Answered step by step

Verified Expert Solution

Question

1 Approved Answer

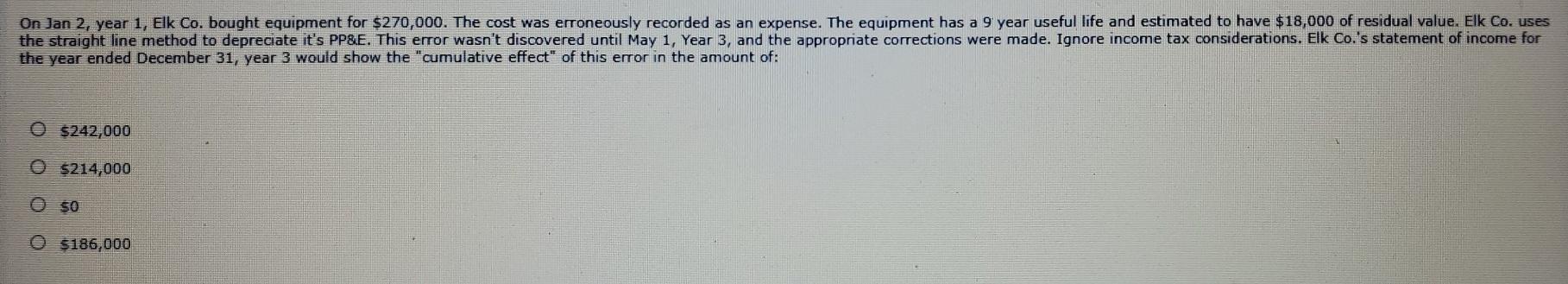

q 10) On Jan 2, year 1, Elk Co. bought equipment for $270,000. The cost was erroneously recorded as an expense. The equipment has a

q 10)

On Jan 2, year 1, Elk Co. bought equipment for $270,000. The cost was erroneously recorded as an expense. The equipment has a 9 year useful life and estimated to have $18,000 of residual value. Elk Co. uses the straight line method to depreciate it's PP&E. This error wasn't discovered until May 1, Year 3, and the appropriate corrections were made. Ignore income tax considerations. Elk Co.'s statement of income for the year ended December 31, year 3 would show the "cumulative effect" of this error in the amount of: 0 $242,000 5214,000 0 50 0 5186,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started