Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q 1 : Simulating Loan Processing ZipLoan, Inc. operates a B 2 B website for ( relatively ) speedy business loans. In this problem, you

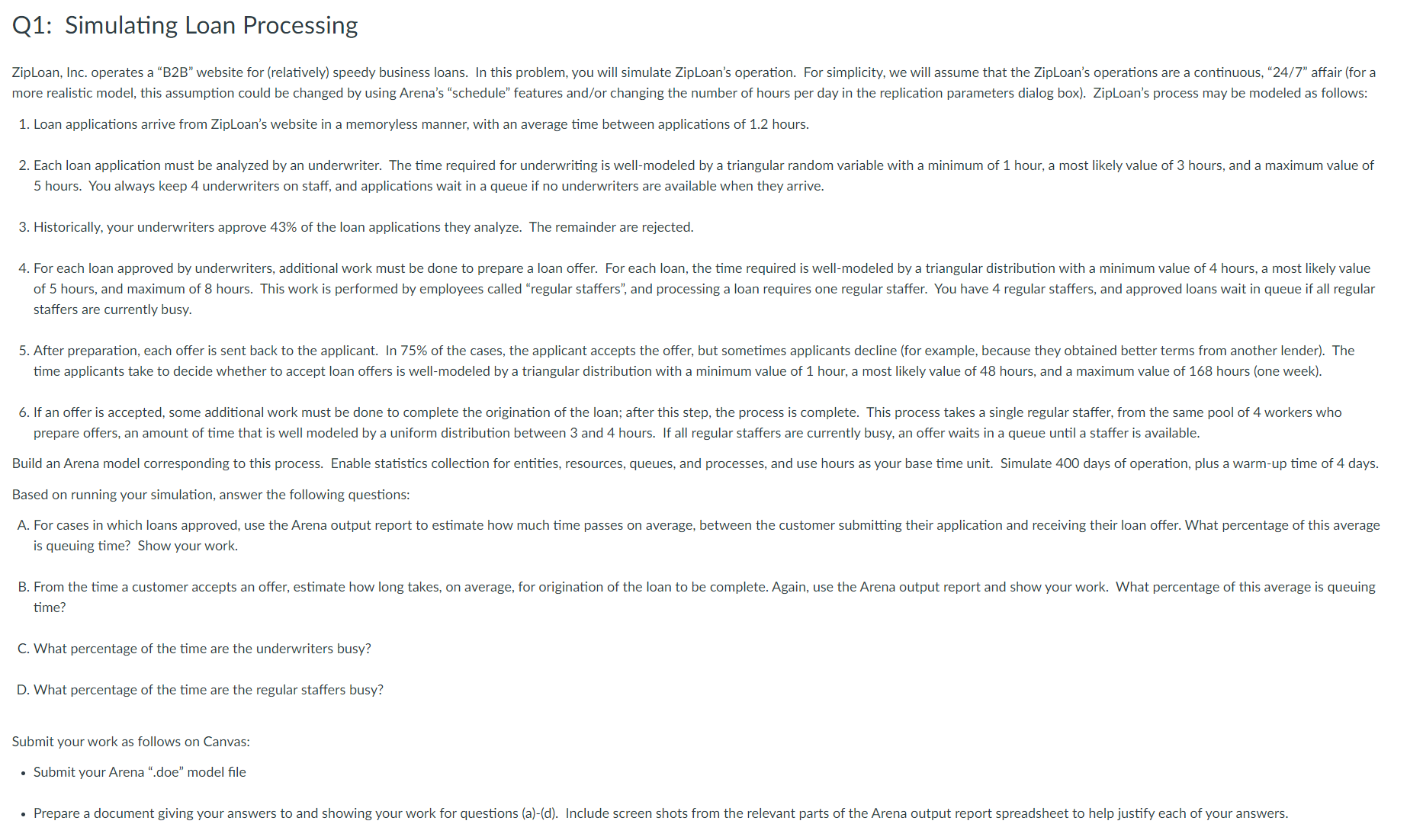

Q: Simulating Loan Processing

ZipLoan, Inc. operates a BB website for relatively speedy business loans. In this problem, you will simulate ZipLoans operation. For simplicity, we will assume that the ZipLoans operations are a continuous, affair for a more realistic model, this assumption could be changed by using Arenas schedule features andor changing the number of hours per day in the replication parameters dialog box ZipLoans process may be modeled as follows:

Loan applications arrive from ZipLoans website in a memoryless manner, with an average time between applications of hours.

Each loan application must be analyzed by an underwriter. The time required for underwriting is wellmodeled by a triangular random variable with a minimum of hour, a most likely value of hours, and a maximum value of hours. You always keep underwriters on staff, and applications wait in a queue if no underwriters are available when they arrive.

Historically, your underwriters approve of the loan applications they analyze. The remainder are rejected.

For each loan approved by underwriters, additional work must be done to prepare a loan offer. For each loan, the time required is wellmodeled by a triangular distribution with a minimum value of hours, a most likely value of hours, and maximum of hours. This work is performed by employees called regular staffers and processing a loan requires one regular staffer. You have regular staffers, and approved loans wait in queue if all regular staffers are currently busy.

After preparation, each offer is sent back to the applicant. In of the cases, the applicant accepts the offer, but sometimes applicants decline for example, because they obtained better terms from another lender The time applicants take to decide whether to accept loan offers is wellmodeled by a triangular distribution with a minimum value of hour, a most likely value of hours, and a maximum value of hours one week

If an offer is accepted, some additional work must be done to complete the origination of the loan; after this step, the process is complete. This process takes a single regular staffer, from the same pool of workers who prepare offers, an amount of time that is well modeled by a uniform distribution between and hours. If all regular staffers are currently busy, an offer waits in a queue until a staffer is available.

Build an Arena model corresponding to this process. Enable statistics collection for entities, resources, queues, and processes, and use hours as your base time unit. Simulate days of operation, plus a warmup time of days.

Based on running your simulation, answer the following questions:

For cases in which loans approved, use the Arena output report to estimate how much time passes on average, between the customer submitting their application and receiving their loan offer. What percentage of this average is queuing time? Show your work.

From the time a customer accepts an offer, estimate how long takes, on average, for origination of the loan to be complete. Again, use the Arena output report and show your work. What percentage of this average is queuing time?

What percentage of the time are the underwriters busy?

What percentage of the time are the regular staffers busy?

Submit your work as follows on Canvas:

Submit your Arena doe model file

Prepare a document giving your answers to and showing your work for questions ad Include screen shots from the relevant parts of the Arena output report spreadsheet to help justify each of your answers.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started