Answered step by step

Verified Expert Solution

Question

1 Approved Answer

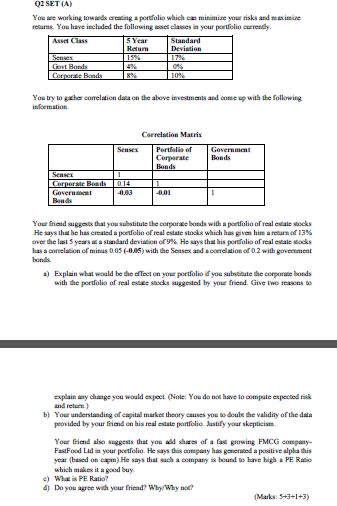

Q 2 SF . T ( A ) You ars working towarde cretaing a portfolio which cal minimiar your risks and ramietine resums. You have

Q SFT

You ars working towarde cretaing a portfolio which cal minimiar your risks and ramietine

resums. You have isclulof the following wases elawes in your poetfolio caerenlly.

You try to gxthor comelation data en the above irvestments and cone up with the following.

isformation.

Correlation Matris

Your friad sugeoso that you substitule the coppor ae botils with a portfitio of real elale socks

He srys that he has created a poetfolio of real estate stods which lhak given him a retarn of

over the last years at a stiadart deviation of Ho seys thal his pertfolio of real evale wooks

has a correlabion of minus with the Sensex and a ecerelation of with governmeat

bonde.

a Explain what would be the efteet en your portfolio if yoe subvtionte the corporate bobds

with the portfolio of real ploce stodks sukgeded by your frient. Give two reawns wo

explain may dimage you would expoct. Note: You do nos have to oompute expectod frak

and return.

b Your undentandifg of capital marken thsory causes yoe so douke the validity of the data

peovided by your friend in his real estate portiflio. Jastify your shepticist

Your friend also sugpess that you wat sharo of a fal growing FMCG company

FastFood Lud ia your poetfolio. He says dis conspaty has goreraod a positive alpla this

year bused on capm He sarys that such a compary is beusif to lave high a PE Rasio

which miakes it a good Suy.

e What is PE Ratio?

d Do you agree with your friend? Why, Why nod?

Marks:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started