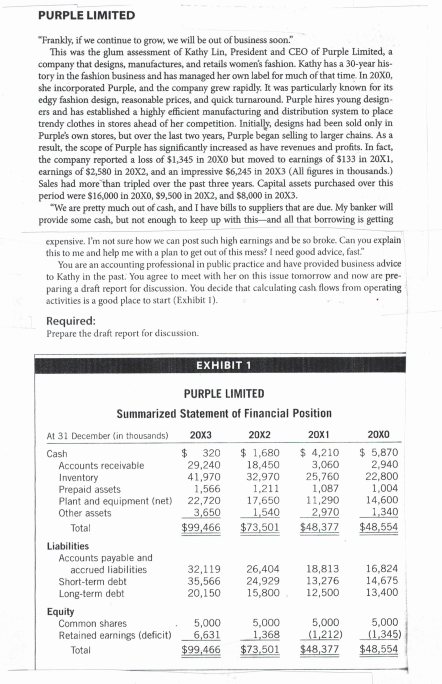

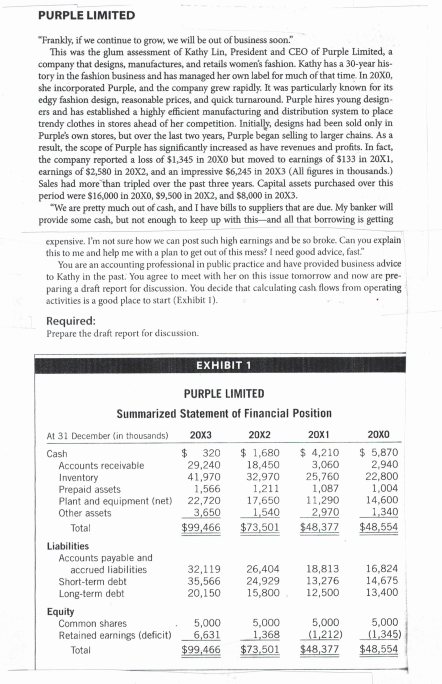

PURPLE LIMITED "Frankly, if we continue to grow, we will be out of business soon." This was the glum assessment of Kathy Lin, President and CEO of Purple Limited, a company that designs, manufactures, and retails women's fashion. Kathy has a 30-year his- tory in the fashion business and has managed her own label for much of that time in 2030, she incorporated Purple, and the company grew rapidly. It was particularly known for its edgy fashion design, reasonable prices, and quick turnaround. Purple hires young design- ers and has established a highly efficient manufacturing and distribution system to place trendy clothes in stores ahead of her competition. Initially, designs had been sold only in Purple's own stores, but over the last two years, Purple began selling to larger chains. As a result, the scope of Purple has significantly increased as have revenues and profits. In fact, the company reported a loss of $1,345 in 2030 but moved to earnings of $133 in 20x1, carnings of $2,580 in 20x2, and an impressive S6,245 in 20x3 (All figures in thousands) Sales had more than tripled over the past three years. Capital assets purchased over this period were $16,000 in 20X0, 59,500 in 20x2, and $8,000 in 20x3. "We are pretty much out of cash, and I have bills to suppliers that are due. My banker will provide some cash, but not enough to keep up with this-and all that borrowing is getting expensive. I'm not sure how we can post such high earnings and be so broke. Can you explain this to me and help me with a plan to get out of this mess? I need good advice, fast." You are an accounting professional in public practice and have provided business advice to Kathy in the past. You agree to meet with her on this issue tomorrow and now are pre paring a draft report for discussion. You decide that calculating cash flows from operating activities is a good place to start (Exhibit 1). Required: Prepare the draft report for discussion. EXHIBIT 1 PURPLE LIMITED Summarized Statement of Financial Position At 31 December (in thousands) 20x3 20x2 20X1 Cash $ 320 $ 1,680 $ 4,210 Accounts receivable 29,240 18,450 3,060 Inventory 41,970 32,970 25,760 Prepaid assets 1,566 1.211 1,087 Plant and equipment (net) 22,720 17,650 11,290 Other assets 3,650 1,540 2,970 Total $99,466 $73,501 $48,377 Liabilities Accounts payable and accrued liabilities 32,119 26,404 18,813 Short-term debt 35,566 24,929 13,276 Long-term debt 20,150 15,800 12,500 Equity Common shares 5,000 5,000 5,000 Retained earnings (deficit) 6,631 1,368 (1,212) Total $99,466 $73,501 $48,377 20X0 $ 5,870 2,940 22,800 1,004 14,600 1,340 $48,554 16,824 14,675 13,400 5,000 (1,345) $48,554