Q 1) Based on your reading of the case study, answer the below

a) what kind of market structure best describes the Indian aviation industry. State the reasons for your answer

b) However, the market did not grow sufficiently large enough for all players to compete; many of the airlines went bankrupt. Discuss this statement in the context of returns to scale

c) In 2012, the government allowed foreign airlines to participate in India's aviation industry. Explain what would happen to the price elasticity of demand for air travel in India and why.

d) Based on the case study, discuss the pricing model most applicable to India's aviation industry

e)In the section on pricing strategies, it is indicated that price war' is ruinous to the industry. Discuss what is meant by price war and the strategies that could be undertaken by the airlines to avoid it in their quest to expand market share

f) What strategies should AirAsia India pursue in such a market to ensure its survival and profitability?

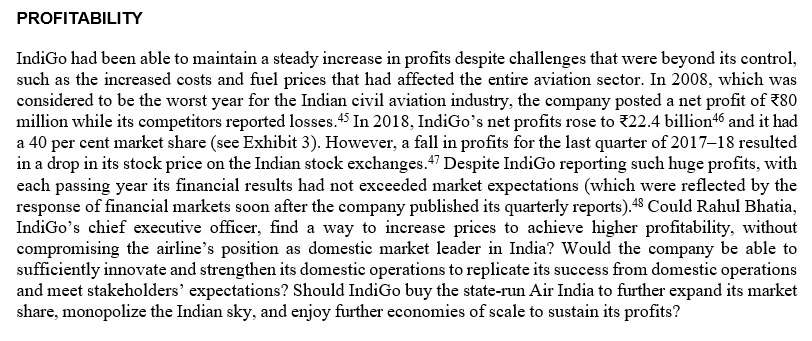

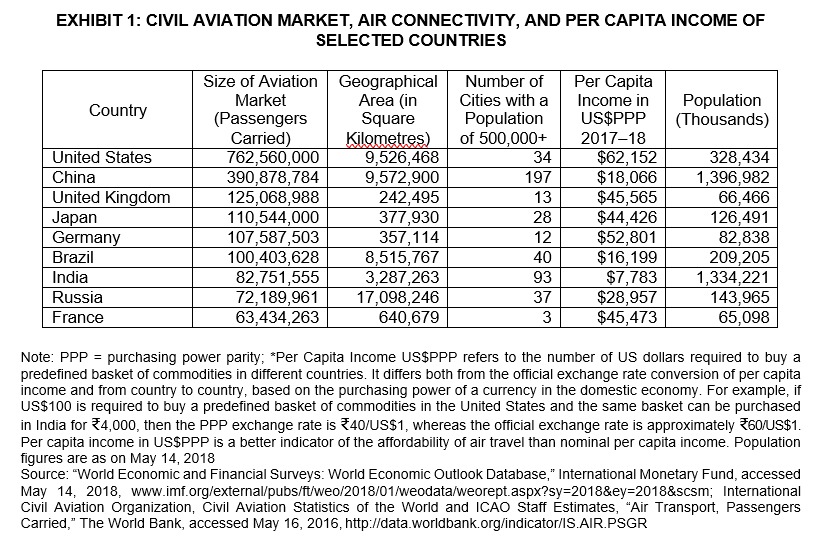

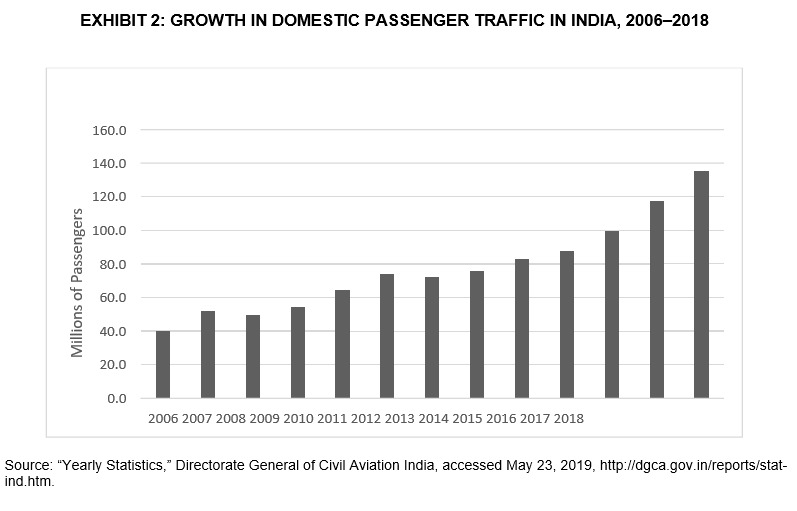

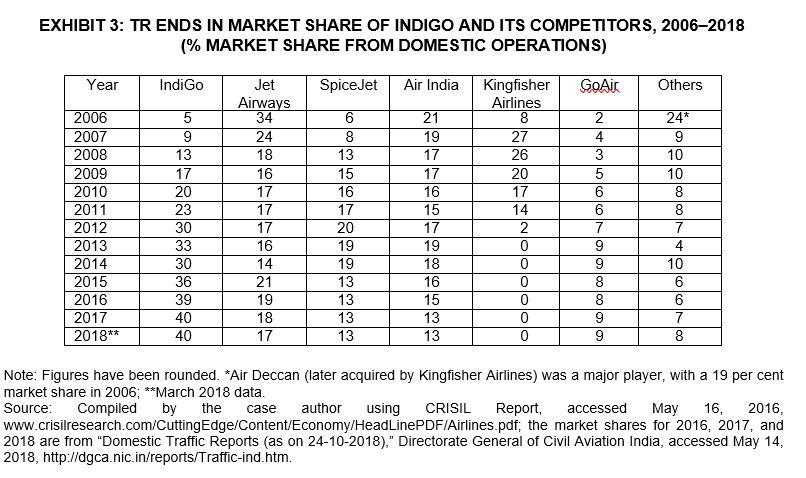

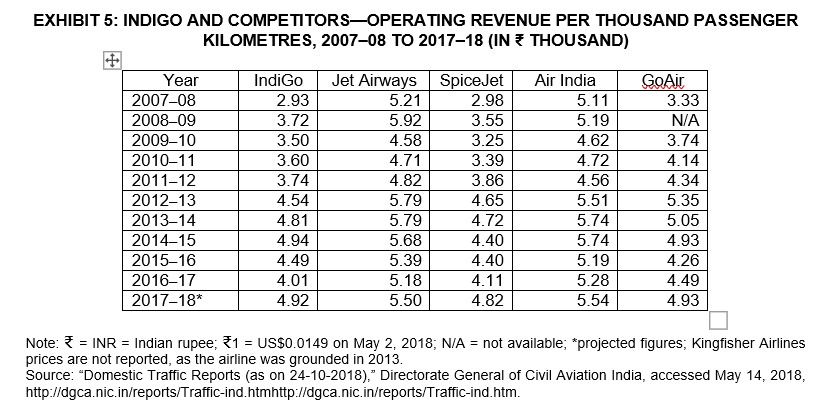

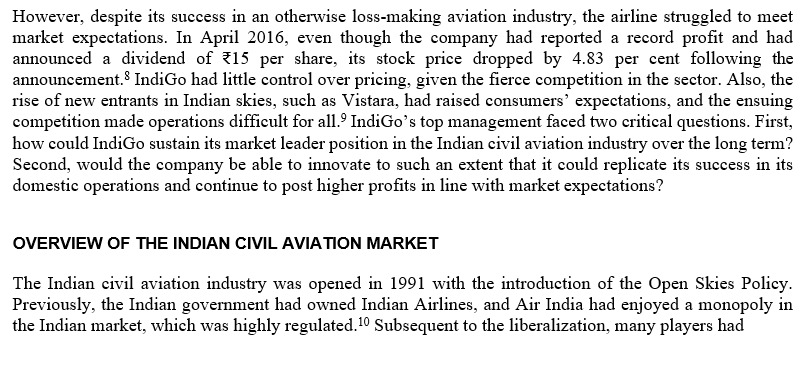

IVEY |Publishing W19161 INDIGO AIRLINES: MONOPOLIZING INDIAN SKIES1 Ramakrushna Ranigrahi wrote this case solely to provide material for class discussion. The author does not intend to illustrate either effective or ineffective handling of a managerial situation. The author may have disguised certain names and other identifying information to protect confidentiality. This publication may not be transmitted, photocopied, digitized, or otherwise reproduced in any form or by any means without the permission of the copyright holder. Reproduction of this material is not covered under authorization by any reproduction rights organization. To order copies or request permission to reproduce materials, contact Ivey Publishing, Ivey Business School, Western University, London, Ontario, Canada, N6G ON1; (t) 519.661.3208; (e) cases@ivey.ca; www.iveycases.com. Our goal is to publish materials of the highest quality; submit any errata to publishcases@ivey.ca. Copyright @ 2019, Ivey Business School Foundation Version: 2019-04-22 On May 2, 2018, InterGlobe Aviation Ltd., owner of IndiGo, India's largest airline, reported a 73 per cent decline in its fourth-quarter profits, following which its share price fell by 18 per cent. Exactly two years earlier, the company had reported a net profit of $19.9 billion, while all other airlines had reported huge losses.# IndiGo had completed more than a decade of operations and had consistently done well by introducing a series of small innovations.' After the airline's entry into the aviation sector in 2006, the global economy had witnessed one of the most severe recessions since the 1970s, and Indian markets experienced their share of the global impact for a prolonged period. Throughout the past 12 years, globally, all airlines in the aviation sector had battled to keep their operations going in the face of high turbine fuel prices. In the Indian aviation market, many of IndiGo's competitors had struggled to even recover their operational costs, and continued to operate under losses. Despite the aviation industry in India being in a financial mess, IndiGo had consistently managed to emerge as the sole profit-making airline, which it achieved by introducing unique and innovative strategies, thereby winning the confidence of all stakeholders including the regulatory authorities. While its competitors were grappling with losses, IndiGo had experienced a dream run since it commenced operations, taking the largest market share in the civil aviation industry in India.'PROFITABILITY IndiGo had been able to maintain a steady increase in profits despite challenges that were beyond its control, such as the increased costs and fuel prices that had affected the entire aviation sector. In 2008, which was considered to be the worst year for the Indian civil aviation industry, the company posted a net profit of $80 million while its competitors reported losses. In 2018, IndiGo's net profits rose to $22.4 billion46 and it had a 40 per cent market share (see Exhibit 3). However, a fall in profits for the last quarter of 2017-18 resulted in a drop in its stock price on the Indian stock exchanges. Despite IndiGo reporting such huge profits, with each passing year its financial results had not exceeded market expectations (which were reflected by the response of financial markets soon after the company published its quarterly reports). Could Rahul Bhatia, IndiGo's chief executive officer, find a way to increase prices to achieve higher profitability, without compromising the airline's position as domestic market leader in India? Would the company be able to sufficiently innovate and strengthen its domestic operations to replicate its success from domestic operations and meet stakeholders' expectations? Should IndiGo buy the state-run Air India to further expand its market share, monopolize the Indian sky, and enjoy further economies of scale to sustain its profits?EXHIBIT 1: CIVIL AVIATION MARKET, AIR CONNECTIVITY, AND PER CAPITA INCOME OF SELECTED COUNTRIES Size of Aviation Geographical Number of Per Capita Country Market Area (in Cities with a Income in Population (Passengers Square Population US$PPP (Thousands) Carried) Kilometres) of 500,000+ 2017-18 United States 762,560,000 9,526,468 34 $62, 152 328,434 China 390,878,784 9,572,900 197 $18,066 1,396,982 United Kingdom 125,068,988 242,495 13 $45,565 66,466 Japan 110,544,000 377,930 28 $44,426 126,491 Germany 107,587,503 357,114 12 $52,801 82,838 Brazil 100,403,628 8,515,767 40 $16, 199 209,205 India 82,751,555 3,287,263 93 $7,783 1,334,221 Russia 72, 189,961 17,098,246 37 $28,957 143,965 France 63,434,263 640,679 3 $45,473 65,098 Note: PPP = purchasing power parity; *Per Capita Income US$PPP refers to the number of US dollars required to buy a predefined basket of commodities in different countries. It differs both from the official exchange rate conversion of per capita income and from country to country, based on the purchasing power of a currency in the domestic economy. For example, if US$100 is required to buy a predefined basket of commodities in the United States and the same basket can be purchased in India for $4,000, then the PPP exchange rate is