Answered step by step

Verified Expert Solution

Question

1 Approved Answer

q 35 q 34 q 33 q 32 Shocked Appliances currently sells microwave ovens for $210. It has costs of $120. A competitor is bringing

q 35

q 34

q 33

q 32

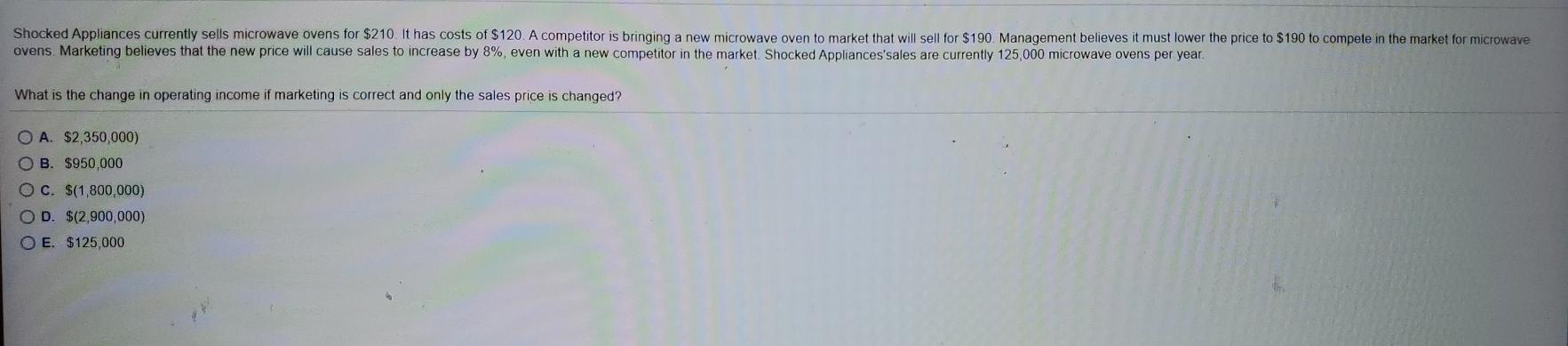

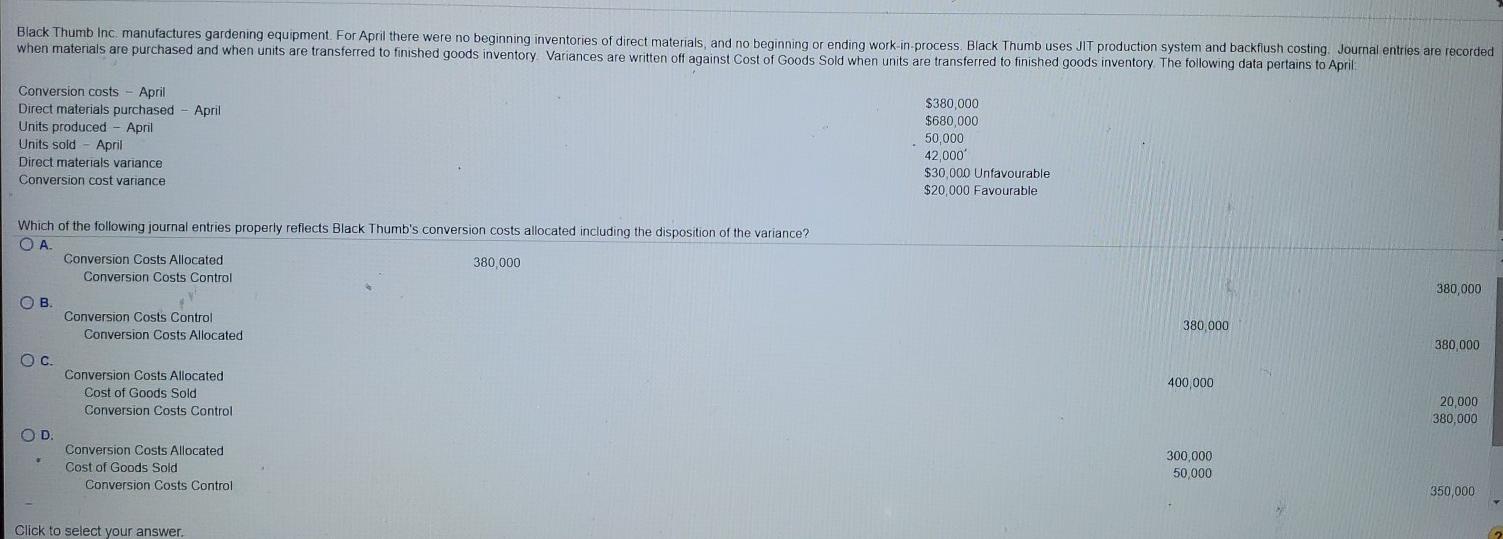

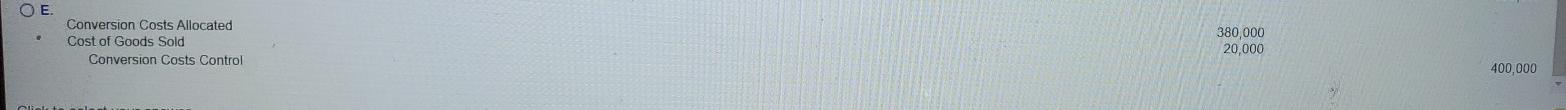

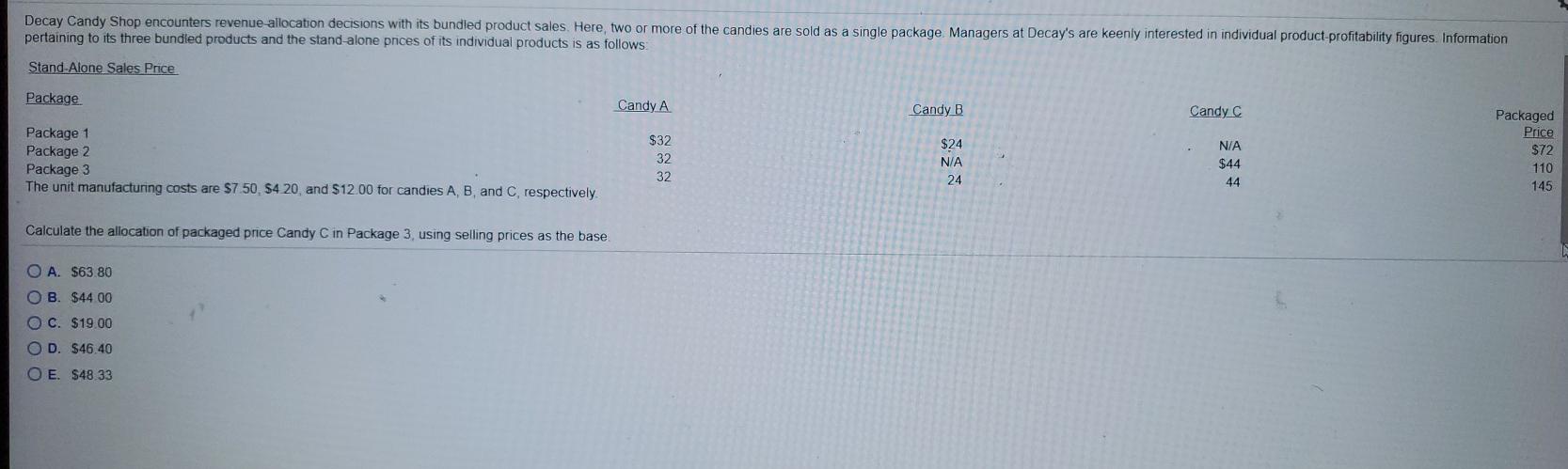

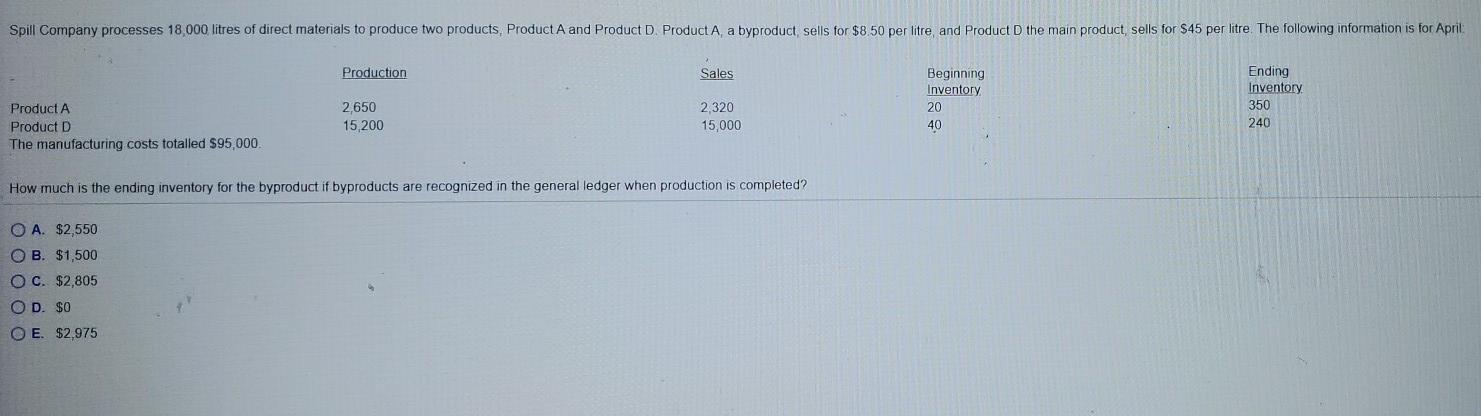

Shocked Appliances currently sells microwave ovens for $210. It has costs of $120. A competitor is bringing a new microwave oven to market that will sell for $190. Management believes it must lower the price to $190 to compete in the market for microwave ovens. Marketing believes that the new price will cause sales to increase by 8%, even with a new competitor in the market Shocked Appliances'sales are currently 125,000 microwave ovens per year. What is the change in operating income if marketing is correct and only the sales price is changed? O A. $2,350,000) OB. $950,000 O C. $(1,800,000) OD. $(2,900,000) O E. $125,000 Black Thumb Inc, manufactures gardening equipment. For April there were no beginning inventories of direct materials, and no beginning or ending work-in-process. Black Thumb uses JIT production system and backflush costing Journal entries are recorded when materials are purchased and when units are transferred to finished goods inventory Variances are written off against Cost of Goods Sold when units are transferred to finished goods inventory The following data pertains to April: April Conversion costs April Direct materials purchased Units produced Units sold April Direct materials variance Conversion cost variance April $380,000 $680,000 50,000 42,000 $30,000 Unfavourable $20,000 Favourable Which of the following journal entries properly reflects Black Thumb's conversion costs allocated including the disposition of the variance? . Conversion Costs Allocated 380 000 Conversion Costs Control 380,000 OB Conversion Costs Control Conversion Costs Allocated 380 000 380,000 Oc. 400 000 Conversion Costs Allocated Cost of Goods Sold Conversion Costs Control 20 000 380,000 OD Conversion Costs Allocated Cost of Goods Sold Conversion Costs Control 300,000 50,000 350,000 Click to select your answer. 2 Decay Candy Shop encounters revenue allocation decisions with its bundled product sales. Here, two or more of the candies are sold as a single package Managers at Decay's are keenly interested in individual product-profitability figures. Information pertaining to its three bundled products and the stand-alone prices of its individual products is as follows: Stand Alone Sales Price Package Candy A Candy B Candy C Package 1 Package 2 Package 3 The unit manufacturing costs are $7 50, $420, and $12.00 for candies A, B, and C, respectively $32 32 32 $24 24 N/A $44 44 Packaged Price $72 110 145 Calculate the allocation of packaged price Candy C in Package 3 using selling prices as the base O A. $63.80 OB. $44 00 OC. $19.00 OD. $46.40 O E $48 33 Spill Company processes 18 000 litres of direct materials to produce two products, Product A and Product D. Product A, a byproduct sells for $8.50 per litre, and Product D the main product, sells for $45 per litre. The following information is for April Production Sales Beginning Inventory 20 40 Ending Inventory 350 240 Product A Product D The manufacturing costs totalled $95,000 2,650 15,200 2320 15,000 How much is the ending inventory for the byproduct if byproducts are recognized in the general ledger when production is completed? O A. $2,550 OB. $1,500 O c. $2,805 OD. $0 O E. $2.975Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started