Question

Q # 4 Risk Management in Capital Budgeting AL-Rahim Company is evaluating a new saw with a life of two years. The saw costs Rs4000

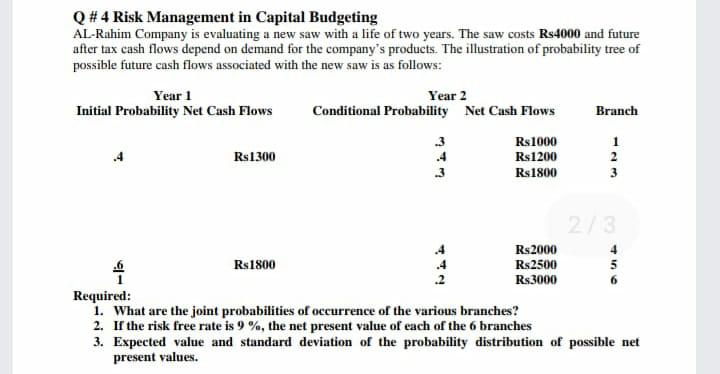

Q # 4 Risk Management in Capital Budgeting

AL-Rahim Company is evaluating a new saw with a life of two years. The saw costs Rs4000 and future after tax cash flows depend on demand for the companys products. The illustration of probability tree of possible future cash flows associated with the new saw is as follows:

Year 1 Year 2

Initial Probability Net Cash Flows Conditional Probability Net Cash Flows Branch

.3 Rs1000 1

.4 Rs1300 .4 Rs1200 2 .3 Rs1800 3

.4 Rs2000 4

.6 Rs1800 .4 Rs2500 5 1 .2 Rs3000 6 Required:

1. What are the joint probabilities of occurrence of the various branches?

2. If the risk free rate is 9 %, the net present value of each of the 6 branches

3. Expected value and standard deviation of the probability distribution of possible net present values.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started