Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q 2 . ( 1 0 points ) The weekend effect is a phenomenon in which stock returns are higher on Friday than on the

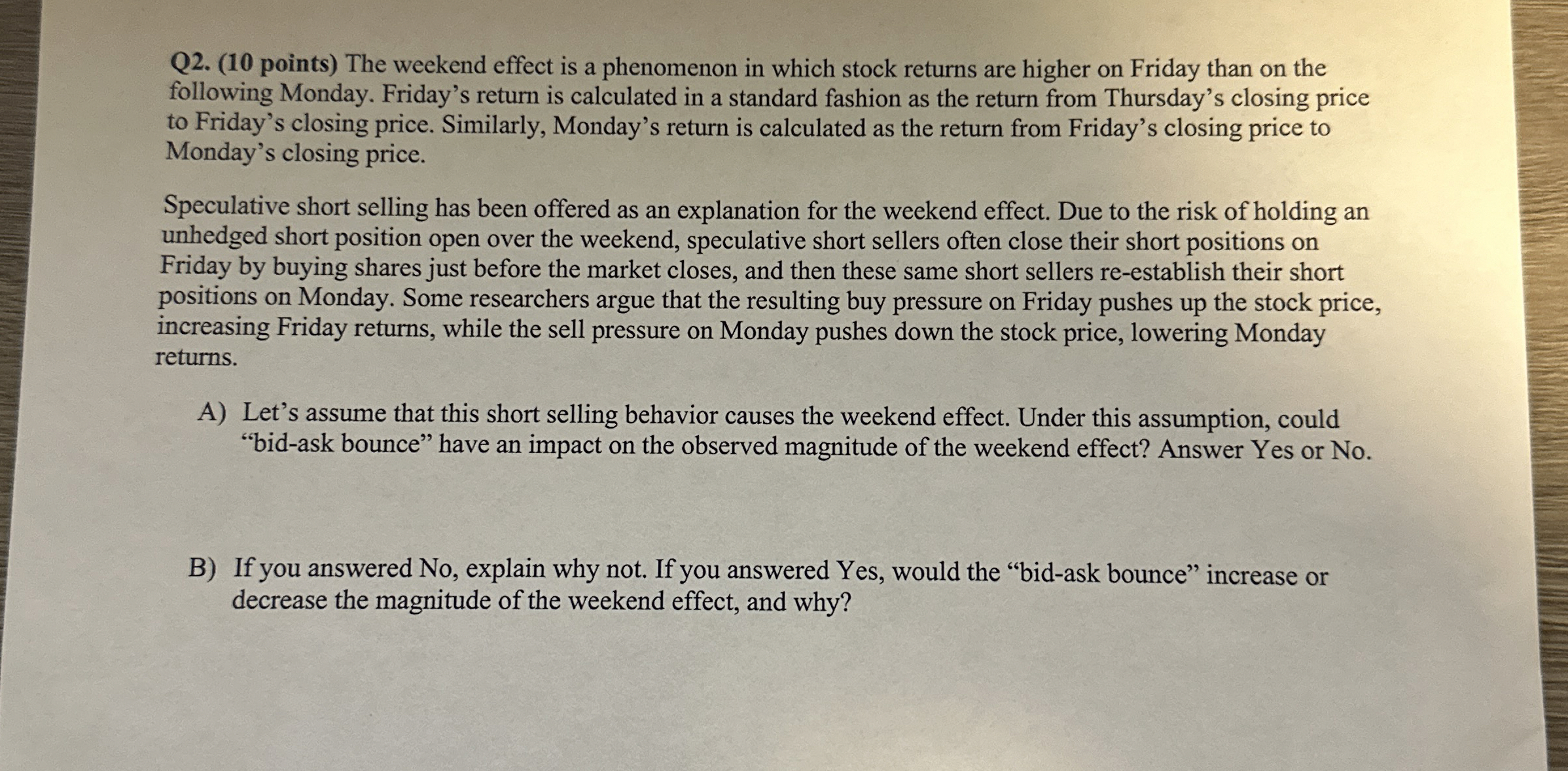

Q points The weekend effect is a phenomenon in which stock returns are higher on Friday than on the following Monday. Friday's return is calculated in a standard fashion as the return from Thursday's closing price to Friday's closing price. Similarly, Monday's return is calculated as the return from Friday's closing price to Monday's closing price.

Speculative short selling has been offered as an explanation for the weekend effect. Due to the risk of holding an unhedged short position open over the weekend, speculative short sellers often close their short positions on Friday by buying shares just before the market closes, and then these same short sellers reestablish their short positions on Monday. Some researchers argue that the resulting buy pressure on Friday pushes up the stock price, increasing Friday returns, while the sell pressure on Monday pushes down the stock price, lowering Monday returns.

A Let's assume that this short selling behavior causes the weekend effect. Under this assumption, could "bidask bounce" have an impact on the observed magnitude of the weekend effect? Answer Yes or No

B If you answered No explain why not. If you answered Yes, would the "bidask bounce" increase or decrease the magnitude of the weekend effect, and why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started