Question

Purchased a building for $570,000. You got a mortgage of $440,000 at 7% with monthly payments based on 30 year amoritization. Loan term is 14.

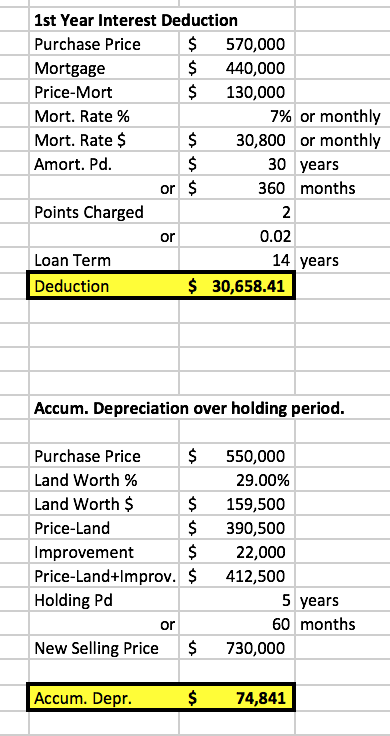

Purchased a building for $570,000. You got a mortgage of $440,000 at 7% with monthly payments based on 30 year amoritization. Loan term is 14. The bank charges 2 points. What is the first year's interest deduction?

Then,You purchase a camp for $550,000 on May 15 so you can use and rent to customers. The land its on is worth 29% of the purchase price. You build a pavilion right away for $22,000. You hold the property for 5 years and sell it for $730,000. What is your accumulated depreciation over the 5-year holding period?

The answers are provided. Show the work / calaculations used to come up with BOTH of the highlighted answers.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started