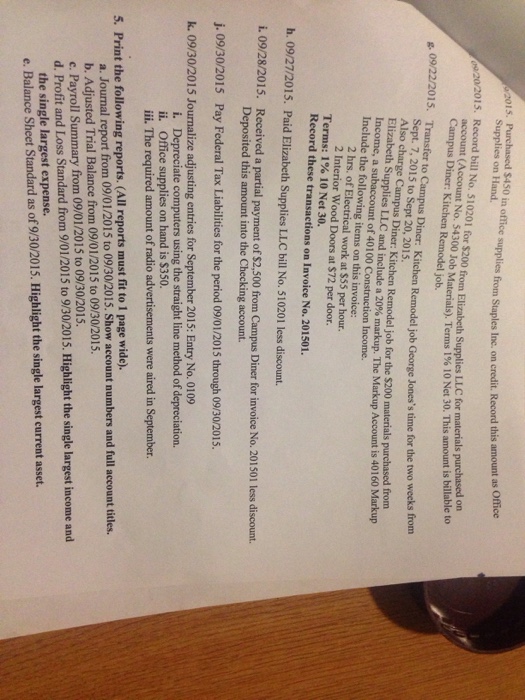

Purchased $450 in office supplies from Staples Imc. on creadit. Record this amount as Office Suplies on Hand. Record bill No.510201 for $200 from Elizabeth Supplies LLC for materials purchased on account (Account No. 54300 Job Materials). Terms 1% 10 Net 30. This amount is billable to Campus Diner: Kitchen Remodel job. Transfer to Campus Diner: Kitchen Remodel job George Jones's time for the two weeks from Sept. 7, 2015 to Sept 20,2015. Also change Campus Dinner: Kitchen Remodel job for the $200 materials purchased from Elizabeth Supplies LIC and include a 20% markup. The Markep Account is 40160 Markup Income, a subaccount of 40100 Construction Income. Include the following items on this invoice: 2hrs.of Electrical work at $55 per hours. 2Interior wood Doors at $72 door. Terms: 1%10 Net 30. Record these transactions on Invoice No. 201501. h. 09/27/2015. Paid Elizabeth Supplies LLC bill No. 510201 less discount. i. 09/28/2015. Received a partial payment of S2.500 from Campus Diner for invoice No. 201501 less discount. Deposited this amount into the Checking account. j. 09/30/2015 Pay Federal Tax Liabilities for the period 09/01/2015 through 09/30/2015. k. 09/30/2015 Journalize adjusting entries for September 2015: Entry No. 0109 Depreciate computers using the straight line method of depreciation. Office supplies on hand is $350. The required amount of radio advertisements were aired in September. Print (he following reports. (All reports must fit to 1 page wide). Journal report from 09/01/2015 to 09/30/2015. Show account numbers and full account titles. Adjusted Trial Balance from 09/01/2015 to 09/30/2015. Payroll Summary from 09/01/2015 to 09/30/2015. Profit and Loss Standard from 9/01/2015 to 9/30/2015. Highlight the single largest income and the single largest expense. Balance Sheet Standard as of 9/30/2015. Highlight the single largest current asset. Purchased $450 in office supplies from Staples Imc. on creadit. Record this amount as Office Suplies on Hand. Record bill No.510201 for $200 from Elizabeth Supplies LLC for materials purchased on account (Account No. 54300 Job Materials). Terms 1% 10 Net 30. This amount is billable to Campus Diner: Kitchen Remodel job. Transfer to Campus Diner: Kitchen Remodel job George Jones's time for the two weeks from Sept. 7, 2015 to Sept 20,2015. Also change Campus Dinner: Kitchen Remodel job for the $200 materials purchased from Elizabeth Supplies LIC and include a 20% markup. The Markep Account is 40160 Markup Income, a subaccount of 40100 Construction Income. Include the following items on this invoice: 2hrs.of Electrical work at $55 per hours. 2Interior wood Doors at $72 door. Terms: 1%10 Net 30. Record these transactions on Invoice No. 201501. h. 09/27/2015. Paid Elizabeth Supplies LLC bill No. 510201 less discount. i. 09/28/2015. Received a partial payment of S2.500 from Campus Diner for invoice No. 201501 less discount. Deposited this amount into the Checking account. j. 09/30/2015 Pay Federal Tax Liabilities for the period 09/01/2015 through 09/30/2015. k. 09/30/2015 Journalize adjusting entries for September 2015: Entry No. 0109 Depreciate computers using the straight line method of depreciation. Office supplies on hand is $350. The required amount of radio advertisements were aired in September. Print (he following reports. (All reports must fit to 1 page wide). Journal report from 09/01/2015 to 09/30/2015. Show account numbers and full account titles. Adjusted Trial Balance from 09/01/2015 to 09/30/2015. Payroll Summary from 09/01/2015 to 09/30/2015. Profit and Loss Standard from 9/01/2015 to 9/30/2015. Highlight the single largest income and the single largest expense. Balance Sheet Standard as of 9/30/2015. Highlight the single largest current asset