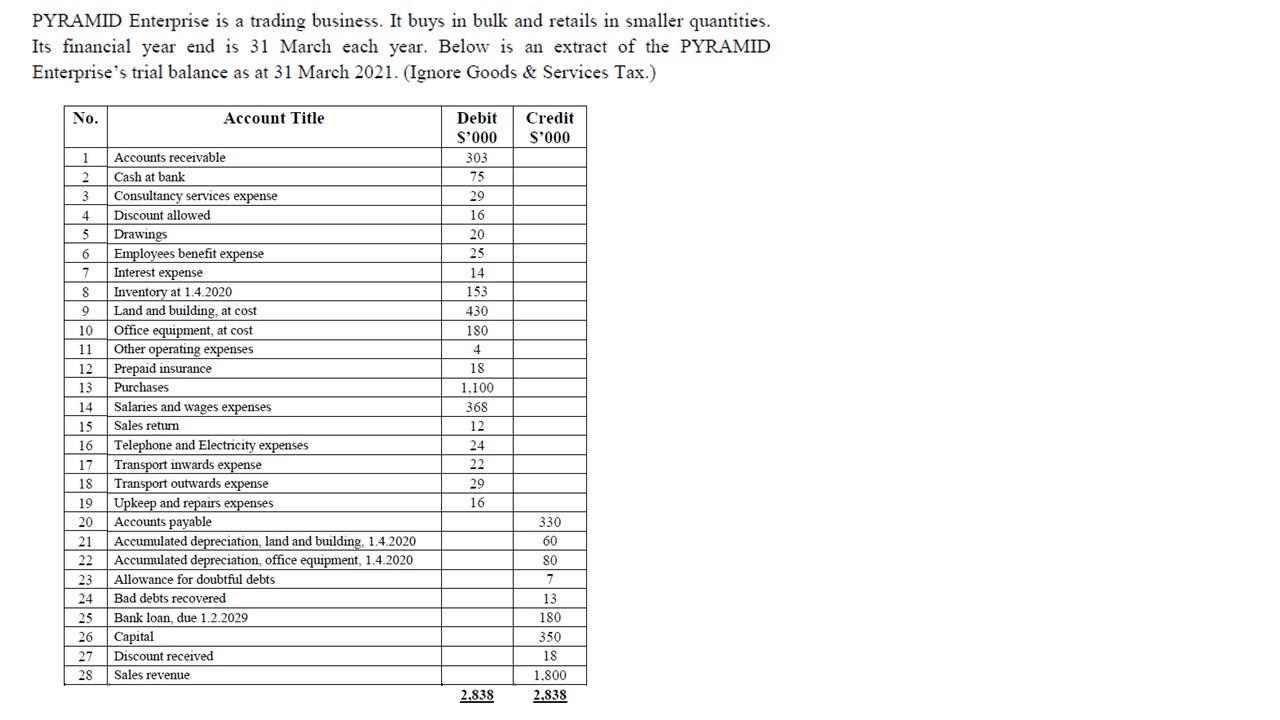

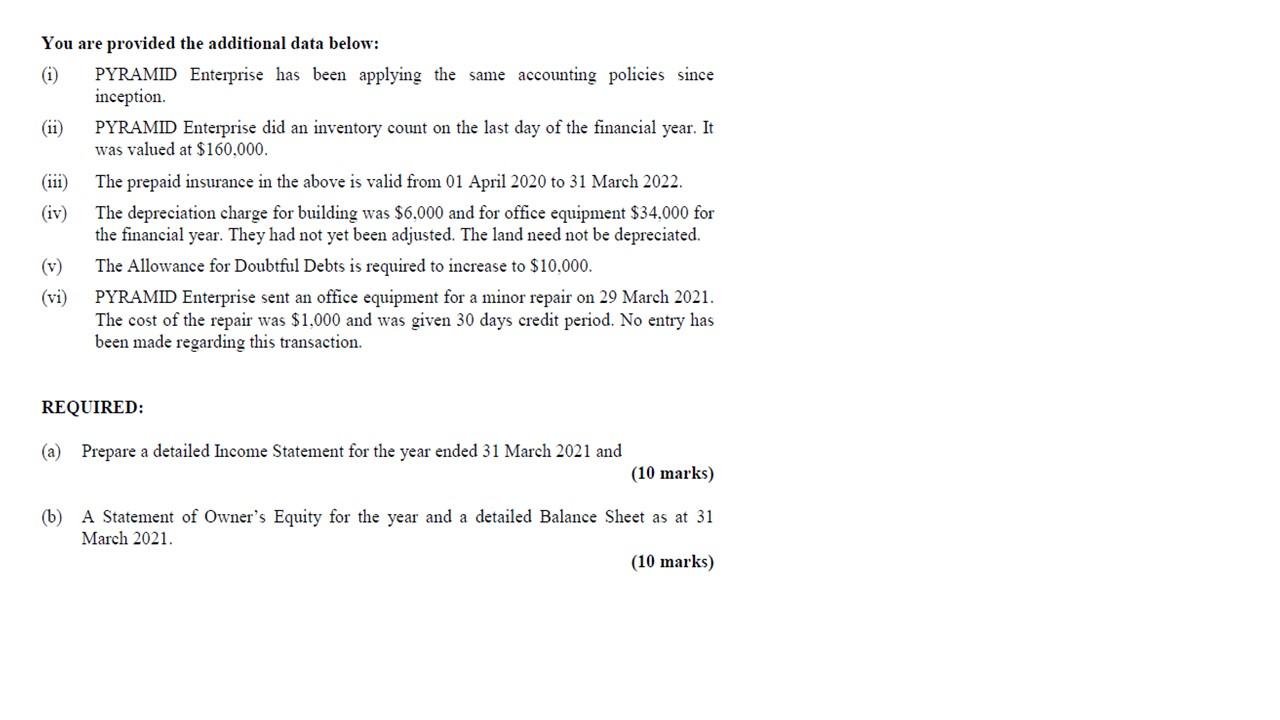

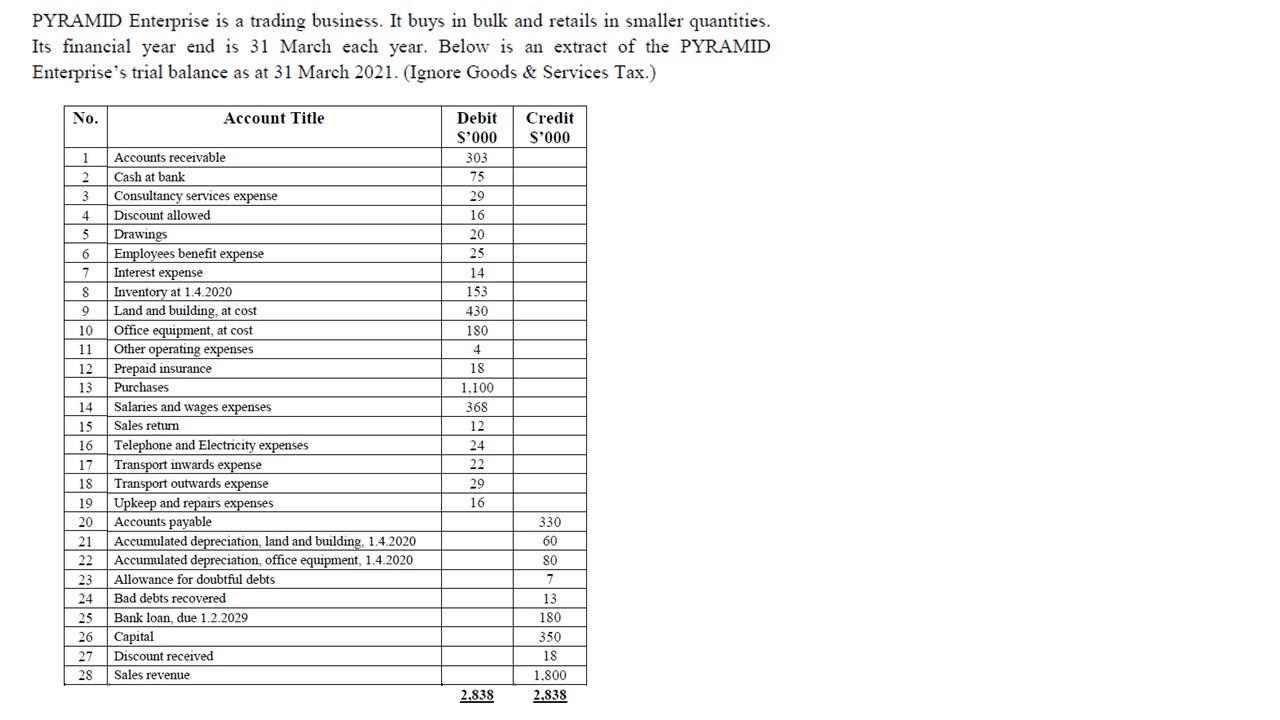

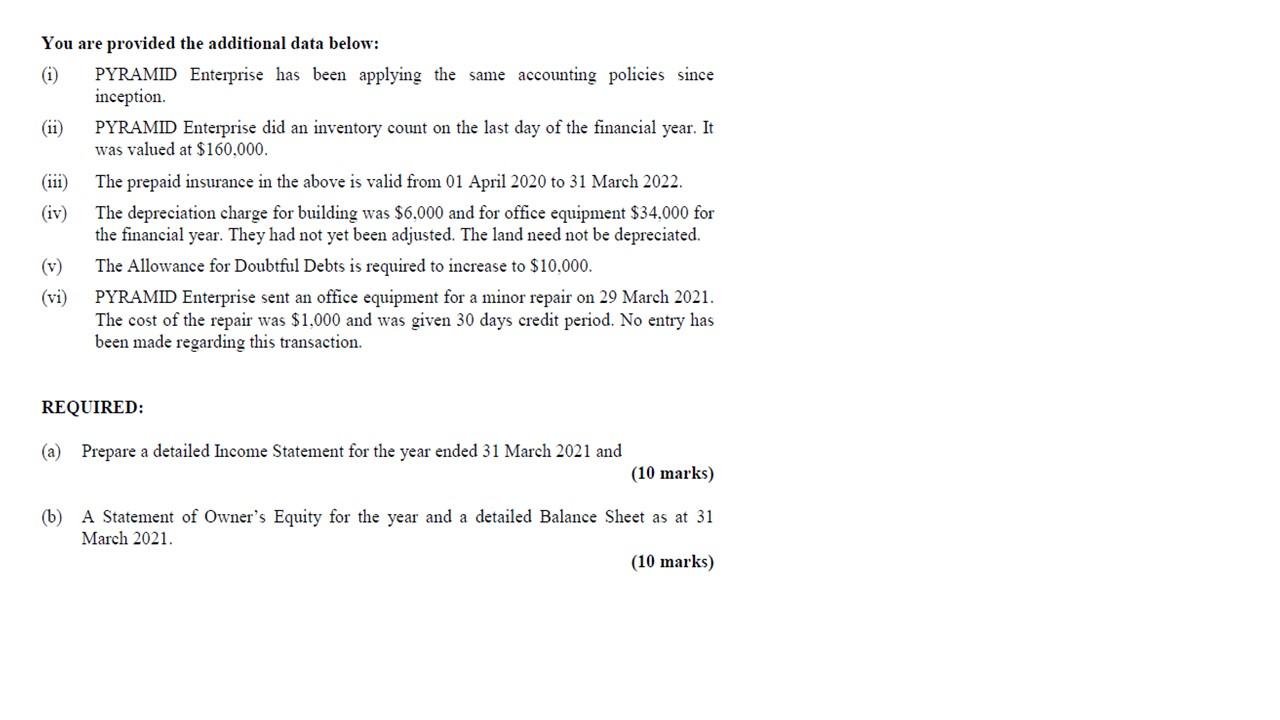

PYRAMID Enterprise is a trading business. It buys in bulk and retails in smaller quantities. Its financial year end is 31 March each year. Below is an extract of the PYRAMID Enterprise's trial balance as at 31 March 2021. (Ignore Goods & Services Tax.) No. Account Title Credit S'000 1 2 3 4 5 6 7 8 9 Debit S'000 303 75 29 16 20 25 14 153 430 180 4 18 1.100 368 12 24 22 29 16 10 11 Accounts receivable Cash at bank Consultancy services expense Discount allowed Drawings Employees benefit expense Interest expense Inventory at 1.4.2020 Land and building, at cost Office equipment, at cost Other operating expenses Prepaid insurance Purchases Salaries and wages expenses Sales return Telephone and Electricity expenses Transport inwards expense Transport outwards expense Upkeep and repairs expenses Accounts payable Accumulated depreciation, land and building. 1.4.2020 Accumulated depreciation office equipment, 1.4.2020 Allowance for doubtful debts Bad debts recovered Bank loan, due 1.2.2029 Capital Discount received Sales revenue 12 15 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 330 60 SO 7 13 180 350 18 1.800 2.838 2.838 You are provided the additional data below: PYRAMID Enterprise has been applying the same accounting policies since inception PYRAMID Enterprise did an inventory count on the last day of the financial year. It was valued at $160.000. (111) The prepaid insurance in the above is valid from 01 April 2020 to 31 March 2022. (iv) The depreciation charge for building was $6,000 and for office equipment $34.000 for the financial year. They had not yet been adjusted. The land need not be depreciated. (v) The Allowance for Doubtful Debts is required to increase to $10.000. PYRAMID Enterprise sent an office equipment for a minor repair on 29 March 2021. The cost of the repair was $1,000 and was given 30 days credit period. No entry has been made regarding this transaction. REQUIRED: (a) Prepare a detailed Income Statement for the year ended 31 March 2021 and (10 marks) (b) A Statement of Owner's Equity for the year and a detailed Balance Sheet as at 31 March 2021 (10 marks)