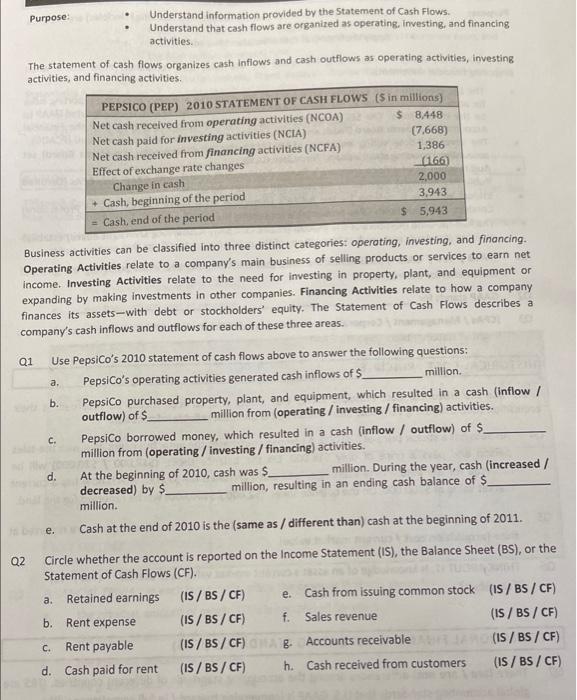

Purpose Understand information provided by the Statement of Cash Flows. Understand that cash flows are organized as operating. Investing, and financing activities. The statement of cash flows organizes cash inflows and cash outflows as operating activities, investing activities, and financing activities. PEPSICO (PEP) 2010 STATEMENT OF CASH FLOWS (5 in millions Net cash received from operating activities (NCOA) $ 8.448 Net cash paid for investing activities (NCIA) (7,668) Net cash received from financing activities (NCFA) 1,386 Effect of exchange rate changes 1166 Change in cash 2,000 + Cash, beginning of the period 3,943 Cash end of the period $5,943 Business activities can be classified into three distinct categories: operating, investing, and financing. Operating Activities relate to a company's main business of selling products or services to earn net income. Investing Activities relate to the need for investing in property, plant, and equipment or expanding by making investments in other companies. Financing Activities relate to how a company finances its assets-with debt or stockholders' equity. The Statement of Cash Flows describes a company's cash inflows and outflows for each of these three areas. Q1 Use PepsiCo's 2010 statement of cash flows above to answer the following questions: PepsiCo's operating activities generated cash inflows of $ million b. PepsiCo purchased property, plant, and equipment, which resulted in a cash (Inflow/ outflow) of $ million from (operating / investing / financing) activities. c. PepsiCo borrowed money, which resulted in a cash (inflow / outflow) of $_ million from (operating / investing / financing) activities. At the beginning of 2010, cash was $ million. During the year, cash (increased / decreased) by $ million, resulting in an ending cash balance of $ million. Cash at the end of 2010 is the same as / different than) cash at the beginning of 2011. a. e. Q2 Circle whether the account is reported on the Income Statement (IS), the Balance Sheet (BS), or the Statement of Cash Flows (CF). a. Retained earnings (IS / BS / CF) e. Cash from issuing common stock (IS / BS / CF) b. Rent expense (IS / BS / CF) f. Sales revenue (IS / BS / CF) Rent payable (IS/BS/CF) g. Accounts receivable (IS / BS / CF) d. Cash paid for rent (IS / BS / CF) h. Cash received from customers (IS/BS/CF) C