Answered step by step

Verified Expert Solution

Question

1 Approved Answer

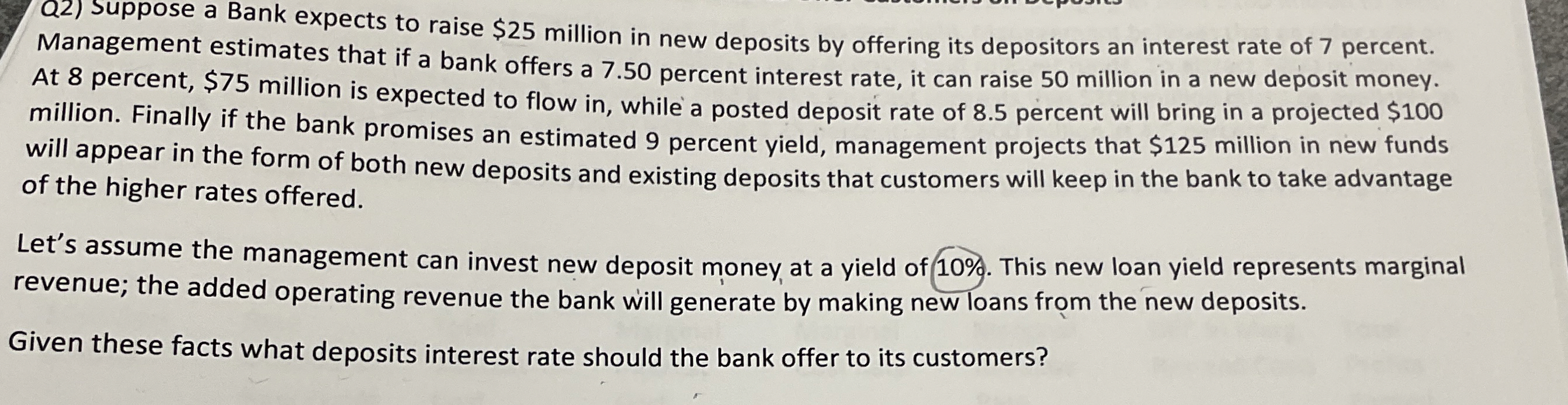

Q 2 ) Suppose a Bank expects to raise $ 2 5 million in new deposits by offering its depositors an interest rate of 7

Q Suppose a Bank expects to raise $ million in new deposits by offering its depositors an interest rate of percent.

Management estimates that if a bank offers a percent interest rate, it can raise million in a new deposit money.

At percent, $ million is expected to flow in while a posted deposit rate of percent will bring in a projected $

million. Finally if the bank promises an estimated percent yield, management projects that $ million in new funds

will appear in the form of both new deposits and existing deposits that customers will keep in the bank to take advantage

of the higher rates offered.

Let's assume the management can invest new deposit money, at a yield of This new loan yield represents marginal

revenue; the added operating revenue the bank will generate by making new loans from the new deposits.

Given these facts what deposits interest rate should the bank offer to its customers?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started