Question

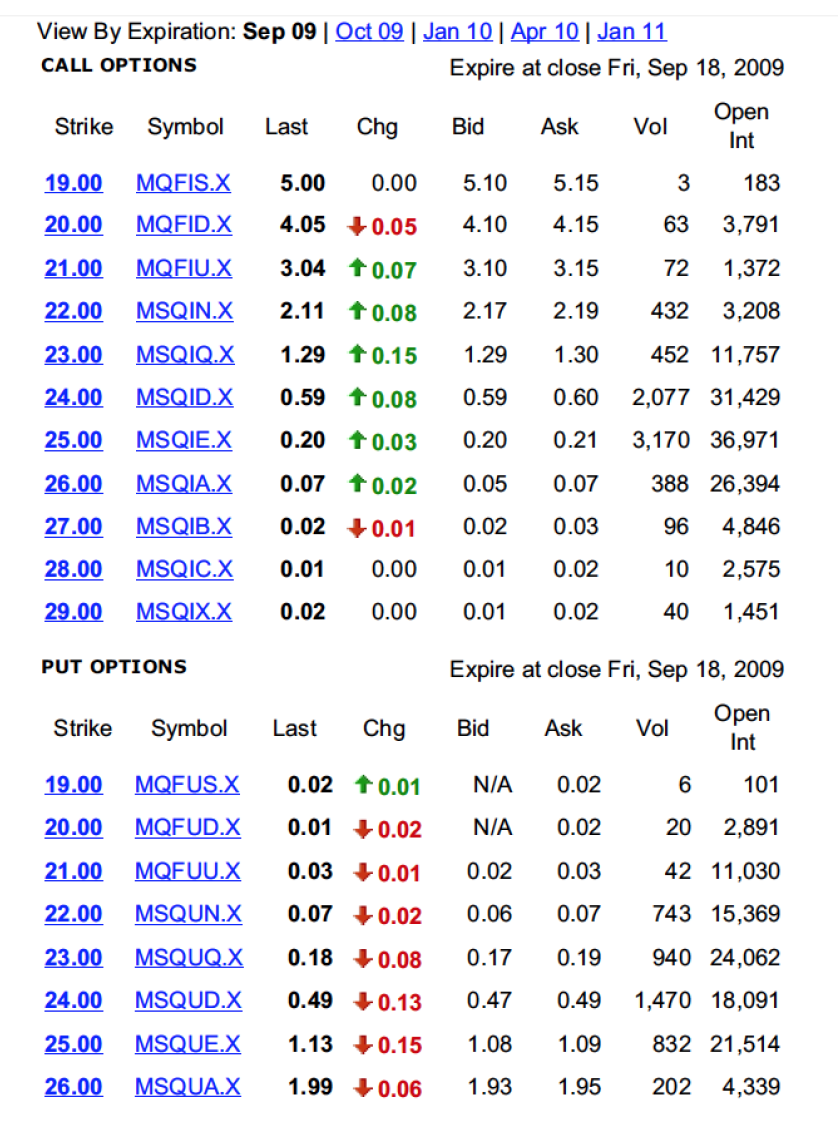

Put-Call parity This exercise asks you to test put-call parity in the data. (a) The chart above contains option quotes for Microsoft from September 3,

Put-Call parity

This exercise asks you to test put-call parity in the data.

(a) The chart above contains option quotes for Microsoft from September 3, 2009. Verify the

put-call parity condition for the options with the strike price as $26. Use the bid prices for both

the call and put options, and assume that Rf = 0. Note, the price of Microsoft on September

3 was $24.11. Do you nd the deviation from the put-call parity? What is your arbitrage

portfolio for the options?

(b) What is wrong with using the bid prices for both the put and the call? If you actually want

to engage in the arbitrage trade for the option with strike $26 from (a), would you use the bid

or the ask price for the put? For the call? Using the appropriate (bid or ask) prices, is your

proposed arbitrage trade still making money?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started