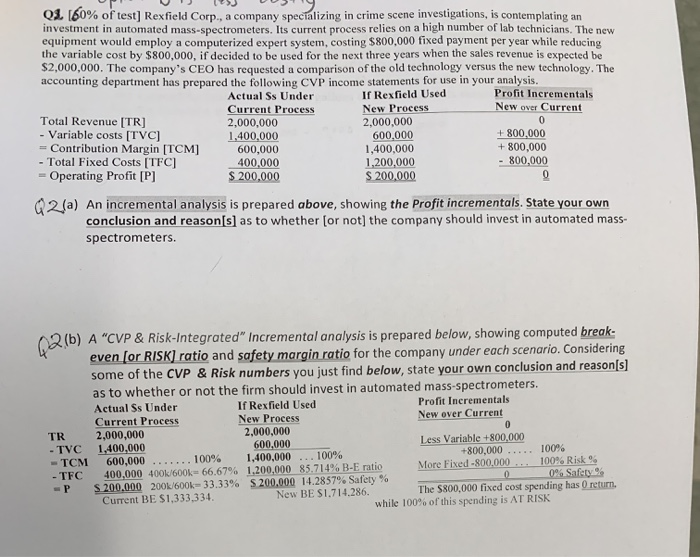

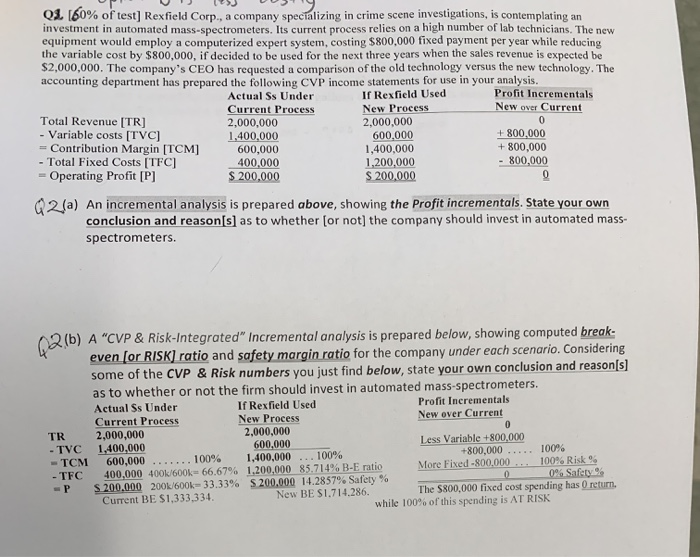

Q 160% of test] Rexfield Corp., a company specializing in crime scene investigations, is contemplating an investment in automated mass-spectrometers. Its current process relies on a high number of lab technicians. The new equipment would employ a computerized expert system, costing $800,000 fixed payment per year while reducing the variable cost by $800,000, if decided to be used for the next three years when the sales revenue is expected be $2,000,000. The company's CEO has requested a comparison of the old technology versus the new technology. The accounting department has prepared the following CVP income statements for use in your analysis. If Rexfield Used New Process 2,000,000 600,000 1,400,000 1,200,000 S 200,000 Profit Incrementals Actual Ss Under New over Current Current Process 2,000,000 1,400,000 600,000 Total Revenue [TR] - Variable costs [TVC Contribution Margin [TCM] - Total Fixed Costs [TFC -Operating Profit [P] 0 +800,000 +800,000 800,000 400,000 S 200,000 2(a) An incremental analysis is prepared above, showing the Profit incrementals. State your own conclusion and reason[s] as to whether [or not] the company should invest in automated mass- spectrometers A "CVP & Risk-In tegrated" Incremental analysis is prepared below, showing computed break even [or RISK] ratio and safety margin ratio for the company under each scenario. Considering some of the CVP & Risk numbers you just find below, state your own conclusion and reason[s] as to whether or not the firm should invest in automated mass-spectrometers. Profit Incrementals New over Current If Rexfield Used New Process Actual Ss Under Current Process 2,000,000 1,400,000 600,000 400,000 400k/600k 66.67 % 1.200,000 85.714 % B- E ratio S 200.000 200k/600k-33.33 % S200,000 14.2857 % Safety % Current BE S1,333,334 2,000,000 600,000 1,400,000 TR Less Variable +800,000 +800,000 More Fixed -800,000 0 100% 100% Risk % 0% Safety % -TVC 100% 100% -TCM - TFC P The $800,000 fixed cost spending has 0 return, New BE $1,714,286. while 100% of this spending is AT RISK Q 160% of test] Rexfield Corp., a company specializing in crime scene investigations, is contemplating an investment in automated mass-spectrometers. Its current process relies on a high number of lab technicians. The new equipment would employ a computerized expert system, costing $800,000 fixed payment per year while reducing the variable cost by $800,000, if decided to be used for the next three years when the sales revenue is expected be $2,000,000. The company's CEO has requested a comparison of the old technology versus the new technology. The accounting department has prepared the following CVP income statements for use in your analysis. If Rexfield Used New Process 2,000,000 600,000 1,400,000 1,200,000 S 200,000 Profit Incrementals Actual Ss Under New over Current Current Process 2,000,000 1,400,000 600,000 Total Revenue [TR] - Variable costs [TVC Contribution Margin [TCM] - Total Fixed Costs [TFC -Operating Profit [P] 0 +800,000 +800,000 800,000 400,000 S 200,000 2(a) An incremental analysis is prepared above, showing the Profit incrementals. State your own conclusion and reason[s] as to whether [or not] the company should invest in automated mass- spectrometers A "CVP & Risk-In tegrated" Incremental analysis is prepared below, showing computed break even [or RISK] ratio and safety margin ratio for the company under each scenario. Considering some of the CVP & Risk numbers you just find below, state your own conclusion and reason[s] as to whether or not the firm should invest in automated mass-spectrometers. Profit Incrementals New over Current If Rexfield Used New Process Actual Ss Under Current Process 2,000,000 1,400,000 600,000 400,000 400k/600k 66.67 % 1.200,000 85.714 % B- E ratio S 200.000 200k/600k-33.33 % S200,000 14.2857 % Safety % Current BE S1,333,334 2,000,000 600,000 1,400,000 TR Less Variable +800,000 +800,000 More Fixed -800,000 0 100% 100% Risk % 0% Safety % -TVC 100% 100% -TCM - TFC P The $800,000 fixed cost spending has 0 return, New BE $1,714,286. while 100% of this spending is AT RISK