Answered step by step

Verified Expert Solution

Question

1 Approved Answer

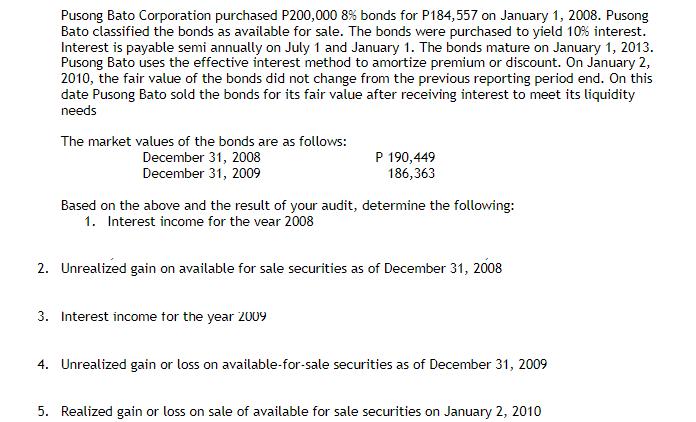

Pusong Bato Corporation purchased P200,000 8% bonds for P184,557 on January 1, 2008. Pusong Bato classified the bonds as available for sale. The bonds

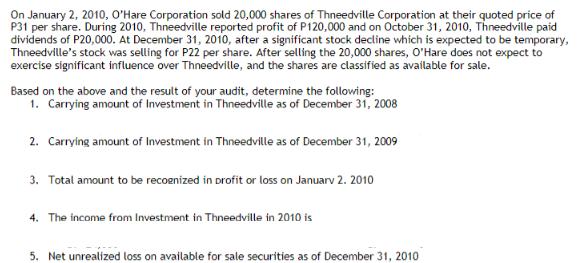

Pusong Bato Corporation purchased P200,000 8% bonds for P184,557 on January 1, 2008. Pusong Bato classified the bonds as available for sale. The bonds were purchased to yield 10% interest. Interest is payable semi annually on July 1 and January 1. The bonds mature on January 1, 2013. Pusong Bato uses the effective interest method to amortize premium or discount. On January 2, 2010, the fair value of the bonds did not change from the previous reporting period end. On this date Pusong Bato sold the bonds for its fair value after receiving interest to meet its liquidity needs The market values of the bonds are as follows: December 31, 2008 December 31, 2009 P 190,449 186,363 Based on the above and the result of your audit, determine the following: 1. Interest income for the year 2008 2. Unrealized gain on available for sale securities as of December 31, 2008 3. Interest income for the year 2009 4. Unrealized gain or loss on available-for-sale securities as of December 31, 2009 5. Realized gain or loss on sale of available for sale securities on January 2, 2010 On January 2, 2010, O'Hare Corporation sold 20,000 shares of Thneedville Corporation at their quoted price of P31 per share. During 2010, Thneedville reported profit of P120,000 and on October 31, 2010, Thneedville paid dividends of P20,000. At December 31, 2010, after a significant stock decline which is expected to be temporary, Thneedville's stock was selling for P22 per share. After selling the 20,000 shares, O'Hare does not expect to exercise significant influence over Thneedville, and the shares are classified as available for sale. Based on the above and the result of your audit, determine the following: 1. Carrying amount of Investment in Thneedville as of December 31, 2008 2. Carrying amount of Investment in Thneedville as of December 31, 2009 3. Total amount to be recognized in profit or loss on Januarv 2. 2010 4. The income from Investment in Thneedville in 2010 is 5. Net unrealized loss on available for sale securities as of December 31, 2010

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started