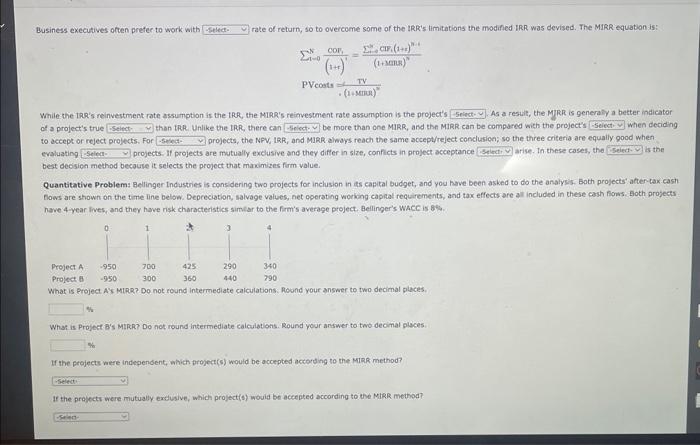

PVecosts=(1+Mmii)2TV While the taR's reinvestment rate assumption is the tRR, the MIRR's reimvestment rate assumption is the project's of a project's true than tRR. Unlike the IRR, there can be more than one MIRR, and the MIRR can be compared with the project's projects, the NFV, IRR, and MIRR almoys reach the same accept/reject conclusion; so the three criteria are equally good when to eccept or reject projects. For arise. In these cases, the projects. If projects are mutually exclusive and they differ in size, conficts in project acceptance evaluating best decision method becaure it selects the project that manimizes firm value. Quantitative Problems Bellinger industries is considering two projects for inclusion in is capital budget, and you have been asked to do the analysis. Both projects' afteritax cash flows are shown on the time line below. Depreciation, salvage values, net operating worigng capral requirements, and tax effects are al included in these cash fions. Aoth projects have 4-year lives, and they have risk characteristics simitar to the firm's average project. Bellinger's WacC is 8/4. What is Project AY Mipar Do not round intermediate calculations: Poond your answer to two decimal places. What is Project B's MIRRT Do not round intermediate calculations. Round your answer to two decinal pleces: If the projects were independent, which project (s) would be accepted accorting to the MinR method? If the projects were mutually exctisive, which project(s) would be accepted according to the MirR method? PVecosts=(1+Mmii)2TV While the taR's reinvestment rate assumption is the tRR, the MIRR's reimvestment rate assumption is the project's of a project's true than tRR. Unlike the IRR, there can be more than one MIRR, and the MIRR can be compared with the project's projects, the NFV, IRR, and MIRR almoys reach the same accept/reject conclusion; so the three criteria are equally good when to eccept or reject projects. For arise. In these cases, the projects. If projects are mutually exclusive and they differ in size, conficts in project acceptance evaluating best decision method becaure it selects the project that manimizes firm value. Quantitative Problems Bellinger industries is considering two projects for inclusion in is capital budget, and you have been asked to do the analysis. Both projects' afteritax cash flows are shown on the time line below. Depreciation, salvage values, net operating worigng capral requirements, and tax effects are al included in these cash fions. Aoth projects have 4-year lives, and they have risk characteristics simitar to the firm's average project. Bellinger's WacC is 8/4. What is Project AY Mipar Do not round intermediate calculations: Poond your answer to two decimal places. What is Project B's MIRRT Do not round intermediate calculations. Round your answer to two decinal pleces: If the projects were independent, which project (s) would be accepted accorting to the MinR method? If the projects were mutually exctisive, which project(s) would be accepted according to the MirR method