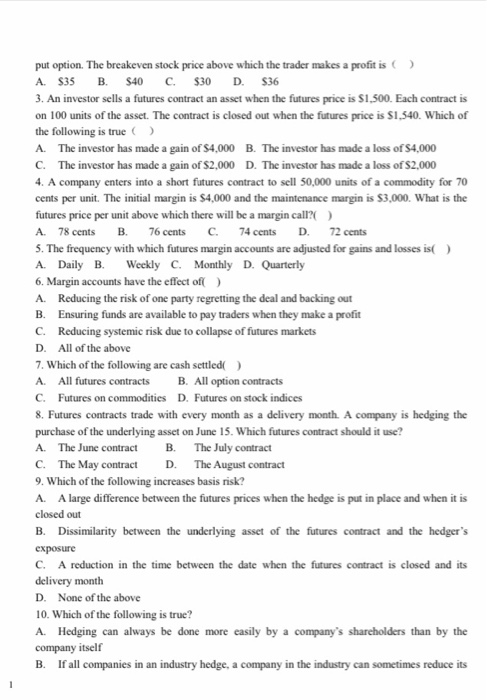

put option. The breakeven stock price above which the trader makes a profit is) A. $35 B. $40 c. $30 D. $36 3. An investor sells a futures contract an asset when the futures price is $1,500. Each contract is on 100 units of the asset. The contract is closed out when the futures price is $1,540. Which of the following is true A. The investor has made a gain of $4,000 B. The investor has made a loss of $4,000 C. The investor has made a gain of $2,000 D. The investor has made a loss of S2,000 4. A company enters into a short futures contract to sell 50,000 units of a commodity for 70 cents per unit. The initial margin is $4,000 and the maintenance margin is $3,000. What is the futures price per unit above which there will be a margin call?() A. 78 cents B. 76 cents c. 74 cents D. 72 cents 5. The frequency with which futures margin accounts are adjusted for gains and losses is) A. Daily B. Weekly C. Monthly D. Quarterly 6. Margin accounts have the effect of A. Reducing the risk of one party regretting the deal and backing out B. Ensuring funds are available to pay traders when they make a profit C. Reducing systemic risk due to collapse of futures markets D. All of the above 7. Which of the following are cash settled() A. All futures contracts B. All option contracts C. Futures on commodities D. Futures on stock indices 8. Futures contracts trade with every month as a delivery month. A company is hedging the purchase of the underlying asset on June 15. Which futures contract should it use? A. The June contract B. The July contract C. The May contract D. The August contract 9. Which of the following increases basis risk? A. A large difference between the futures prices when the hedge is put in place and when it is closed out B. Dissimilarity between the underlying asset of the futures contract and the hedger's exposure C. A reduction in the time between the date when the futures contract is closed and its delivery month D. None of the above 10. Which of the following is true? A. Hedging can always be done more easily by a company's shareholders than by the company itself B. If all companies in an industry hedge, a company in the industry can sometimes reduce its