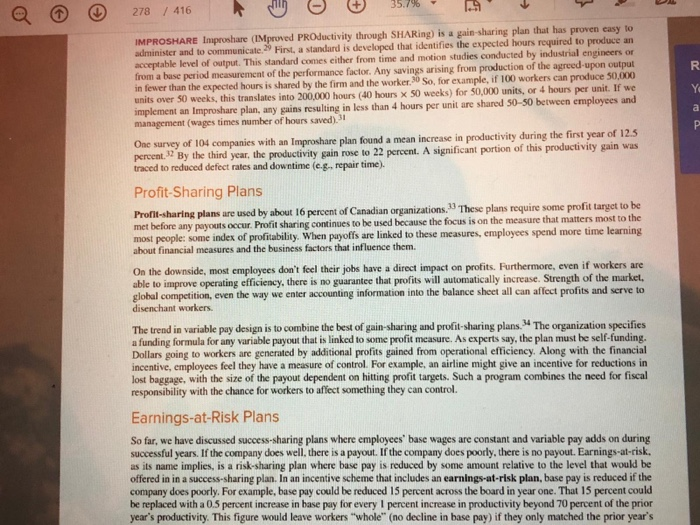

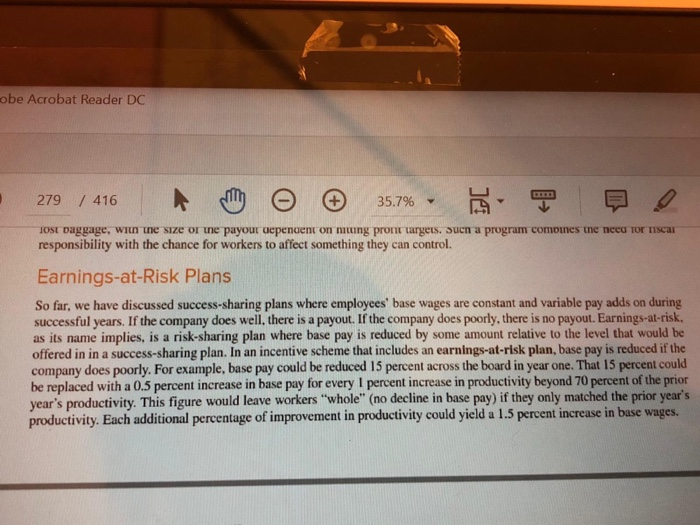

Q 278 416 il 357% 29 IMPROSHARE Impreshare (IMproved PROJuctivity through SHARing) is a al-sharing plan that has proven easy to administer and to communicate. First, a standard is developed that identifies the expected hours required to produce an acceptable level of output. This standard comes either from time and motion studies conducted by industrial engineers or from a base period measurement of the performance factor. Any savings arising from production of the agreed upon output in fewer than the expected hours is shared by the firm and the worker. So, for example, if 100 workers can produce 50,000 units over 50 weeks, this translates into 200,000 hours (40 hours x 50 weeks) for 50,000 units, or 4 hours per unit. If we implement an Improshare plan, any pains resulting in less than 4 hours per unit are shared 50-50 between employees and management (wages times number of hours saved).31 One survey of 104 companies with an Improshare plan found a mean increase in productivity during the first year of 125 percent. By the third year, the productivity gain rose to 22 percent. A significant portion of this productivity gain was traced to reduced defect rates and downtime (c.g. repair time) Profit-Sharing Plans Profi-sharing plans are used by about 16 percent of Canadian organizations. These plans require some profit target to be met before any payouts occur. Profit sharing continues to be used because the focus is on the measure that matters most to the most people: some index of profitability. When payoffs are linked to these measures, employees spend more time learning about financial measures and the business factors that influence them. On the downside, most employees don't feel their jobs have a direct impact on profits. Furthermore, even if workers are able to improve operating efficiency, there is no guarantee that profits will automatically increase. Strength of the market. global competition, even the way we enter accounting information into the balance sheet all can affect profits and serve to disenchant workers. The trend in variable pay design is to combine the best of gain-sharing and profit-sharing plans. The organization specifies a funding formula for any variable payout that is linked to some profit measure. As experts say, the plan must be self-funding. Dollars going to workers are generated by additional profits gained from operational efficiency. Along with the financial incentive, employees feel they have a measure of control. For example, an airline might give an incentive for reductions in lost baggage, with the size of the payout dependent on hitting profit targets. Such a program combines the need for fiscal responsibility with the chance for workers to affect something they can control Earnings-at-Risk Plans So far, we have discussed success-sharing plans where employees' base wages are constant and variable pay adds on during successful years. If the company does well, there is a payout. If the company does poorly, there is no payout. Earnings-at-risk. as its name implies, is a risk-sharing plan where base pay is reduced by some amount relative to the level that would be offered in in a success-sharing plan. In an incentive scheme that includes an earnings-at-risk plan, base pay is reduced if the company does poorly. For example, base pay could be reduced 15 percent across the board in year one. That 15 percent could be replaced with a 0.5 percent increase in base pay for every percent increase in productivity beyond 70 percent of the prior year's productivity. This figure would leave workers "whole" (no decline in base pay) if they only matched the prior year's obe Acrobat Reader DC 279 / 416 A chi 35.7% 7 Tost baggage, with the size or the payout cependent on nung pron targets. Sucn a program comoines the need for Scal responsibility with the chance for workers to affect something they can control. Earnings-at-Risk Plans So far, we have discussed success-sharing plans where employees' base wages are constant and variable pay adds on during successful years. If the company does well, there is a payout. If the company does poorly, there is no payout. Earnings-at-risk, as its name implies, is a risk-sharing plan where base pay is reduced by some amount relative to the level that would be offered in in a success-sharing plan. In an incentive scheme that includes an earnings-at-risk plan, base pay is reduced if the company does poorly. For example, base pay could be reduced 15 percent across the board in year one. That 15 percent could be replaced with a 0.5 percent increase in base pay for every 1 percent increase in productivity beyond 70 percent of the prior year's productivity. This figure would leave workers "whole" (no decline in base pay) if they only matched the prior year's productivity. Each additional percentage of improvement in productivity could yield a 1.5 percent increase in base wages. Q 278 / 416 Am o 35.7% - 6 N ycan RUCKER PLAN The Rucker plan involves a somewhat more complex formula than a Scanlon plan for determining worker incentive bonuses. Essentially, a ratio is calculated that expresses the value of production required for each dollar of total wage bill. Consider the following illustration:27 1. Assume accounting records show the company expended $0.60 worth of electricity, materials, supplies, and so on, to produce Sl worth of product. The value added is $0.40 for each sl of sales value. Assume also that 45 percent of the value added was attributable to labour, a productivity ratio (PR) can be allocated from the formula PR (labour) x 0.40 x 0.45 = 1.00. Solving yields PR = 5.5555.... 2. If the wage bill equals $100,000, the expected production value is the wage bill ($100,000) X PR (5.5555...) $555,556. 3. If actual production value equals $650,000, then the savings (actual production value minus expected production value) is $94.444 PARTH EMPLOYEE CONTRIBUTIONS: DETERMINING INDIVIDUAL PAY 251 4. Because the labour contribution to value added is 45 percent, the bonus to the workforce should be 0.45 x 594.444 $42,500 5. The savings are distributed as incentive bonuses according to a formula similar to the Scanlon formula 75 percent of the bonus is distributed to workers immediately and 25 percent is kept as an emergency fund to cover poor months. Any excess in the emergency fund at the end of the year is then distributed to workers. IMPLEMENTATION OF SCANLON/RUCKER PLANS There are two major components vital to the implementation and success of a Rucker or Scanlon plan: (1) a productivity norm and (2) development of effective worker committees Development of a productivity norm requires both effective measurement of base year data and acceptance by workers and management of this standard for calculating bonus incentives. The second ingredient of Scanlon/Rucker plans is a series of worker committees (also known as productivity committees or bonus committees). The primary function of these committees is to evaluate employee and management suggestions for ways to improve productivity and/or cut costs. It is not uncommon for the suggestion rate to be above that found in companies with standard suggestion incentive plans.* The climate that Scanlon/Rucker plans foster is probably the element most vital to success