Answered step by step

Verified Expert Solution

Question

1 Approved Answer

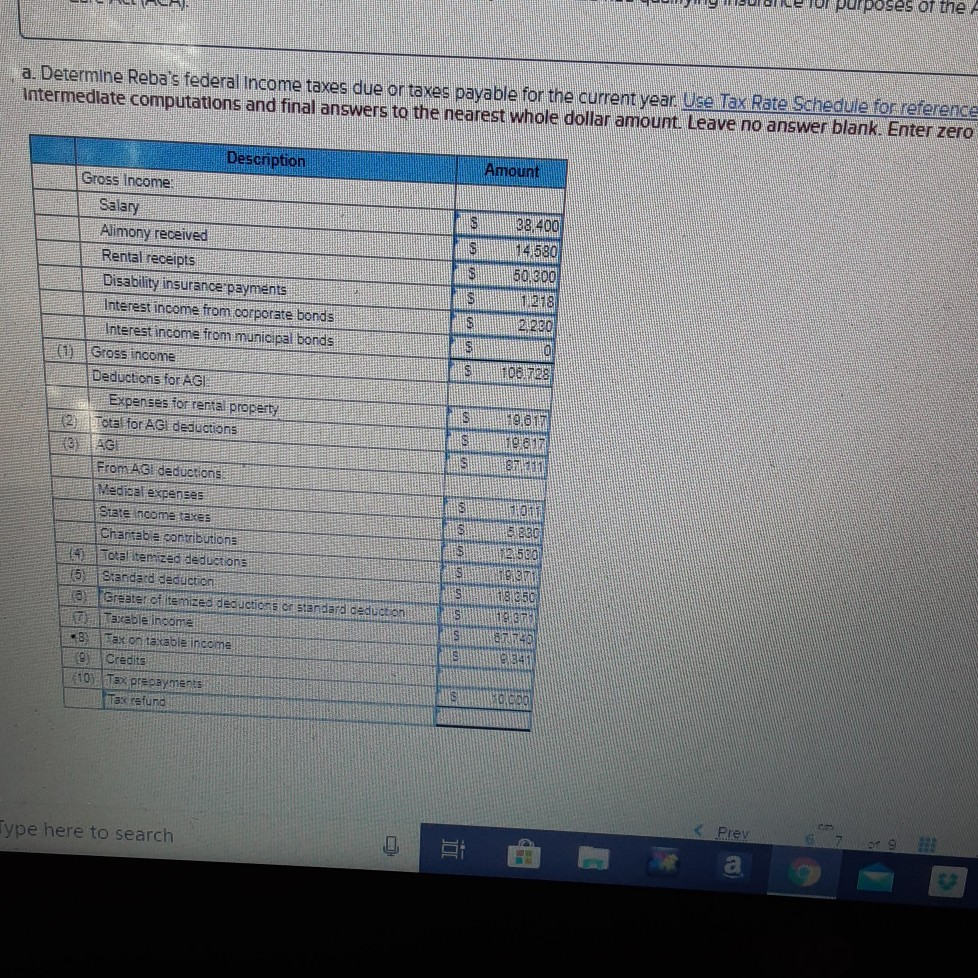

Purposes of the a. Determine Reba's federal Income taxes due or taxes payable for the current year. Use Tax Rate Schedule for reference Intermediate computations

Purposes of the a. Determine Reba's federal Income taxes due or taxes payable for the current year. Use Tax Rate Schedule for reference Intermediate computations and final answers to the nearest whole dollar amount. Leave no answer blank. Enter zero Amount S S 38.400 14580 50 300 12118 21200 10 S S S SI 108.728 5 Description Gross Income Salary Alimony received Rental receipts Disability insurance payments Interest income from corporate bonds Interest income from municipal bonds Gross income Deductions for AGL Expenses for rental property 2 Total for AGI deductions AGI From AGL deductions Medical expenses Siate ncome taxes Chantable contributions 49Total itemized deductions 5 Standard deduction Greater of itemized deductions of standard deduction axable income * Tax on ta cable income - Credits 10 Tax prepayments Tax refund S is 119 617 1962 87 15 $ 15 ON 5. EBC 12500 1960 181650 1910 1611145 9541 ES S o con Type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started