Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q 1 . A manufactuxing firm which you control, is interested in investing in a new manufacturing technology, which has a promise to provide high

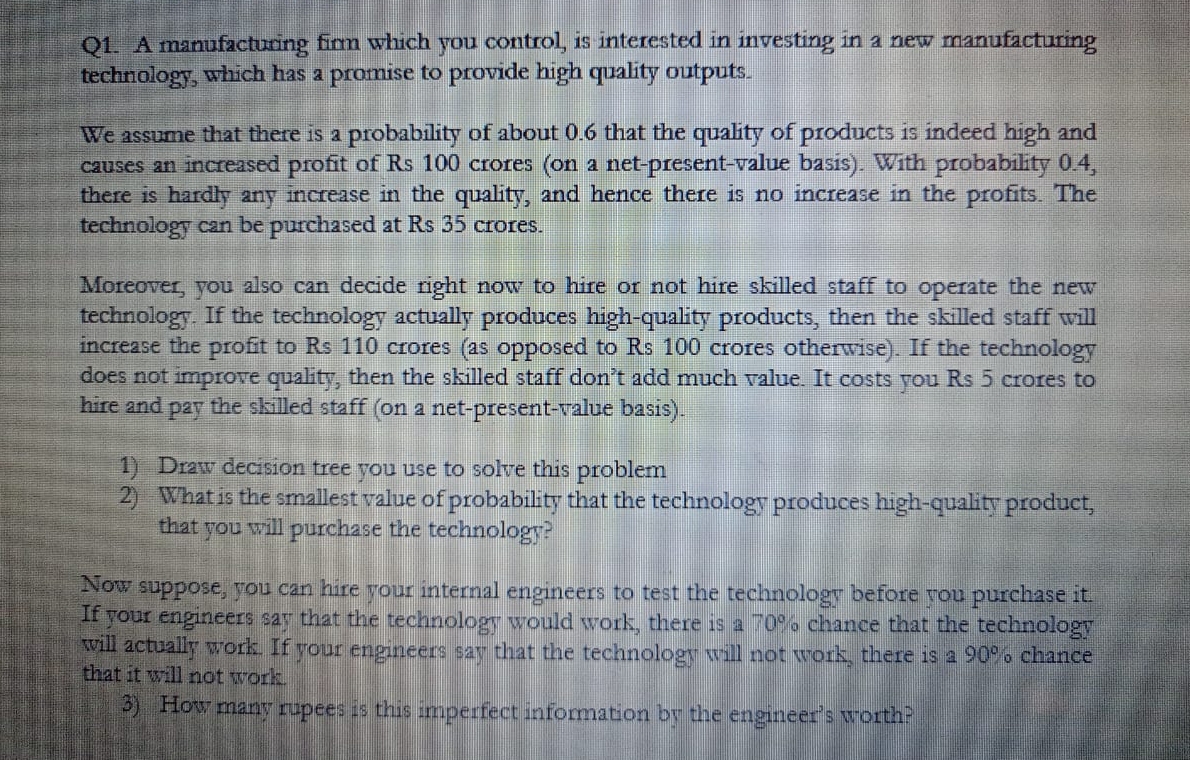

Q A manufactuxing firm which you control, is interested in investing in a new manufacturing technology, which has a promise to provide high quality outputs.

We assume that there is a probability of about that the quality of products is indeed high and causes an increased profit of Rs crores on a netpresentvalue basis With probability there is hardly any increase in the quality, and hence there is no increase in the profits. The technology can be purchased at Rs crores.

Moreover, you also can decide right now to hire or not hire skilled staff to operate the new technology. If the technology actually produces highquality products, then the skilled staff will increase the profit to Rs crores as opposed to Rs crores otherwise If the technology does not improve quality, then the skilled staff don't add much value. It costs you Rs crores to hire and pay the skilled staff on a netpresentvalue basis

Draw decision tree you use to solve this problem

What is the smallest value of probability that the technology produces highquality product, that you will purchase the technology?

Now suppose, you can hire your internal engineers to test the technology before you purchase it If your engineers say that the technology would work, there is a chance that the technology will actually work. If your engineers say that the technology will not work, there is a chance that it will not work.

How many rupees is this imperfect information by the engineer's worth?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started