Answered step by step

Verified Expert Solution

Question

1 Approved Answer

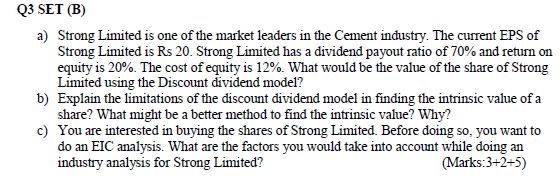

Q 3 SET ( B ) a ) Strong Limited is one of the market leaders in the Cement industry. The current EPS of Strong

Q SET B

a Strong Limited is one of the market leaders in the Cement industry. The current EPS of

Strong Limited is Rs Strong Limited has a dividend payout ratio of and return on

equity is The cost of equity is What would be the value of the share of Strong

Limited using the Discount dividend model?

b Explain the limitations of the discount dividend model in finding the intrinsic value of a

share? What might be a better method to find the intrinsic value? Why?

c You are interested in buying the shares of Strong Limited. Before doing so you want to

do an EIC analysis. What are the factors you would take into account while doing an

industry analysis for Strong Limited?

Marks:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started