Answered step by step

Verified Expert Solution

Question

1 Approved Answer

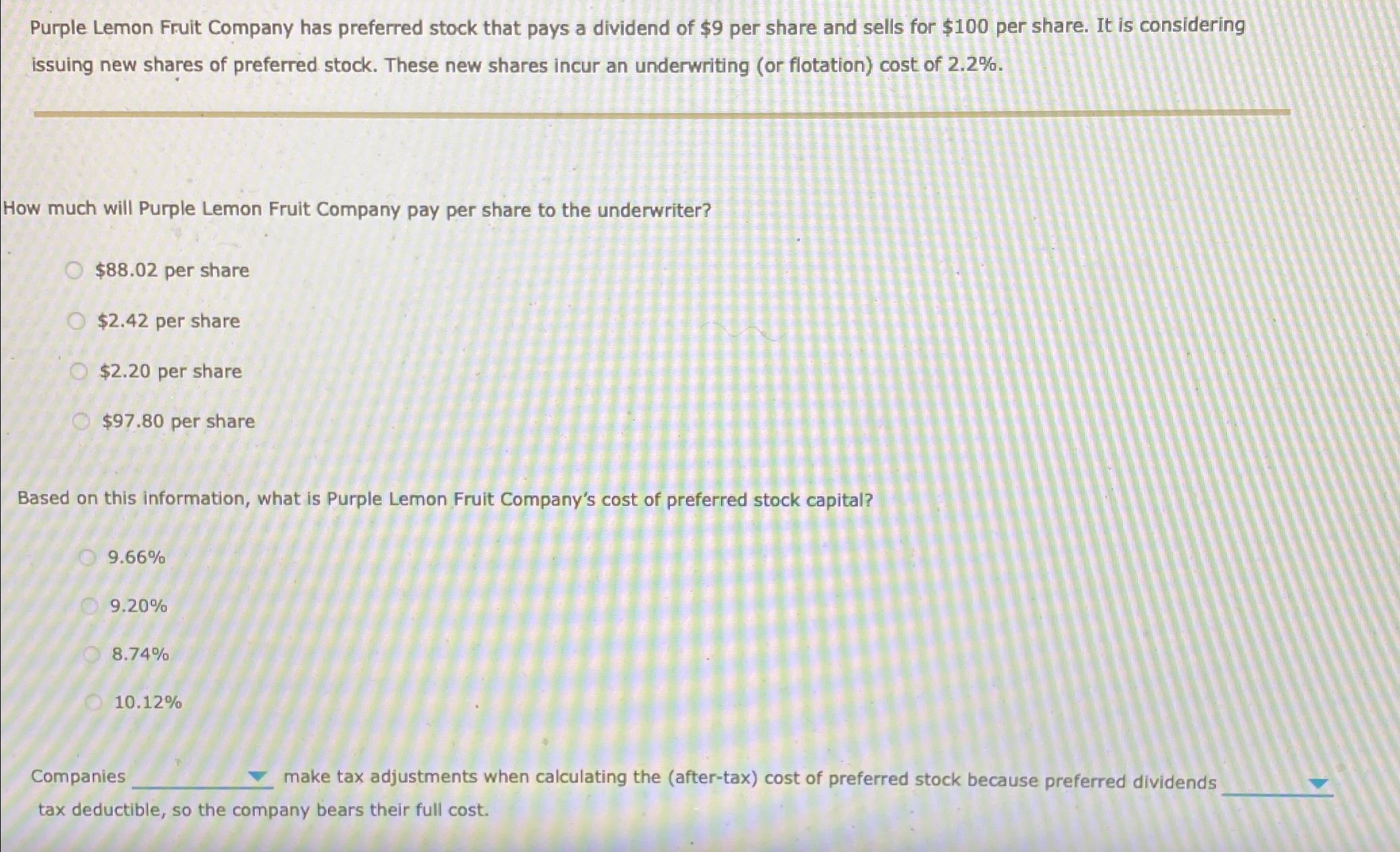

Purple Lemon Fruit Company has preferred stock that pays a dividend of $ 9 per share and sells for $ 1 0 0 per share.

Purple Lemon Fruit Company has preferred stock that pays a dividend of $ per share and sells for $ per share. It is considering issuing new shares of preferred stock. These new shares incur an underwriting or flotation cost of

How much will Purple Lemon Fruit Company pay per share to the underwriter?

$ per share

$ per share

$ per share

$ per share

Based on this information, what is Purple Lemon Fruit Company's cost of preferred stock capital?

Companies

make tax adjustments when calculating the aftertax cost of preferred stock because preferred dividends tax deductible, so the company bears their full cost.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started