Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Purse Corporation owns 7 0 percent of Scarf Company's voting shares. On January 1 , 2 0 3 , Scarf sold bonds with a par

Purse Corporation owns percent of Scarf Company's voting shares. On January Scarf sold bonds with a par value of

$ at Purse purchased $ par value of the bonds; the remainder was sold to nonaffillates. The bonds mature in five

years and pay an annual Interest rate of percent. Interest is pald semlannually on January and July

Required:

a What amount of interest expense should be reported in the consolidated income statement?

b Prepare the Journal entrles Purse recorded during with regard to its Investment in Scarf bonds.

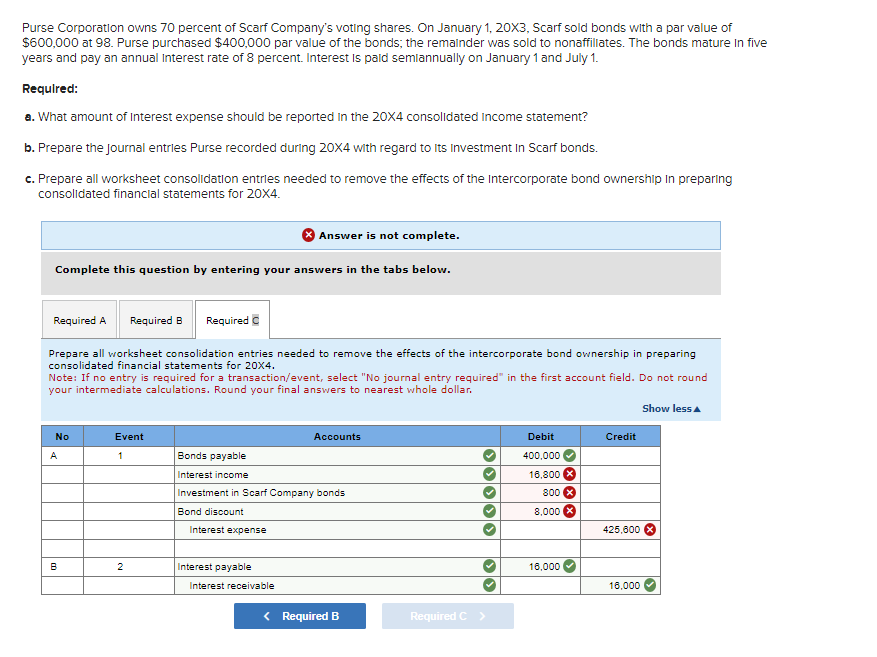

c Prepare all worksheet consolidation entrles needed to remove the effects of the intercorporate bond ownership in preparing

consolidated financlal statements for

Answer is not complete.

Complete this question by entering your answers in the tabs below.

Required

Required B

Required C

Prepare all worksheet consolidation entries needed to remove the effects of the intercorporate bond ownership in preparing

consolidated financial statements for

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field. Do not round

your intermediate calculations. Round your final answers to nearest whole dollar.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started