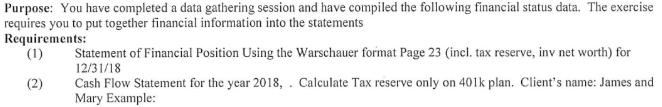

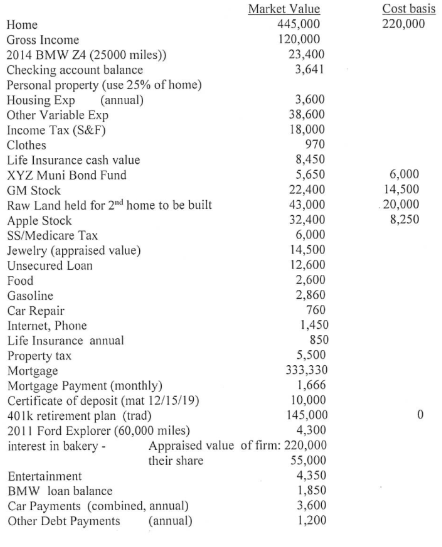

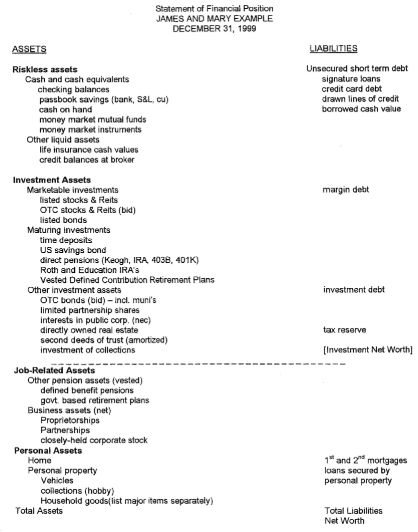

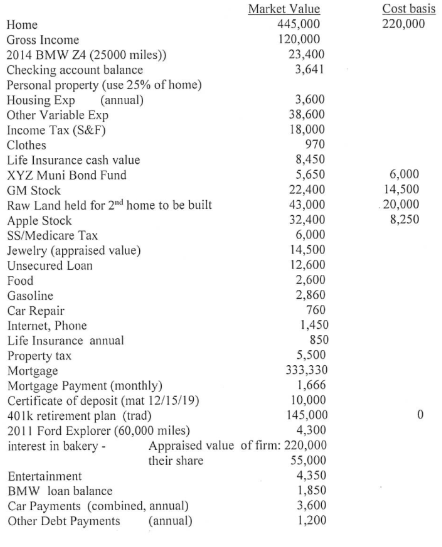

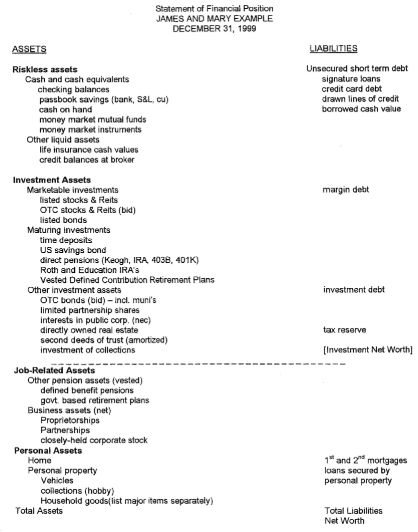

Purpose: You have completed a data gathering session and have compiled the following financial status data. The exercise requires you to put together financial information into the statements Requirements: (1) Statement of Financial Position Using the Warschauer format Page 23 (incl. tax reserve, inv net worth) for 12/31/18 (2) Cash Flow Statement for the year 2018, . Calculate Tax reserve only on 401k plan. Client's name: James and Mary Example: Cost basis 220,000 6,000 14,500 20,000 8,250 Market Value Home 445,000 Gross Income 120,000 2014 BMW Z4 (25000 miles)) 23,400 Checking account balance 3,641 Personal property (use 25% of home) Housing Exp (annual) 3,600 Other Variable Exp 38,600 Income Tax (S&F) 18,000 Clothes 970 Life Insurance cash value 8,450 XYZ Muni Bond Fund 5,650 GM Stock 22,400 Raw Land held for 2nd home to be built 43,000 Apple Stock 32,400 SS/Medicare Tax 6,000 Jewelry (appraised value) 14,500 Unsecured Loan 12,600 Food 2,600 Gasoline 2,860 Car Repair 760 Internet, Phone 1,450 Life Insurance annual 850 Property tax 5,500 Mortgage 333,330 Mortgage Payment (monthly) 1,666 Certificate of deposit (mat 12/15/19) 10,000 401k retirement plan (trad) 145,000 2011 Ford Explorer (60,000 miles) 4,300 interest in bakery Appraised value of firm: 220,000 their share 55,000 Entertainment 4,350 BMW loan balance 1,850 Car Payments (combined, annual) 3,600 Other Debt Payments (annual) 1,200 Statement of Financial Position JAMES AND MARY EXAMPLE DECEMBER 31, 1999 ASSETS LIABILITIES Unsecured short term debt signature loans credit card debt drawn lines of credit borrowed cash value Riskless assets Cash and cash equivalents checking balances passbook savings (bank, S&L, cu) cash on hand money market mutual funds money market instrurnents Other liquid assets life insurance cash values credit balances at broker margin debt Investment Assets Marketable investments listed stocks & Reits OTC stocks & Reits (bid) listed bonds Maturing Investments time deposits US savings bond direct pensions (Keogh, IRA 4038, 401K) Roth and Education IRA'S Vested Defined Contribution Retirement Plans Other investment assets OTC bonds (bid) - incl. muni's limited partnership shares interests in public corp. (nec) directly owned real estate second deeds of trust (amortized) investment of collections investment debt tax reserve [Investment Net Worth] Job-Related Assets Other pension assets (vested) defined benefit pensions govt based retirement plans Business assets (net) Proprietorships Partnerships closely-held corporate stock Personal Assets Home Personal property Vehicles collections (hobby) Household goods list major items separately) Total Assets 1" and 2 mortgages loans secured by personal property Total Liabilities Net Worth Purpose: You have completed a data gathering session and have compiled the following financial status data. The exercise requires you to put together financial information into the statements Requirements: (1) Statement of Financial Position Using the Warschauer format Page 23 (incl. tax reserve, inv net worth) for 12/31/18 (2) Cash Flow Statement for the year 2018, . Calculate Tax reserve only on 401k plan. Client's name: James and Mary Example: Cost basis 220,000 6,000 14,500 20,000 8,250 Market Value Home 445,000 Gross Income 120,000 2014 BMW Z4 (25000 miles)) 23,400 Checking account balance 3,641 Personal property (use 25% of home) Housing Exp (annual) 3,600 Other Variable Exp 38,600 Income Tax (S&F) 18,000 Clothes 970 Life Insurance cash value 8,450 XYZ Muni Bond Fund 5,650 GM Stock 22,400 Raw Land held for 2nd home to be built 43,000 Apple Stock 32,400 SS/Medicare Tax 6,000 Jewelry (appraised value) 14,500 Unsecured Loan 12,600 Food 2,600 Gasoline 2,860 Car Repair 760 Internet, Phone 1,450 Life Insurance annual 850 Property tax 5,500 Mortgage 333,330 Mortgage Payment (monthly) 1,666 Certificate of deposit (mat 12/15/19) 10,000 401k retirement plan (trad) 145,000 2011 Ford Explorer (60,000 miles) 4,300 interest in bakery Appraised value of firm: 220,000 their share 55,000 Entertainment 4,350 BMW loan balance 1,850 Car Payments (combined, annual) 3,600 Other Debt Payments (annual) 1,200 Statement of Financial Position JAMES AND MARY EXAMPLE DECEMBER 31, 1999 ASSETS LIABILITIES Unsecured short term debt signature loans credit card debt drawn lines of credit borrowed cash value Riskless assets Cash and cash equivalents checking balances passbook savings (bank, S&L, cu) cash on hand money market mutual funds money market instrurnents Other liquid assets life insurance cash values credit balances at broker margin debt Investment Assets Marketable investments listed stocks & Reits OTC stocks & Reits (bid) listed bonds Maturing Investments time deposits US savings bond direct pensions (Keogh, IRA 4038, 401K) Roth and Education IRA'S Vested Defined Contribution Retirement Plans Other investment assets OTC bonds (bid) - incl. muni's limited partnership shares interests in public corp. (nec) directly owned real estate second deeds of trust (amortized) investment of collections investment debt tax reserve [Investment Net Worth] Job-Related Assets Other pension assets (vested) defined benefit pensions govt based retirement plans Business assets (net) Proprietorships Partnerships closely-held corporate stock Personal Assets Home Personal property Vehicles collections (hobby) Household goods list major items separately) Total Assets 1" and 2 mortgages loans secured by personal property Total Liabilities Net Worth