Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Python coding please ans thank you! Individual Retirement Accounts Money earned in an ordinary savings account is subject to federal, state, and local income taxes.

Python coding please ans thank you!

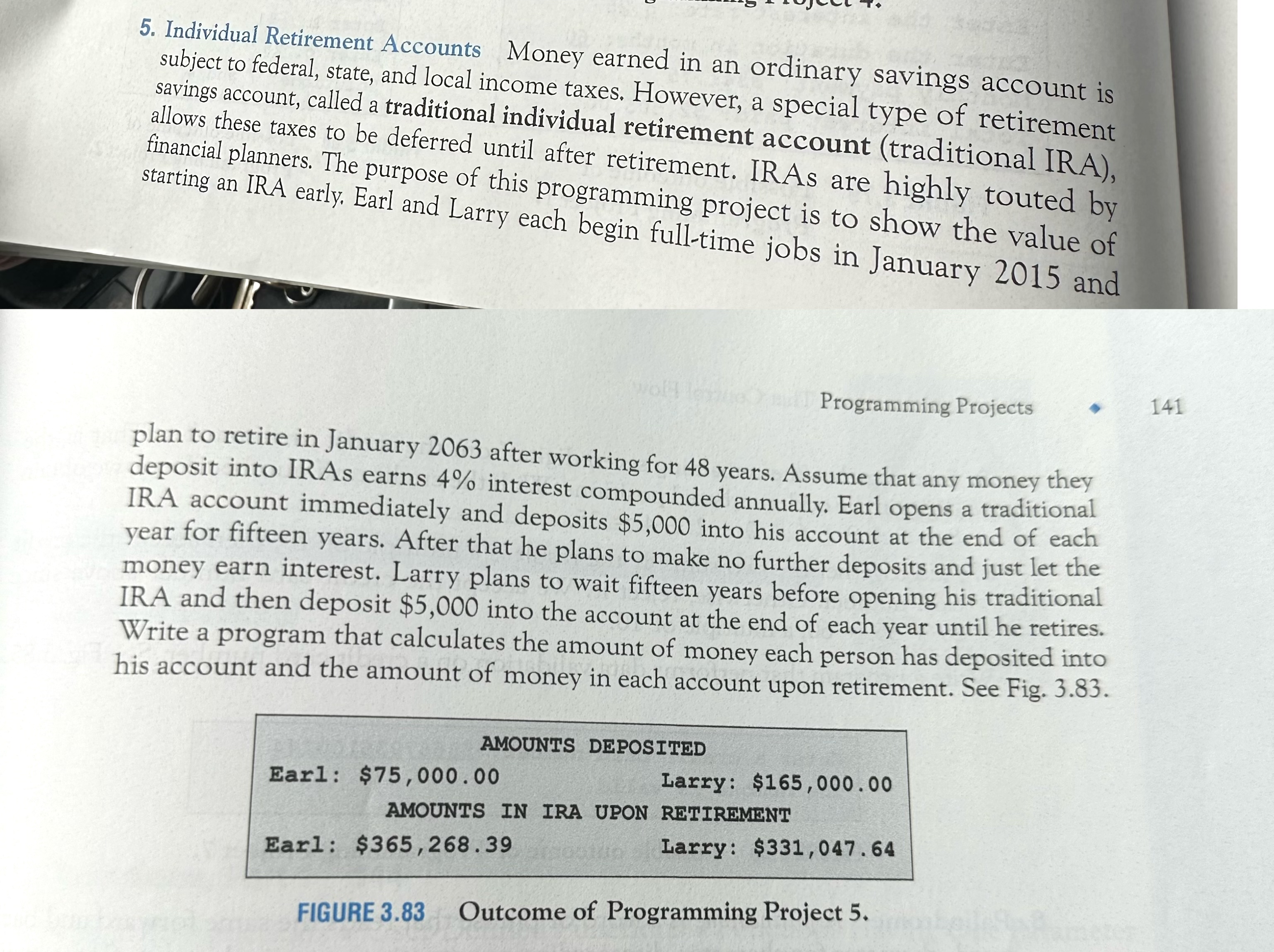

Individual Retirement Accounts Money earned in an ordinary savings account is subject to federal, state, and local income taxes. However, a special type of retirement savings account, called a traditional individual retirement account traditional IRA allows these taxes to be deferred until after retirement. IRAs are highly touted by financial planners. The purpose of this programming project is to show the value of starting an IRA early. Earl and Larry each begin fulltime jobs in January and

Programming Projects

plan to retire in January after working for years. Assume that any money they deposit into IRAs earns interest compounded annually. Earl opens a traditional IRA account immediately and deposits $ into his account at the end of each year for fifteen years. After that he plans to make no further deposits and just let the money earn interest. Larry plans to wait fifteen years before opening his traditional IRA and then deposit $ into the account at the end of each year until he retires. Write a program that calculates the amount of money each person has deposited into his account and the amount of money in each account upon retirement. See Fig.

tableAMOUNTS DEPOSITEDEarl: $Larry: $AMOUNTS IN IRA UPON RETIREMENT,,Earl: $Larry: $

FIGURE Outcome of Programming Project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started