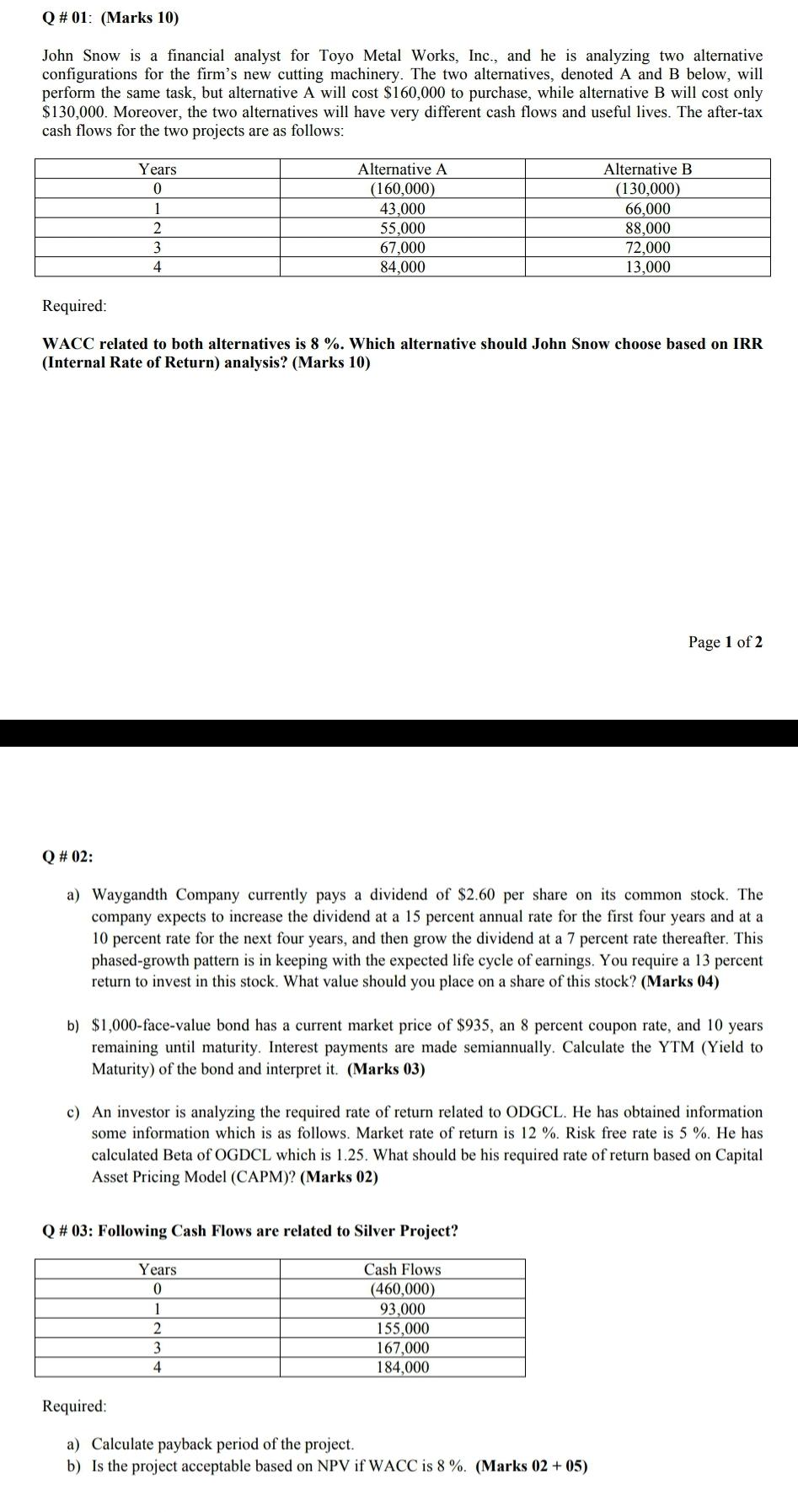

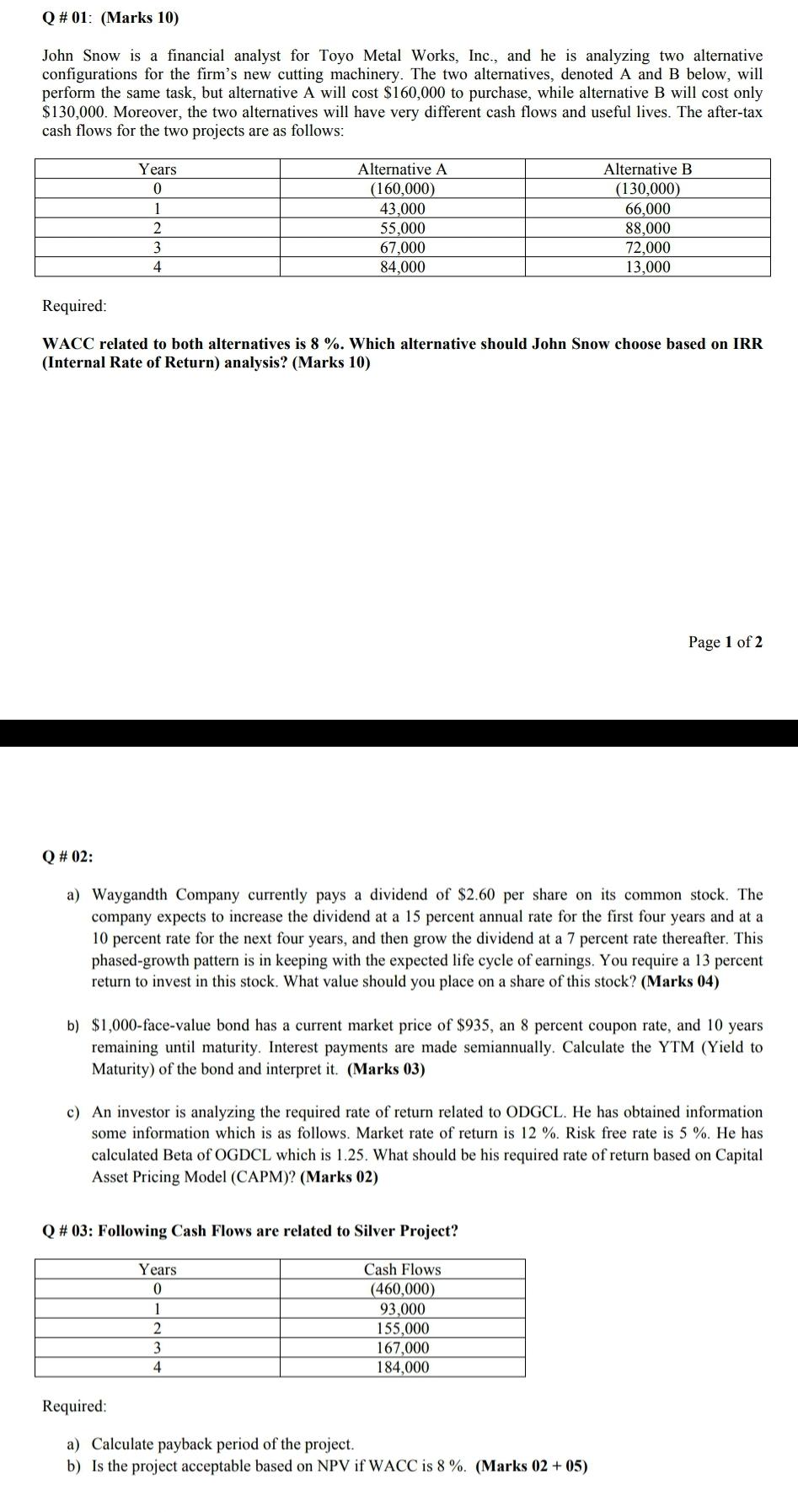

Q # 01: (Marks 10) John Snow is a financial analyst for Toyo Metal Works, Inc., and he is analyzing two alternative configurations for the firm's new cutting machinery. The two alternatives, denoted A and B below, will perform the same task, but alternative A will cost $160,000 to purchase, while alternative B will cost only $130,000. Moreover, the two alternatives will have very different cash flows and useful lives. The after-tax cash flows for the two projects are as follows: Years 0 1 2 3 4 Alternative A (160,000) 43,000 55,000 67,000 84,000 Alternative B (130,000) 66,000 88,000 72,000 13,000 Required: WACC related to both alternatives is 8 %. Which alternative should John Snow choose based on IRR (Internal Rate of Return) analysis? (Marks 10) Page 1 of 2 Q # 02: a) Waygandth Company currently pays a dividend of $2.60 per share on its common stock. The company expects to increase the dividend at a 15 percent annual rate for the first four years and at a 10 percent rate for the next four years, and then grow the dividend at a 7 percent rate thereafter. This phased-growth pattern is in keeping with the expected life cycle of earnings. You require a 13 percent return to invest in this stock. What value should you place on a share of this stock? (Marks 04) b) $1,000-face-value bond has a current market price of $935, an 8 percent coupon rate, and 10 years remaining until maturity. Interest payments are made semiannually. Calculate the YTM (Yield to Maturity) of the bond and interpret it. (Marks 03) c) An investor is analyzing the required rate of return related to ODGCL. He has obtained information some information which is as follows. Market rate of return is 12 %. Risk free rate is 5 %. He has calculated Beta of OGDCL which is 1.25. What should be his required rate of return based on Capital Asset Pricing Model (CAPM)? (Marks 02) Q # 03: Following Cash Flows are related to Silver Project? Years 0 1 2 3 Cash Flows (460,000) 93,000 155,000 167,000 184,000 4 Required: a) Calculate payback period of the project. b) Is the project acceptable based on NPV if WACC is 8 %. (Marks 02 +05)