Answered step by step

Verified Expert Solution

Question

1 Approved Answer

q 17 Chapter 28 The Market for Equity Derivatives 17. Suppose you bought an index call option for $5.50 with a strike index of 1000

q 17

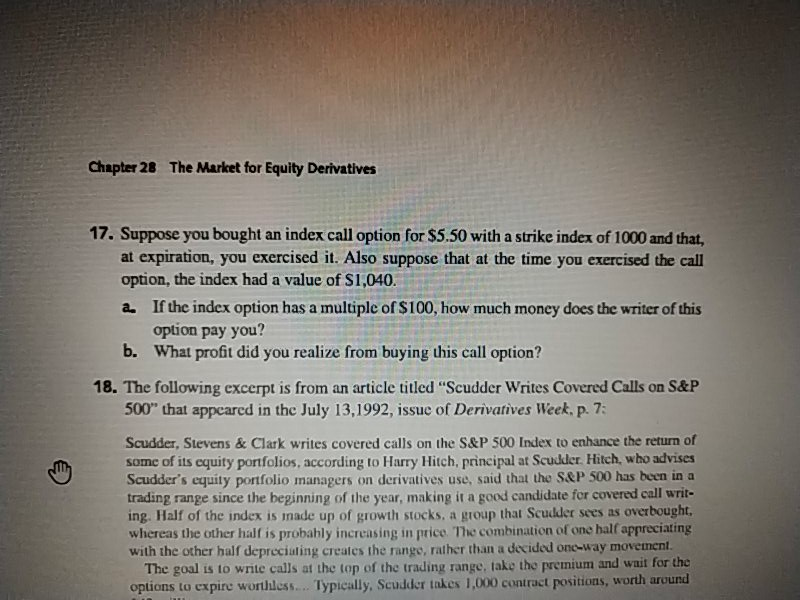

Chapter 28 The Market for Equity Derivatives 17. Suppose you bought an index call option for $5.50 with a strike index of 1000 and that, at expiration, you exercised it. Also suppose that at the time you exercised the call option, the index had a value of $1,040. 2. If the index option has a multiple of $100, how much money does the writer of this option pay you? b. What profit did you realize from buying this call option? 18. The following excerpt is from an article titled "Scudder Writes Covered Calls on S&P 500" that appeared in the July 13,1992, issue of Derivatives Week, p. 7: Scudder, Stevens & Clark writes covered calls on the S&P 500 Index to enhance the return of some of its equity portfolios, according to Harry Hitch, principal at Scudder. Hitch, who advises Scudder's equity portfolio managers on derivatives use, said that the S&P 500 has been in a trading range since the beginning of the year, making it a good candidate for covered call writ- ing. Half of the index is made up of growth stocks, a group that Scudder sees as overbought, whereas the other hair is probably increasing in price. The combination of one half appreciating with the other half depreciating creates the rango, rather than a decided one-way moveinent. The goal is to write calls at the top of the trading range, take the premium and wait for the options to expire worthless... Typically, Scudder inkes 1,000 contract positions, worth aroundStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started