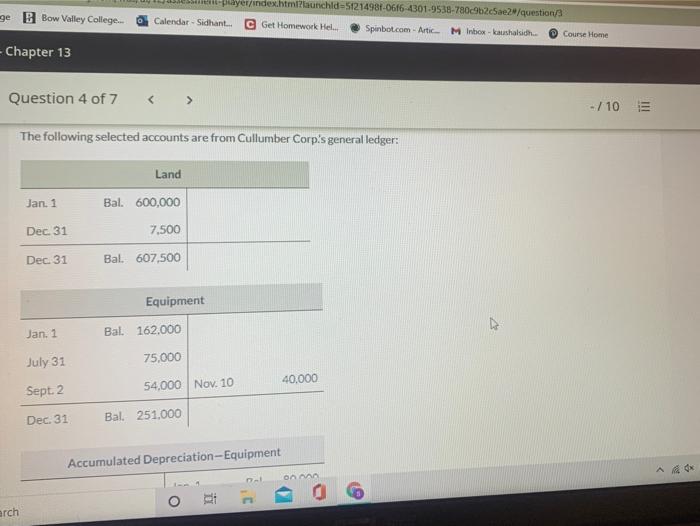

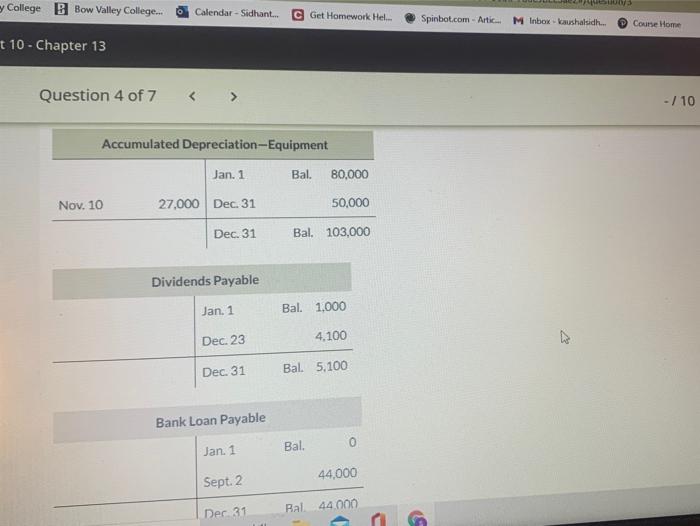

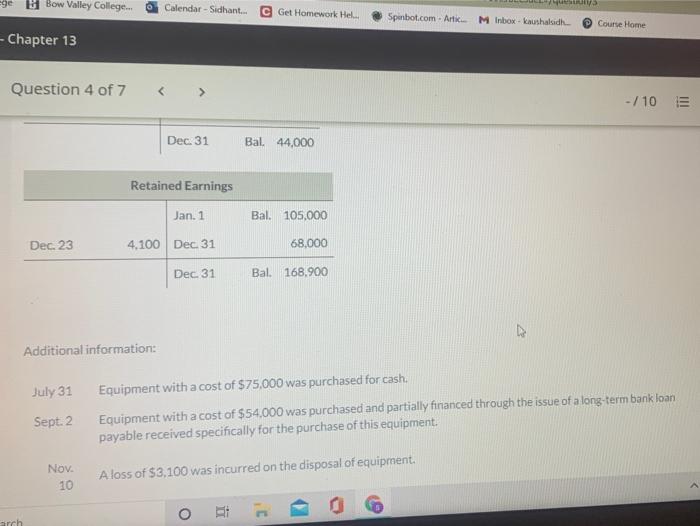

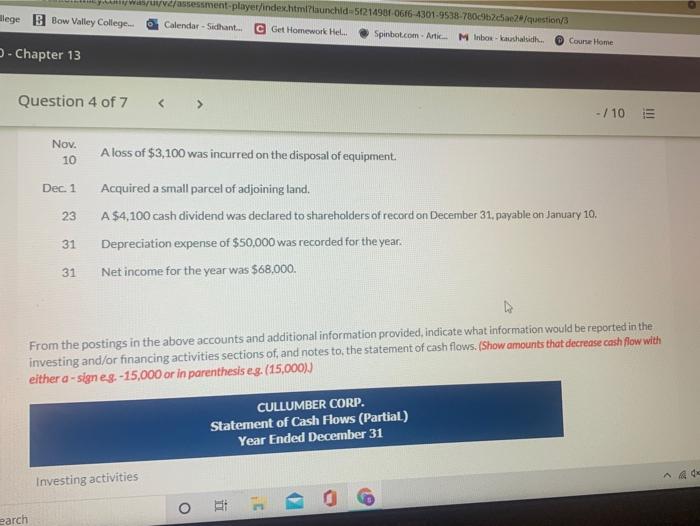

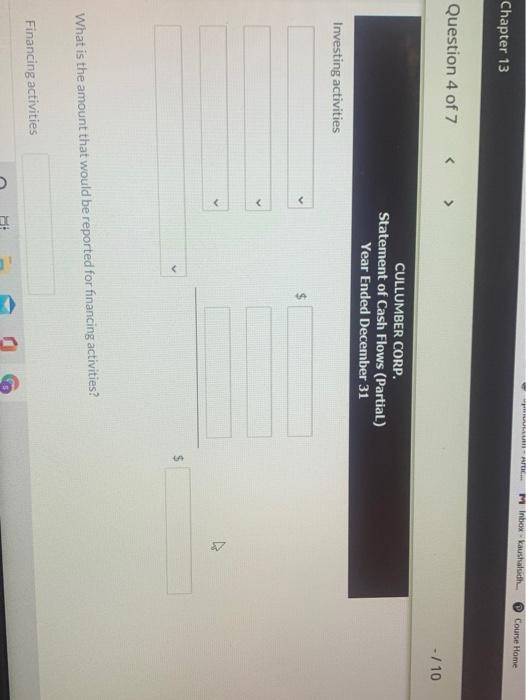

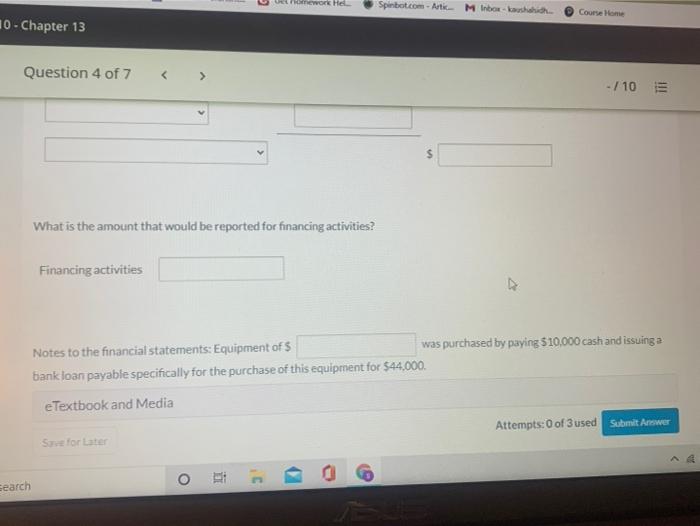

puyer/index.html?launchid=51214981-06f6-4301-9538-780c9b2c5ae2/question/3 ge B Bow Valley College. Calendar - Sidhant... Get Homework Hel Spinbot.com - Artic M Inbox - Kaushalsidh. Course Home Chapter 13 Question 4 of 7 - / 10 The following selected accounts are from Cullumber Corp's general ledger: Land Jan 1 Bal. 600,000 Dec. 31 7.500 Dec 31 Bal.607,500 Equipment Jan. 1 Bal 162.000 July 31 75,000 40,000 Sept 2 54,000 Nov. 10 Dec. 31 Bal 251.000 Accumulated Depreciation-Equipment arch College B Bow Valley College... Calendar - Sidhant... c Get Homework Hel. Spinbot.com - Artic... MInbox - Kaushalsidh... Course Home t 10 - Chapter 13 Question 4 of 7 - / 10 Accumulated Depreciation-Equipment Jan. 1 Bal. 80,000 Nov. 10 27,000 Dec. 31 50,000 Dec. 31 Bal103,000 Dividends Payable Jan. 1 Bal 1,000 Dec. 23 4.100 Dec 31 Bal 5.100 Bank Loan Payable Jan. 1 Bal. 44,000 Sept. 2 Bal 44.000 Dec 31 3 Bow Valley College... ws Calendar - Sidhant. Get Homework Hel. Spinbot.com. Arti MInbox - kaushalsidh Course Home - Chapter 13 Question 4 of 7 -/10 E Dec. 31 Bal 44,000 Retained Earnings Jan. 1 Bal. 105.000 Dec. 23 4,100 Dec 31 68.000 Dec. 31 Bal 168.900 Additional information: July 31 Equipment with a cost of $75,000 was purchased for cash. Sept.2 Equipment with a cost of $54,000 was purchased and partially financed through the issue of a long-term bank loan payable received specifically for the purchase of this equipment Nov. A loss of $3,100 was incurred on the disposal of equipment, 10 arch ww/assessment-player/index.html?launchid=51214988 0616-4301-9538-780c9b2ce2/question/3 alege B Bow Valley College... Calendar - Secthant... c Get Homework Hel Spinbot.com. Artic M Inbox - kaushalih... Course Home - Chapter 13 Question 4 of 7 -/10 Nov. A loss of $3,100 was incurred on the disposal of equipment. 10 Dec. 1 Acquired a small parcel of adjoining land. 23 A $4,100 cash dividend was declared to shareholders of record on December 31. payable on January 10, 31 Depreciation expense of $50,000 was recorded for the year. 31 Net income for the year was $68,000. From the postings in the above accounts and additional information provided, indicate what information would be reported in the investing and/or financing activities sections of, and notes to the statement of cash flows. (Show amounts that decrease cash flow with either a-sign eg.-15,000 or in parenthesis es. (15,000).) CULLUMBER CORP. Statement of Cash Flows (Partial) Year Ended December 31 40 Investing activities O earch - Art MInbox kaushalsich Course Home Chapter 13 Question 4 of 7 - / 10 CULLUMBER CORP. Statement of Cash Flows (Partial) Year Ended December 31 Investing activities A $ What is the amount that would be reported for financing activities? Financing activities n He Spinbot.com - Artic Inbox - kaushahih Course Home 10 - Chapter 13 Question 4 of 7 - / 10 What is the amount that would be reported for financing activities? Financing activities Notes to the financial statements: Equipment of was purchased by paying $10,000 cash and issuing a bank loan payable specifically for the purchase of this equipment for $44,000. eTextbook and Media Attempts:0 of 3 used Submit Answer Sfor later 2 - 0 C Search