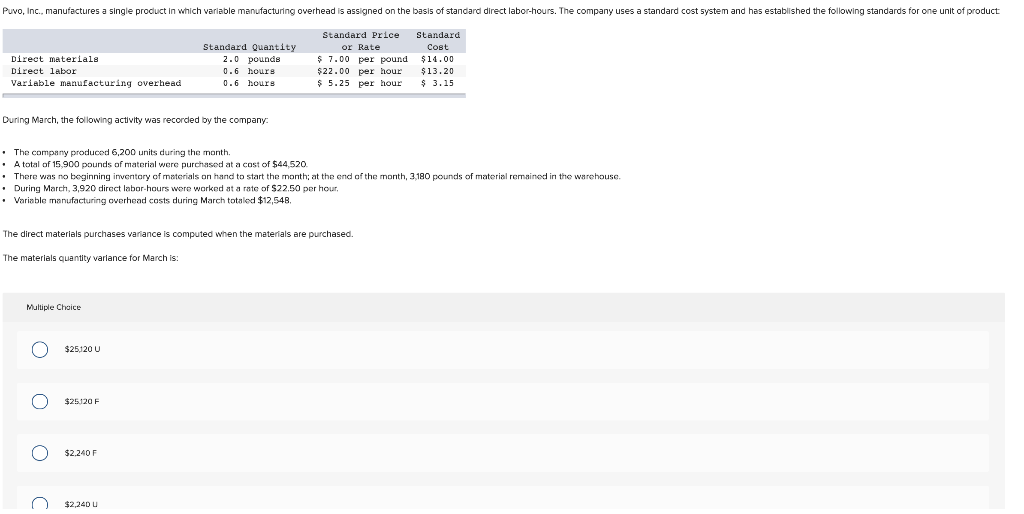

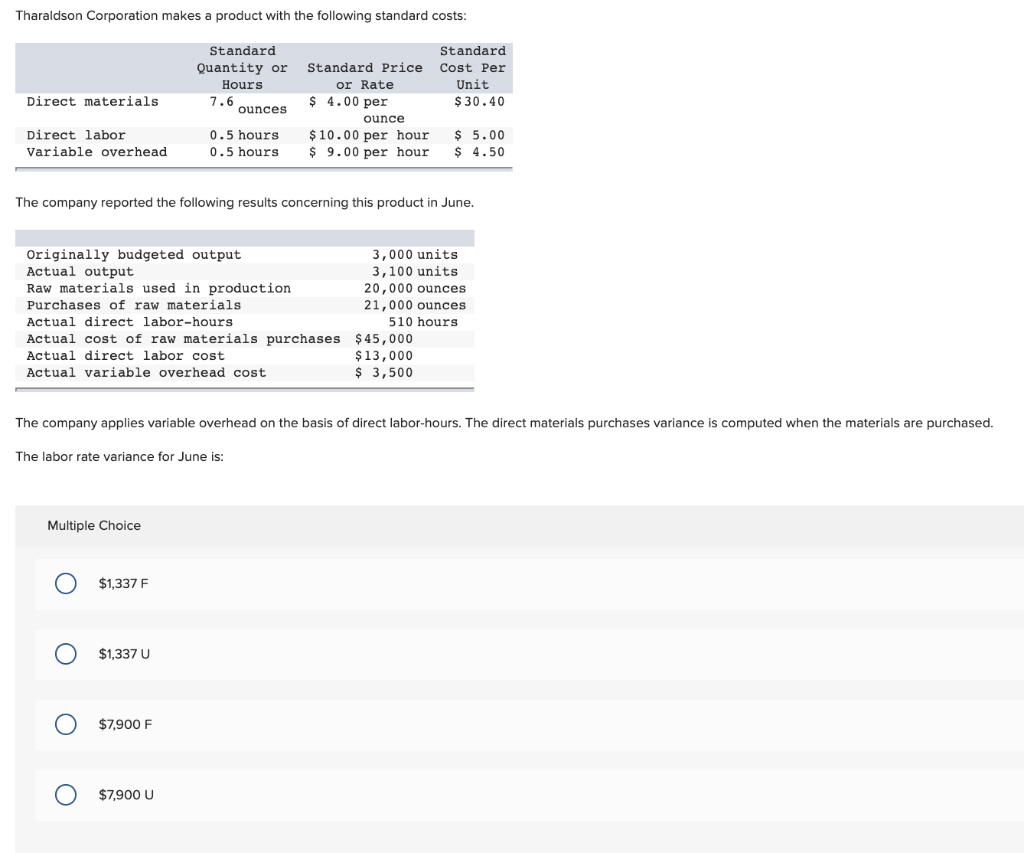

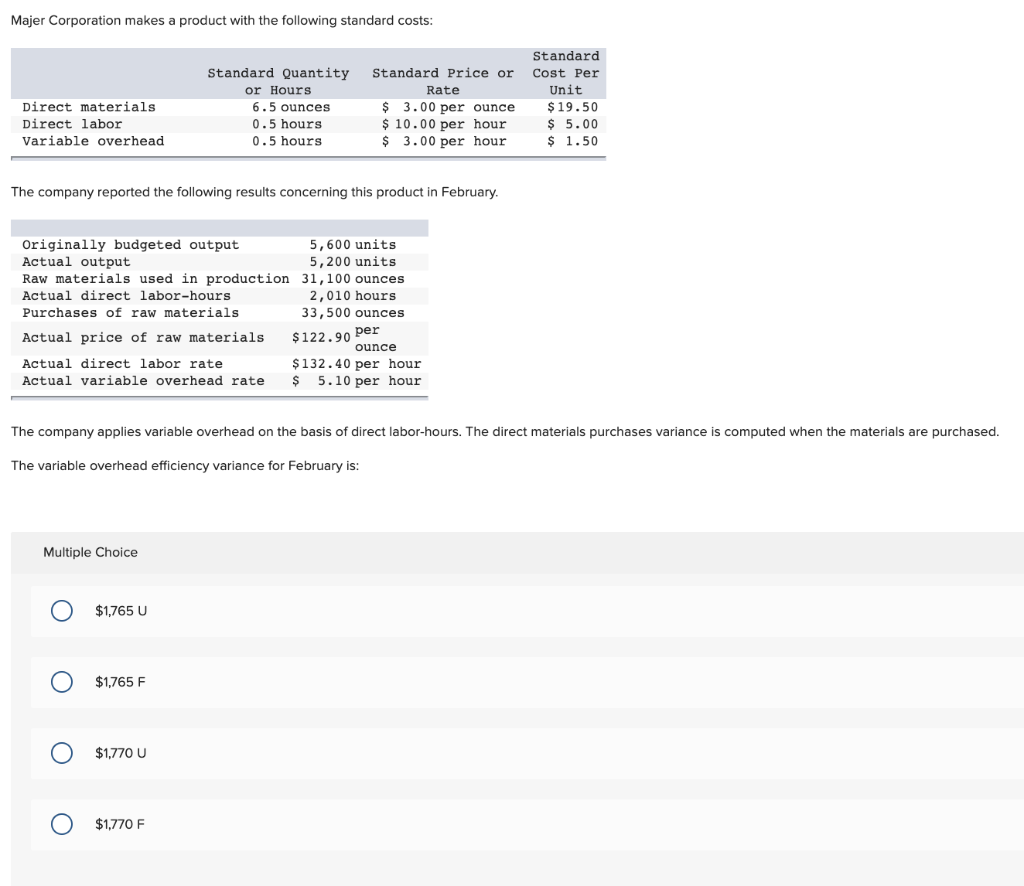

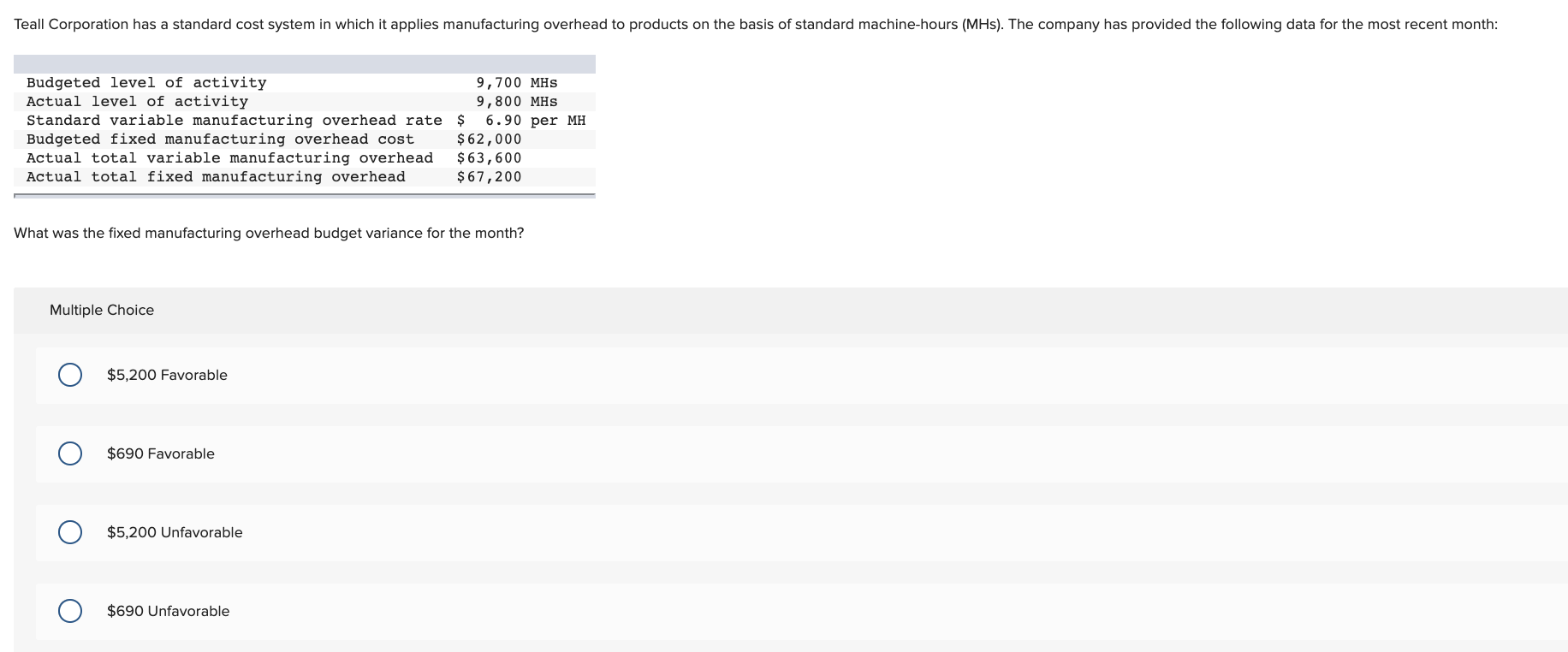

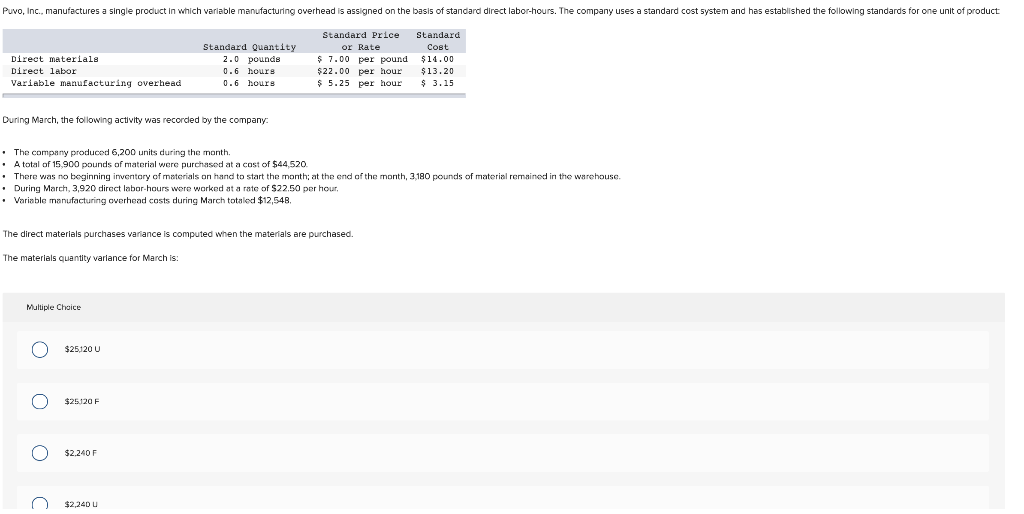

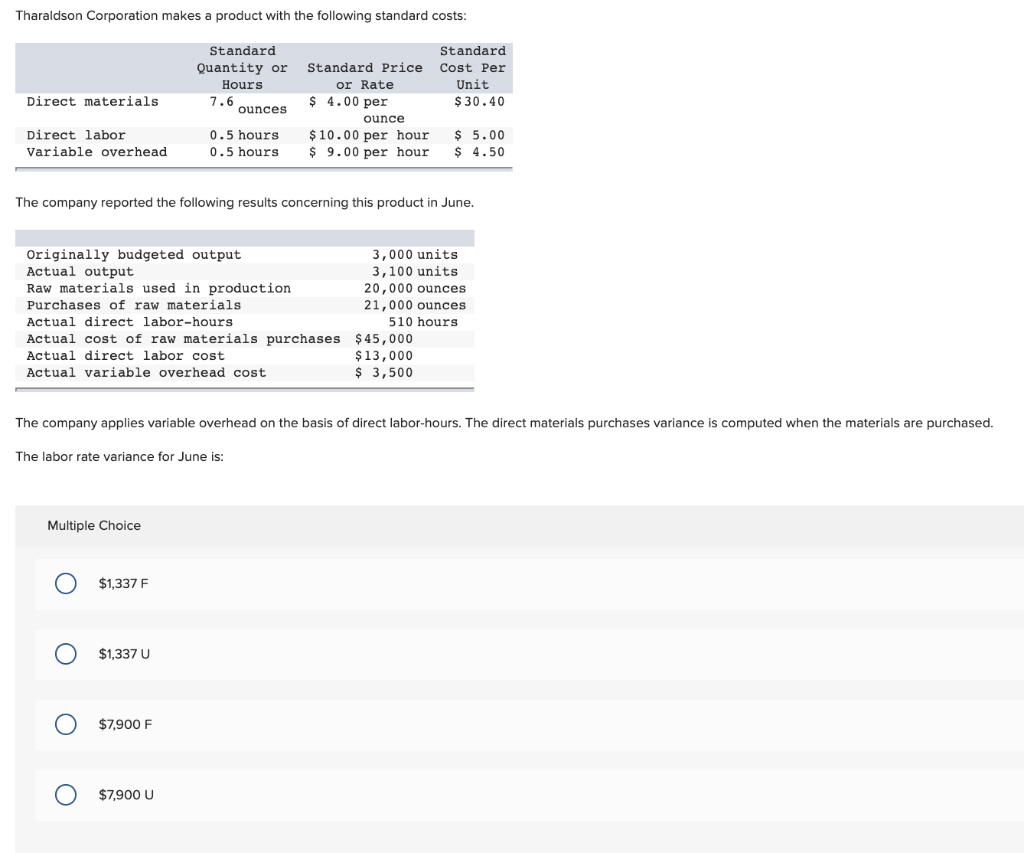

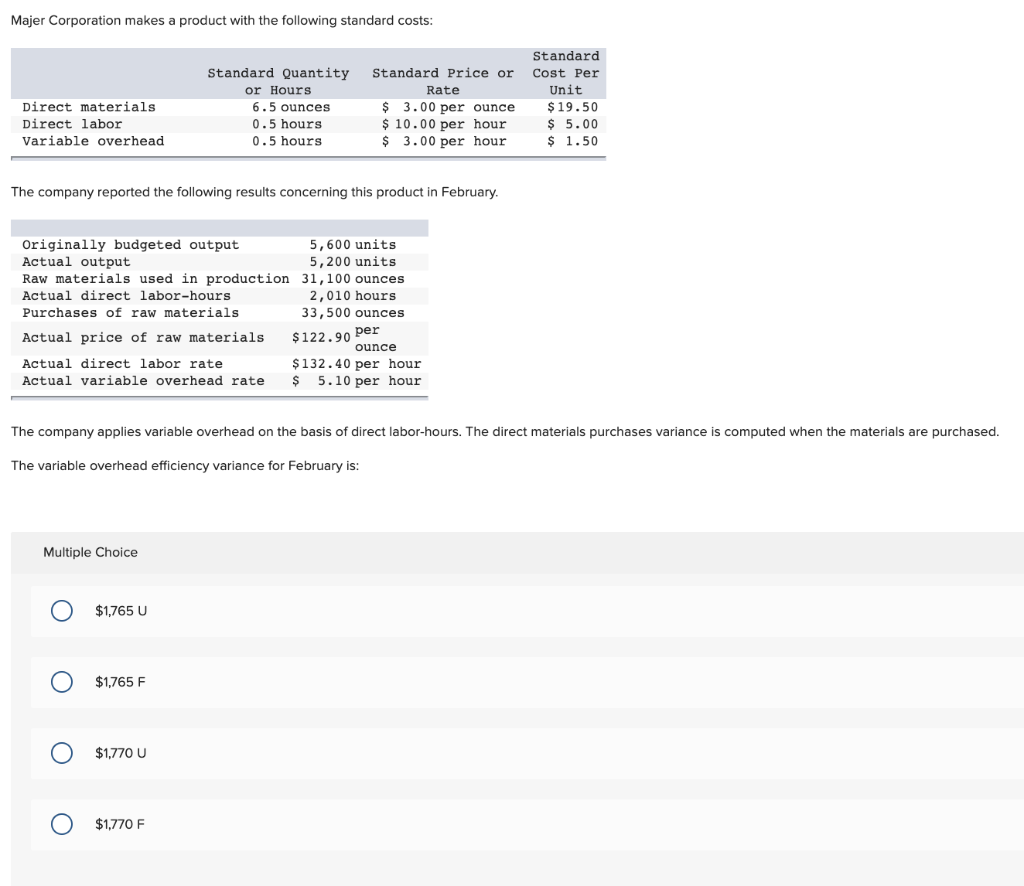

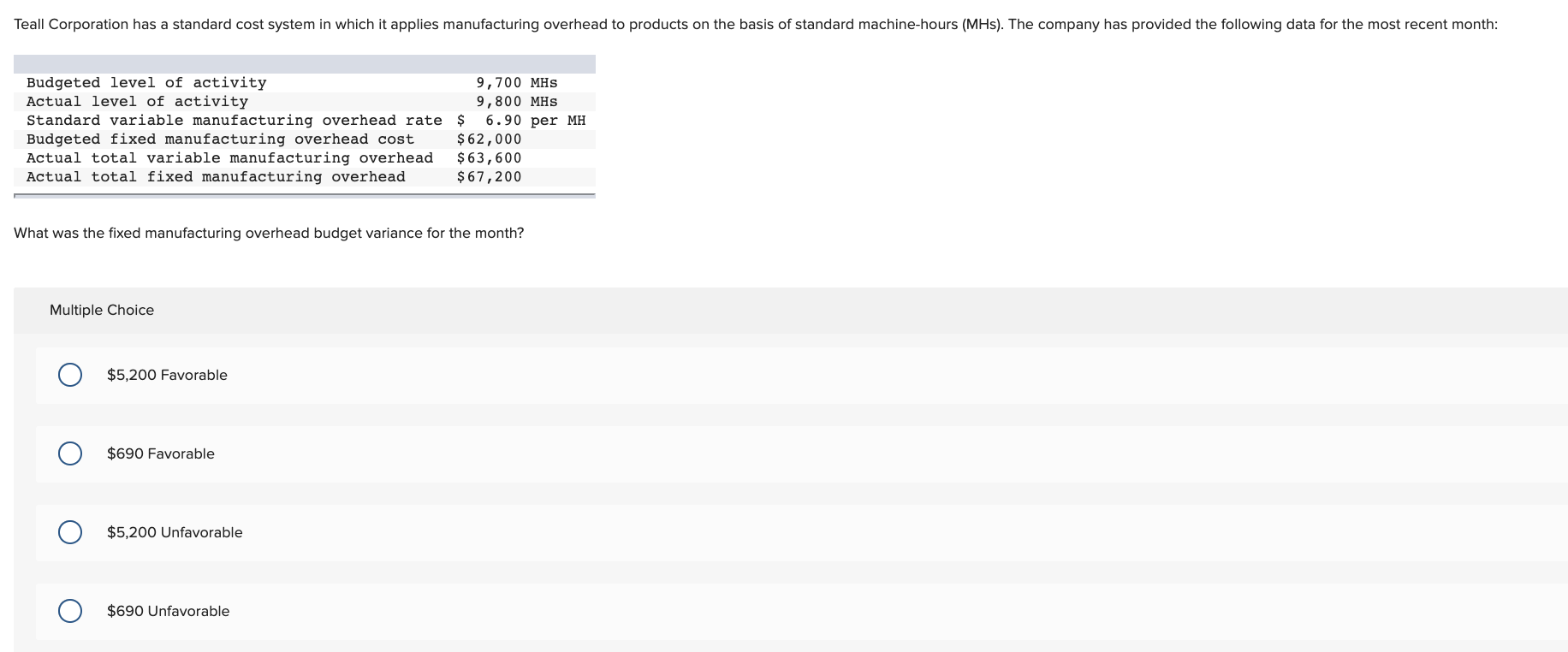

Puvo, Inc., manufactures a single product in which variable manufacturing overhead is assigned on the basis of standard direct labor-hours. The company uses a standard cost system and has established the following standards for one unit of product Direct materials Direct labor Variable manufacturing overhead Standard Quantity 2.0 pounds 0.6 hours 0.6 hours Standard Price or Rate $ 7.00 per pound $22.00 per hour $ 5.25 per hour Standard Cost $14.00 $13.20 $ 3.15 During March, the following activity was recorded by the company The company produced 6,200 units during the month. . A total of 15,900 pounds of material were purchased at a cost of $44,520. . There was no beginning inventory of materials on hand to start the month; at the end of the month, 3.180 pounds of material remained in the warehouse . During March, 3,920 direct labor-hours were worked at a rate of $22.50 per hour, Variable manufacturing overhead costs during March totaled $12,548 The direct materials purchases variance is computed when the materials are purchased. The materials quantity variance for March is: Multiple Choice O $25120 U 0 $25.120 F O $2.240 F $2,240 u C Tharaldson Corporation makes a product with the following standard costs: Standard Quantity or Hours 1.6 ounces Direct materials Standard Standard Price Cost Per or Rate Unit $ 4.00 per $ 30.40 ounce $10.00 per hour $ 5.00 $ 9.00 per hour $ 4.50 Direct labor Variable overhead 0.5 hours 0.5 hours The company reported the following results concerning this product in June. Originally budgeted output 3,000 units Actual output 3,100 units Raw materials used in production 20,000 ounces Purchases of raw materials 21,000 ounces Actual direct labor-hours 510 hours Actual cost of raw materials purchases $45,000 Actual direct labor cost $13,000 Actual variable overhead cost $ 3,500 The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The labor rate variance for June is: Multiple Choice 0 $1,337 F O $1,3370 O $7,900 F 0 O $7.900 U Majer Corporation makes a product with the following standard costs: Standard Standard Price or Cost Per Rate Unit $ 3.00 per ounce $19.50 $ 10.00 per hour $ 5.00 $ 3.00 per hour $ 1.50 Standard Quantity or Hours 6.5 ounces 0.5 hours 0.5 hours Direct materials Direct labor Variable overhead The company reported the following results concerning this product in February Originally budgeted output 5,600 units Actual output 5,200 units Raw materials used in production 31,100 ounces Actual direct labor-hours 2,010 hours Purchases of raw materials 33,500 ounces Actual price of raw materials ounce Actual direct labor rate $132.40 per hour Actual variable overhead rate $ 5.10 per hour $122.90 per The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The variable overhead efficiency variance for February is: Multiple Choice O $1,765 U O $1,765 F 0 $1,770 U 0 $1,770 F Teall Corporation has a standard cost system in which it applies manufacturing overhead to products on the basis of standard machine-hours (MHs). The company has provided the following data for the most recent month: Budgeted level of activity 9,700 MHS Actual level of activity 9,800 MHS Standard variable manufacturing overhead rate $ 6.90 per MH Budgeted fixed manufacturing overhead cost $62,000 Actual total variable manufacturing overhead $63,600 Actual total fixed manufacturing overhead $67,200 What was the fixed manufacturing overhead budget variance for the month? Multiple Choice $5,200 Favorable O $690 Favorable 0 $5,200 Unfavorable $690 Unfavorable