Answered step by step

Verified Expert Solution

Question

1 Approved Answer

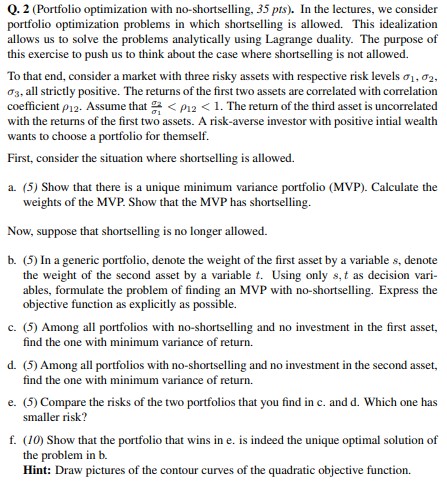

Q . 2 ( Portfolio optimization with no - shortselling, 3 5 p t s ) . In the lectures, we consider portfolio optimization problems

QPortfolio optimization with noshortselling, In the lectures, we consider

portfolio optimization problems in which shortselling is allowed. This idealization

allows us to solve the problems analytically using Lagrange duality. The purpose of

this exercise to push us to think about the case where shortselling is not allowed.

To that end, consider a market with three risky assets with respective risk levels

all strictly positive. The returns of the first two assets are correlated with correlation

coefficient Assume that The return of the third asset is uncorrelated

with the returns of the first two assets. A riskaverse investor with positive intial wealth

wants to choose a portfolio for themself.

First, consider the situation where shortselling is allowed.

a Show that there is a unique minimum variance portfolio MVP Calculate the

weights of the MVP Show that the MVP has shortselling.

Now, suppose that shortselling is no longer allowed.

b In a generic portfolio, denote the weight of the first asset by a variable denote

the weight of the second asset by a variable Using only as decision vari

ables, formulate the problem of finding an MVP with noshortselling. Express the

objective function as explicitly as possible.

c Among all portfolios with noshortselling and no investment in the first asset,

find the one with minimum variance of return.

d Among all portfolios with noshortselling and no investment in the second asset,

find the one with minimum variance of return.

e Compare the risks of the two portfolios that you find in c and d Which one has

smaller risk?

f Show that the portfolio that wins in e is indeed the unique optimal solution of

the problem in

Hint: Draw pictures of the contour curves of the quadratic objective function.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started